Question: Ch 15: End-of-Chapter Problems - Convertible Securities Given the following information concerning a convertible bond: Principal: $1,000 Coupon: 6 percent Maturity: 12 years Call price:

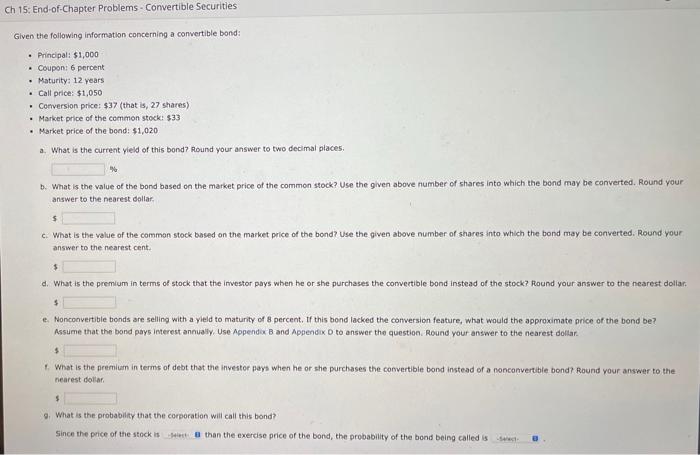

Ch 15: End-of-Chapter Problems - Convertible Securities Given the following information concerning a convertible bond: Principal: $1,000 Coupon: 6 percent Maturity: 12 years Call price: $1,050 Conversion price: $37 (that is, 27 shares) Market price of the common stock: $33 Market price of the bond: $1,020 a. What is the current yield of this bond? Round your answer to two decimal places b. What is the value of the bond based on the market price of the common stock? Use the given above number of shares into which the bond may be converted, Round your answer to the nearest dollar $ What is the value of the common stock based on the market price of the bond? Use the given above number of shares into which the band may be converted, Round your answer to the nearest cent. $ d. What is the premium in terms of stock that the investor pays when he or she purchases the convertible bond instead of the stock? Round your answer to the nearest dollar. $ e. Nonconvertible bonds are selling with a yield to maturity of 8 percent. If this bond lacked the conversion feature, what would the approximate price of the bond be? Assume that the bond pays Interest annually Use Appenda B and Appendix D to answer the question. Round your answer to the nearest dollar $ + What is the premium in terms of debt that the investor pay when he or she purchases the convertible bond instead of a nonconvertible bond? Round your answer to the nearest dollar $ 9. What is the probability that the corporation will call this bond? Since the price of the stock is than the exercise price of the bond, the probability of the bond being called is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts