Question: Ch 16: End-of-Chapter Problems - Financial Planning and Forecasting Click here to read the eBook: Forecasted Financial Statements PRO FORMA INCOME STATEMENT Austin Grocers recently

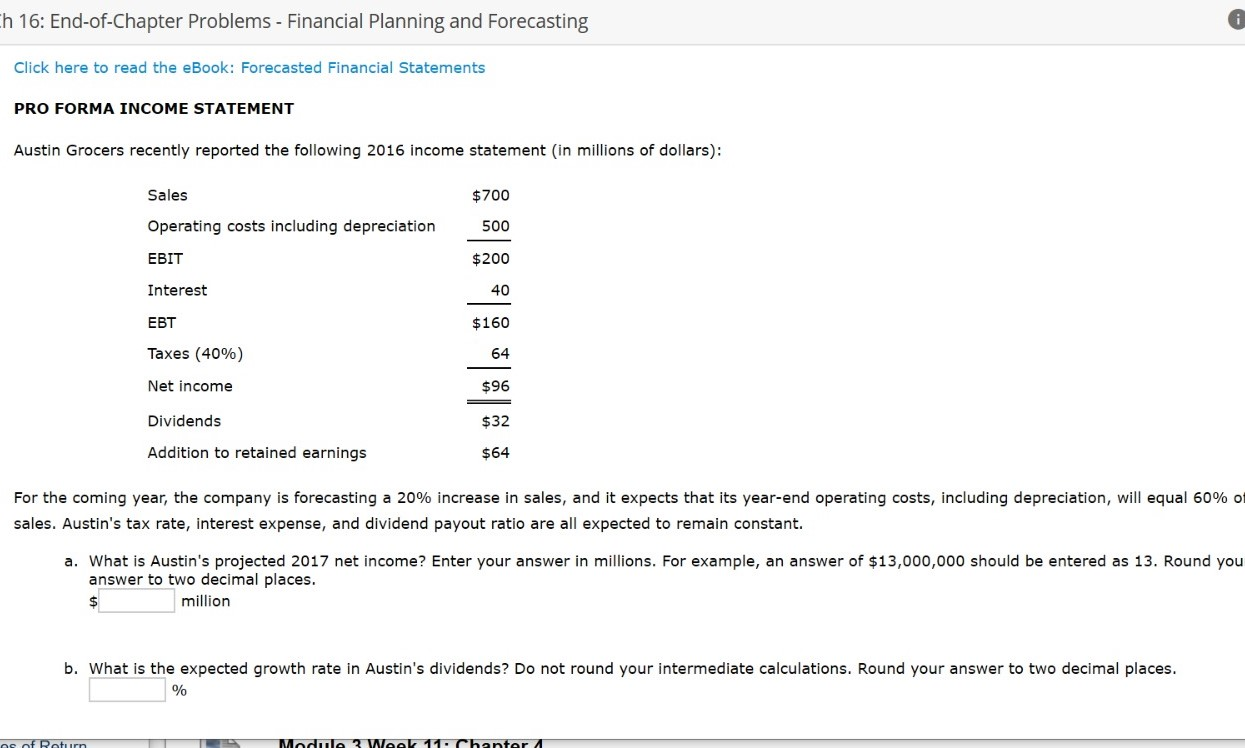

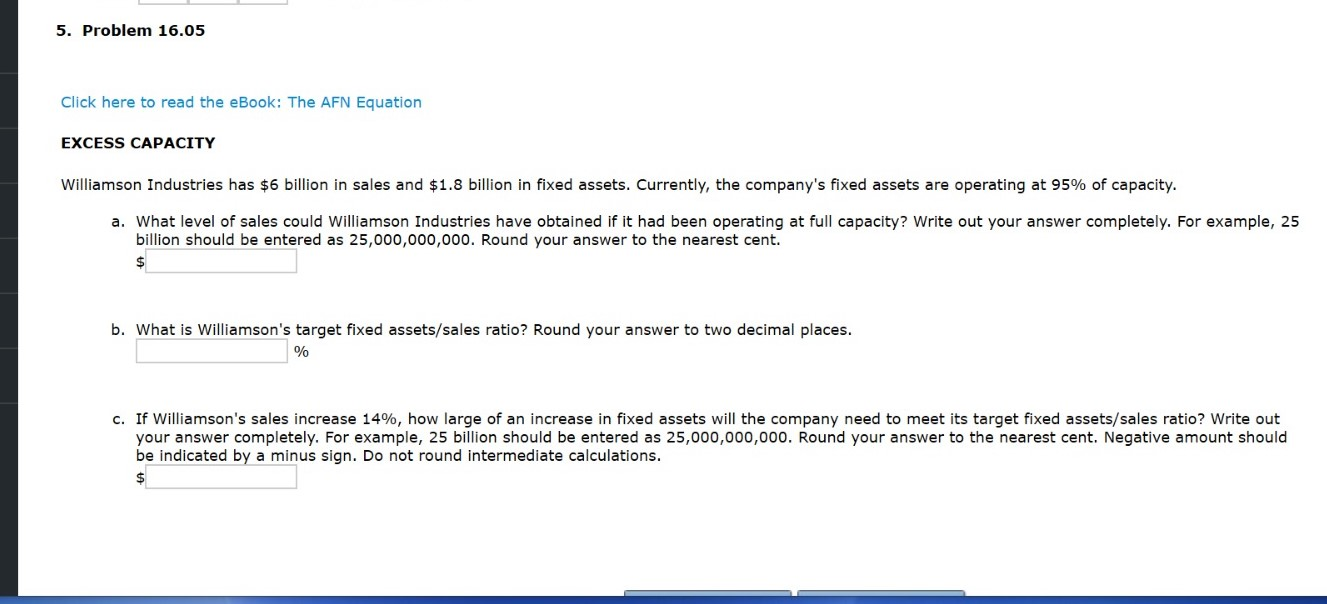

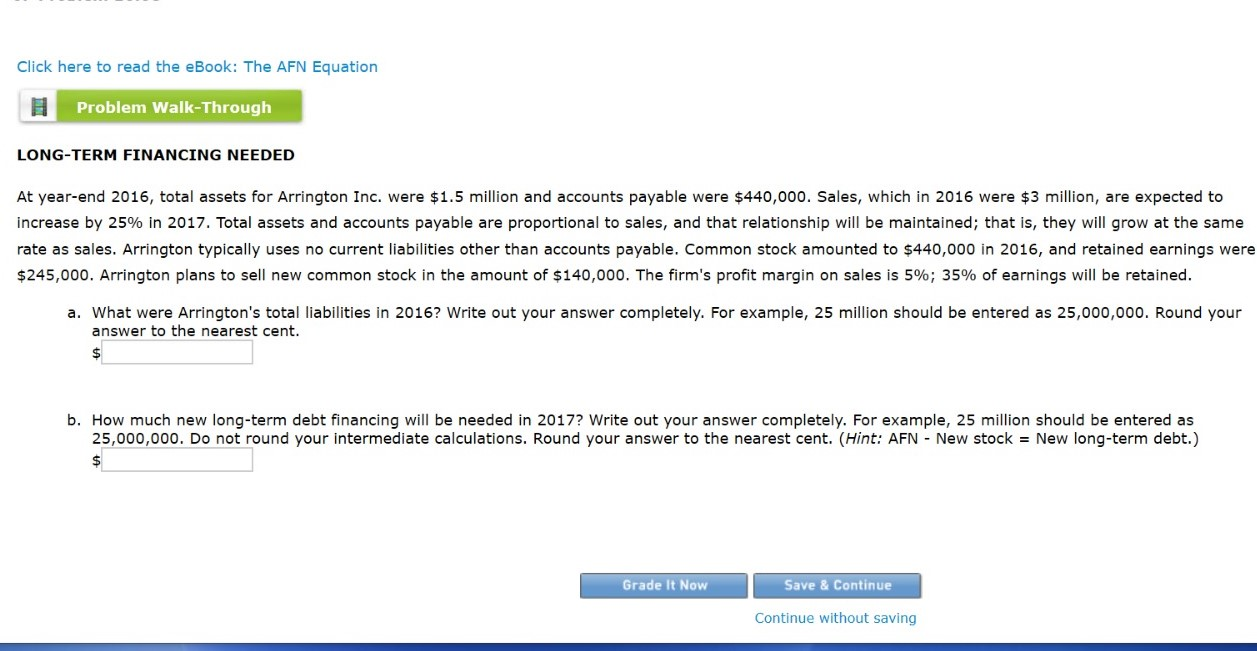

Ch 16: End-of-Chapter Problems - Financial Planning and Forecasting Click here to read the eBook: Forecasted Financial Statements PRO FORMA INCOME STATEMENT Austin Grocers recently reported the following 2016 income statement (in millions of dollars): Sales $700 Operating costs including depreciation 500 $200 EBIT Interest $160 Taxes (40%) 64 Net income $96 Dividends $32 $64 Addition to retained earnings For the coming year, the company is forecasting a 20% increase in sales, and it expects that its year-end operating costs, including depreciation, will equal 60% of sales. Austin's tax rate, interest expense, and dividend payout ratio are all expected to remain constant. a. What is Austin's projected 2017 net income? Enter your answer in millions. For example, an answer of $13,000,000 should be entered as 13. Round you answer to two decimal places. million b. What is the expected growth rate in Austin's dividends? Do not round your intermediate calculations. Round your answer to two decimal places. os of Return Module 3 WAA11-Chanter 5. Problem 16.05 Click here to read the eBook: The AFN Equation EXCESS CAPACITY Williamson Industries has $6 billion in sales and $1.8 billion in fixed assets. Currently, the company's fixed assets are operating at 95% of capacity. a. What level of sales could Williamson Industries have obtained if it had been operating at full capacity? Write out your answer completely. For example, 25 billion should be entered as 25,000,000,000. Round your answer to the nearest cent. b. What is Williamson's target fixed assets/sales ratio? Round your answer to two decimal places. c. If Williamson's sales increase 14%, how large of an increase in fixed assets will the company need to meet its target fixed assets/ sales ratio? Write out your answer completely. For example, 25 billion should be entered as 25,000,000,000. Round your answer to the nearest cent. Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Click here to read the eBook: The AFN Equation Problem Walk-Through LONG-TERM FINANCING NEEDED At year-end 2016, total assets for Arrington Inc. were $1.5 million and accounts payable were $440,000. Sales, which in 2016 were $3 million, are expected to increase by 25% in 2017. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington typically uses no current liabilities other than accounts payable. Common stock amounted to $440,000 in 2016, and retained earnings were $245,000. Arrington plans to sell new common stock in the amount of $140,000. The firm's profit margin on sales is 5%; 35% of earnings will be retained. a. What were Arrington's total liabilities in 2016? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Round your answer to the nearest cent. b. How much new long-term debt financing will be needed in 2017? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round your intermediate calculations. Round your answer to the nearest cent. (Hint: AFN - New stock = New long-term debt.) Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts