Question: Ch 16: Homework_Writing Submitting a text entry box or a file upload Due Monday by 11:59pm Points 15 Available until Apr 30 at 11:59pm The

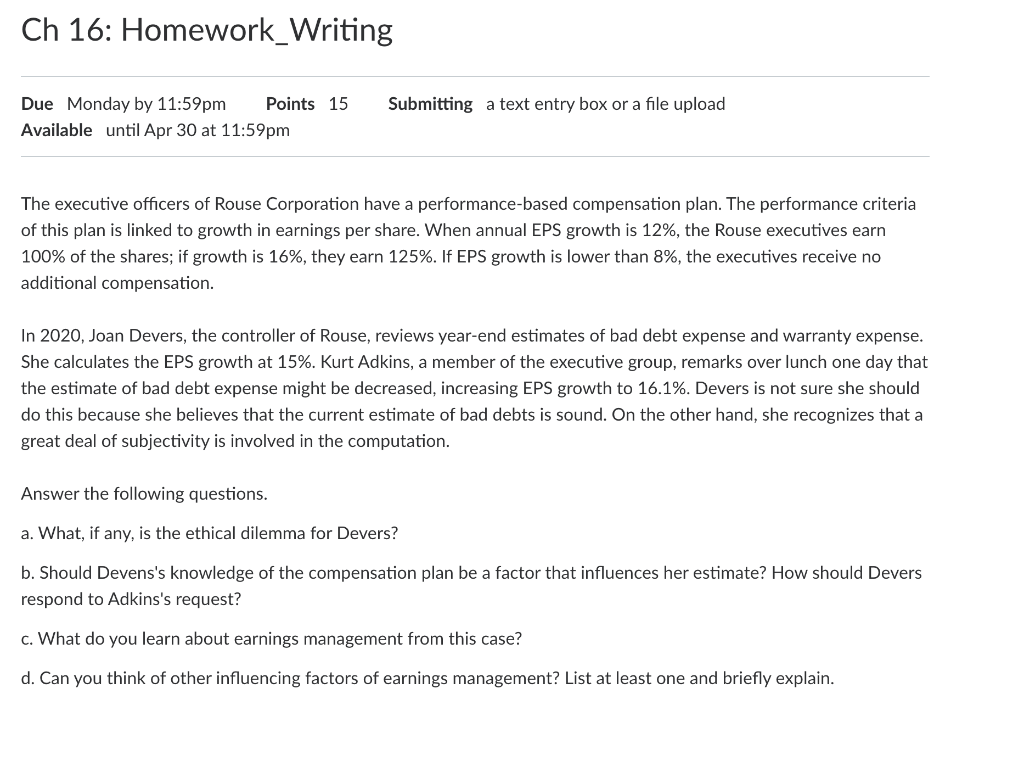

Ch 16: Homework_Writing Submitting a text entry box or a file upload Due Monday by 11:59pm Points 15 Available until Apr 30 at 11:59pm The executive officers of Rouse Corporation have a performance-based compensation plan. The performance criteria of this plan is linked to growth in earnings per share. When annual EPS growth is 12%, the Rouse executives earn 100% of the shares; if growth is 16%, they earn 125%. If EPS growth is lower than 8%, the executives receive no additional compensation. In 2020, Joan Devers, the controller of Rouse, reviews year-end estimates of bad debt expense and warranty expense. She calculates the EPS growth at 15%. Kurt Adkins, a member of the executive group, remarks over lunch one day that the estimate of bad debt expense might be decreased, increasing EPS growth to 16.1%. Devers is not sure she should do this because she believes that the current estimate of bad debts is sound. On the other hand, she recognizes that a great deal of subjectivity is involved in the computation. Answer the following questions. a. What, if any, is the ethical dilemma for Devers? b. Should Devens's knowledge of the compensation plan be a factor that influences her estimate? How should Devers respond to Adkins's request? c. What do you learn about earnings management from this case? d. Can you think of other influencing factors of earnings management? List at least one and briefly explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts