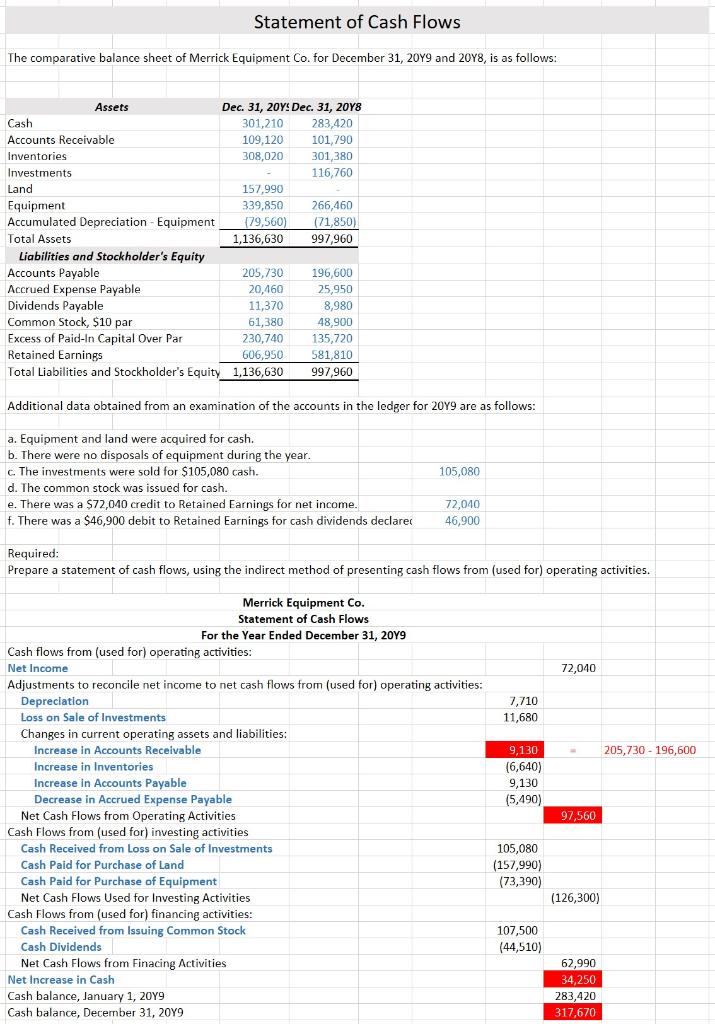

Question: Ch. 16 Statement of Cash Flows *Please help solve for Increase in Accounts Receivable. *What I have in red is incorrect. *Please use formulas to

Ch. 16 Statement of Cash Flows

*Please help solve for "Increase in Accounts Receivable".

*What I have in red is incorrect.

*Please use formulas to show work when necessary.

Thank you!

Statement of Cash Flows The comparative balance sheet of Merrick Equipment Co. for December 31, 2019 and 20Y8, is as follows: Assets Dec. 31, 20Y! Dec. 31, 20Y8 Cash 301,210 283,420 Accounts Receivable 109,120 101,790 Inventories 308,020 301,380 Investments 116,760 Land 157,990 Equipment 339,850 266,460 Accumulated Depreciation - Equipment 179,560) (71,850) Total Assets 1,136,630 997,960 Liabilities and Stockholder's Equity Accounts Payable 205,730 196,600 Accrued Expense Payable 20,460 25,950 Dividends Payable 11,370 8,980 Common Stock, $10 par 48,900 Excess of Paid-in Capital Over Par 230,740 135,720 Retained Earnings 606,950 581,810 Total Liabilities and Stockholder's Equity 1,136,630 997,960 61,380 Additional data obtained from an examination of the accounts in the ledger for 2049 are as follows: 105,080 a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. c. The investments were sold for $105,080 cash. d. The common stock was issued for cash. e. There was a $72,040 credit to Retained Earnings for net income. f. There was a $46,900 debit to Retained Earnings for cash dividends declares 72,040 46,900 Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from (used for) operating activities. 72,040 7,710 11,680 205,730 - 196,600 Merrick Equipment Co. Statement of Cash Flows For the Year Ended December 31, 2019 Cash flows from (used for) operating activities: Net Income Adjustments to reconcile net income to net cash flows from (used for) operating activities: Depreciation Loss on Sale of Investments Changes in current operating assets and liabilities: Increase in Accounts Receivable Increase in Inventories Increase in Inventorie Increase in Accounts Payable Decrease in Accrued Expense Payable Net Cash Flows from Operating Activities Cash Flows from (used for) investing activities Cash Received from Loss on Sale of Investments Cash Paid for Purchase of Land Cash Paid for Purchase of Equipment Net Cash Flows Used for Investing Activities Cash Flows from (used for) financing activities: Cash Received from Issuing Common Stock Cash Dividends Net Cash Flows from Finacing Activities Net Increase in Cash Cash balance, January 1, 2049 Cash balance, December 31, 2049 9,130 (6,640) 9,130 (5,490) 97,560 105,080 (157,990) (73,390) (126,300) 107,500 (44,510) 62,990 34,250 283,420 317,670

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts