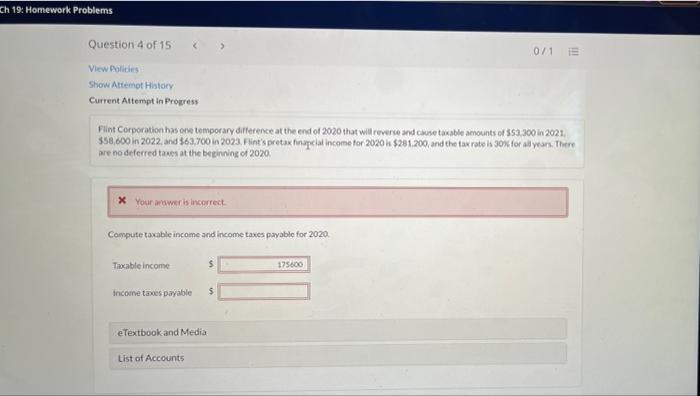

Question: Ch 19: Homework Problems > 0/1 E Question 4 of 15 View Policies Show Attempt History Current Attempt in Progress Flint Corporation has one temporary

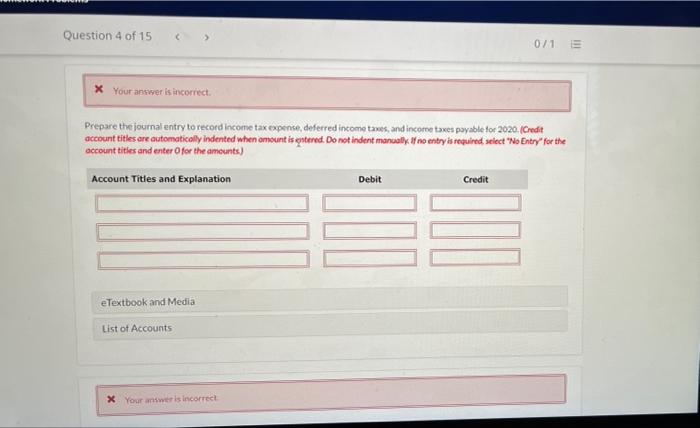

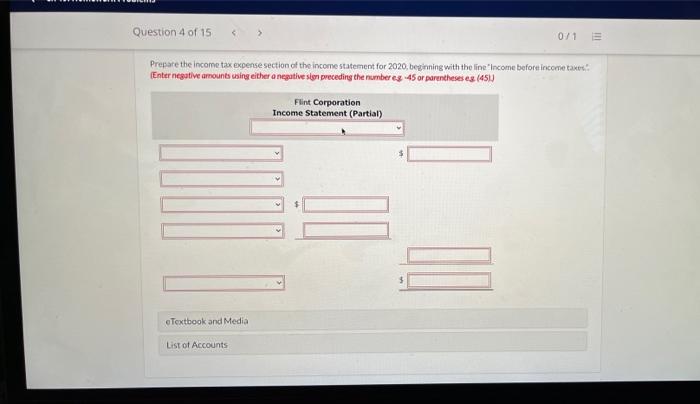

Ch 19: Homework Problems > 0/1 E Question 4 of 15 View Policies Show Attempt History Current Attempt in Progress Flint Corporation has one temporary difference at the end of 2020 that will reverse and cause taxable amounts of 553.300 in 2021. $58.600 in 2022 and 563.700 in 2023. Fit's pretax inspelat income for 2020 $281.200, and the tax rate is 30% for all years. There are no deferred taxes at the beginning of 2020, * Your awer is incorrect Compute taxable income and income taxes payable for 2020 Taxable income $ 175600 income taxes payable $ e Textbook and Media List of Accounts Question 4 of 15 >> 071 = * Your answer is incorrect Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually no entry is required, select "No Entry for the account titles and enter for the amounts) Account Titles and Explanation Debit Credit e Textbook and Media List of Accounts x Your answer is incorrect Question 4 of 15 071 III Prepare the income tax expense section of the income statement for 2020, beginning with the line income before income taxes (Enter negative amounts using either a negative ser preceding the number es 45 or parentheses es (451) Flint Corporation Income Statement (Partial) eTextbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts