Question: CH 19 HW Book Print om Exercise 19-27 (Algorithmic) (LO. 7) What are the tax consequences to Euclid from the following independent events? In your

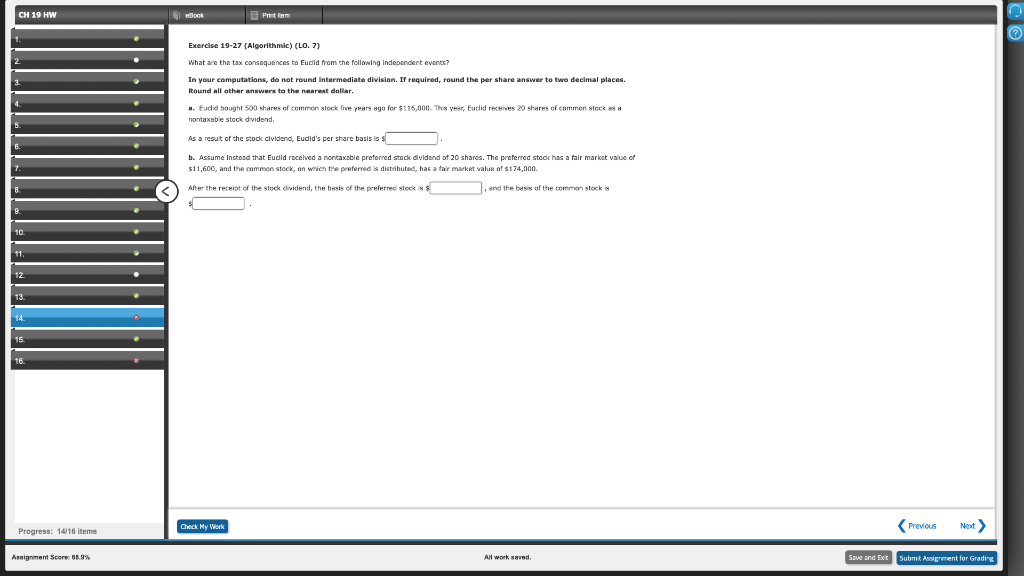

CH 19 HW Book Print om Exercise 19-27 (Algorithmic) (LO. 7) What are the tax consequences to Euclid from the following independent events? In your computations, do not round intermediate division. If required, round the per share answer to two decimal places. Round all other answers to the nearest dollar. *. Eudid bought 500 shares of common stock five years ago for $116,000. This year, Euclid receives 20 shares of common stock sa nontaxable stock dividend. As a result of the stock cividend, Eudid's per share basis is $ b. Assume instead that Euclid received a nontaxable preferred stock dividend of 20 shares. The preferred stock has a fair market value of $11,600, and the common stock, on which the preferred is distributed, has a fair market value of $174,000. After the receipt of the stock divident, the basis of the preferred stocks and the basis of the common stock is 11. 12 13 14 15 Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts