Question: Ch 22. Assignment - International Financial Management e par The nse of globalization is due to the many companies that have become multinational corporations for

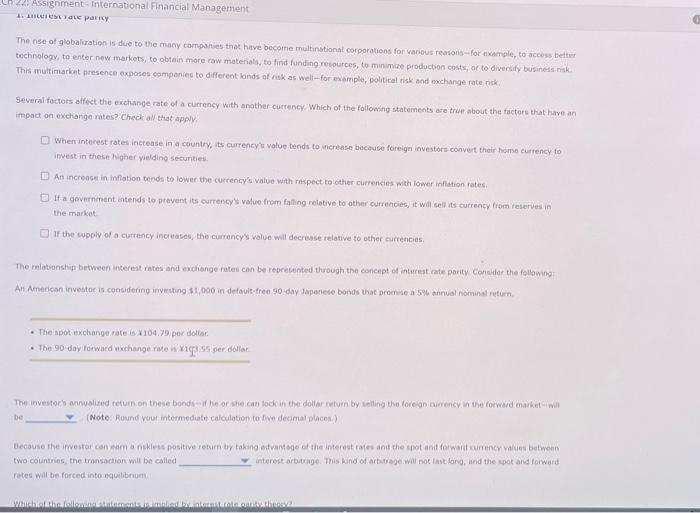

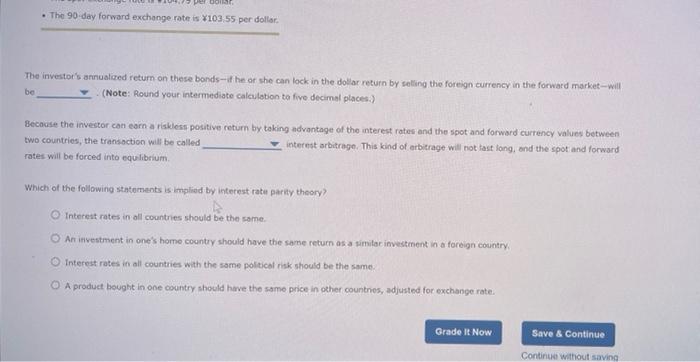

Ch 22. Assignment - International Financial Management e par The nse of globalization is due to the many companies that have become multinational corporations for various reasong-for example, to access better technology, to enter new markets, to obtain more raw materials, to find funding resources, to minimize production costs, or to diversity business risk This multimariot presence exposes companies to different kinds of risk as well-for example, political risk and exchange rate nisk Several factors affect the exchange rate of a currency with another currency. Which of the following statements are trur about the factors that have an impact on exchange rates? Check all that apply Wher interest rates increase in a country, its currency's value tends to increase because foreign investors convert their home currency to invest in these higher yielding securities An increase in inflation tends to lower the currency's value with respect to other currencies with lower Inflation rates If a government intends to prevent its currency value from falling relative to other currencies, it will sell its currency from reserves in the market If the supply of a currency increases the currency's value will decrease relative to other currencies The relationship between interest rates and exchange rates can be represented though the concept of interest rate parity Consider the following An American investor is considering investing $1,000 in default-free 90-day Japeriete bonds that promise a 5% annual rominatretorn The spot exchange rate is 1104.79 per dollar The 90-day forward wwchange rate was per dollar The investor's annualized return on these bonds he or she can lock in the dollar turn by selling the foreign currency in the forward market will be (Note: Round your intermediate calculation to live decimal places) Because the investor con cam a niklusa positive return by taking advantage of the interest rates and the spot and forward currency waves between two countries, the transaction will be called interest arbitrage. This kind of arbitrage will not last long, and the spot and forward rates will be forced into equilibrium Wachstan The 90-day forward exchange rate is 103.55 per dollar The investor's annualized return on these bonds-- he or she can lock in the dollar return by selling the foreign currency in the forward market-will be (Note: Round your intermediate calculation to five decimal places) Because the investor can earn a riskless positive return by taking advantage of the interest rates and the spot and forward currency values between two countries, the transaction will be called Interest arbitrage. This kind of arbitrage will not fast long, and the spot and forward rates will be forced into equilibrium Which of the following statements is implied by interest ratu parity theory Interest rates in all countries should be the same An investment in one's home country should have the same return as a similar investment in a foreign country Interest rates in all countries with the same political risk should be the same A product bought in one country should have the same price in other countries, adjusted for exchange rate. Grade it Now Save & Continue Continue without saving Ch 22. Assignment - International Financial Management e par The nse of globalization is due to the many companies that have become multinational corporations for various reasong-for example, to access better technology, to enter new markets, to obtain more raw materials, to find funding resources, to minimize production costs, or to diversity business risk This multimariot presence exposes companies to different kinds of risk as well-for example, political risk and exchange rate nisk Several factors affect the exchange rate of a currency with another currency. Which of the following statements are trur about the factors that have an impact on exchange rates? Check all that apply Wher interest rates increase in a country, its currency's value tends to increase because foreign investors convert their home currency to invest in these higher yielding securities An increase in inflation tends to lower the currency's value with respect to other currencies with lower Inflation rates If a government intends to prevent its currency value from falling relative to other currencies, it will sell its currency from reserves in the market If the supply of a currency increases the currency's value will decrease relative to other currencies The relationship between interest rates and exchange rates can be represented though the concept of interest rate parity Consider the following An American investor is considering investing $1,000 in default-free 90-day Japeriete bonds that promise a 5% annual rominatretorn The spot exchange rate is 1104.79 per dollar The 90-day forward wwchange rate was per dollar The investor's annualized return on these bonds he or she can lock in the dollar turn by selling the foreign currency in the forward market will be (Note: Round your intermediate calculation to live decimal places) Because the investor con cam a niklusa positive return by taking advantage of the interest rates and the spot and forward currency waves between two countries, the transaction will be called interest arbitrage. This kind of arbitrage will not last long, and the spot and forward rates will be forced into equilibrium Wachstan The 90-day forward exchange rate is 103.55 per dollar The investor's annualized return on these bonds-- he or she can lock in the dollar return by selling the foreign currency in the forward market-will be (Note: Round your intermediate calculation to five decimal places) Because the investor can earn a riskless positive return by taking advantage of the interest rates and the spot and forward currency values between two countries, the transaction will be called Interest arbitrage. This kind of arbitrage will not fast long, and the spot and forward rates will be forced into equilibrium Which of the following statements is implied by interest ratu parity theory Interest rates in all countries should be the same An investment in one's home country should have the same return as a similar investment in a foreign country Interest rates in all countries with the same political risk should be the same A product bought in one country should have the same price in other countries, adjusted for exchange rate. Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts