Question: Ch 24: Assignment - Enterprise Risk Management Different companies have different risk exposures, and their risk management approach is customized to the type of risk

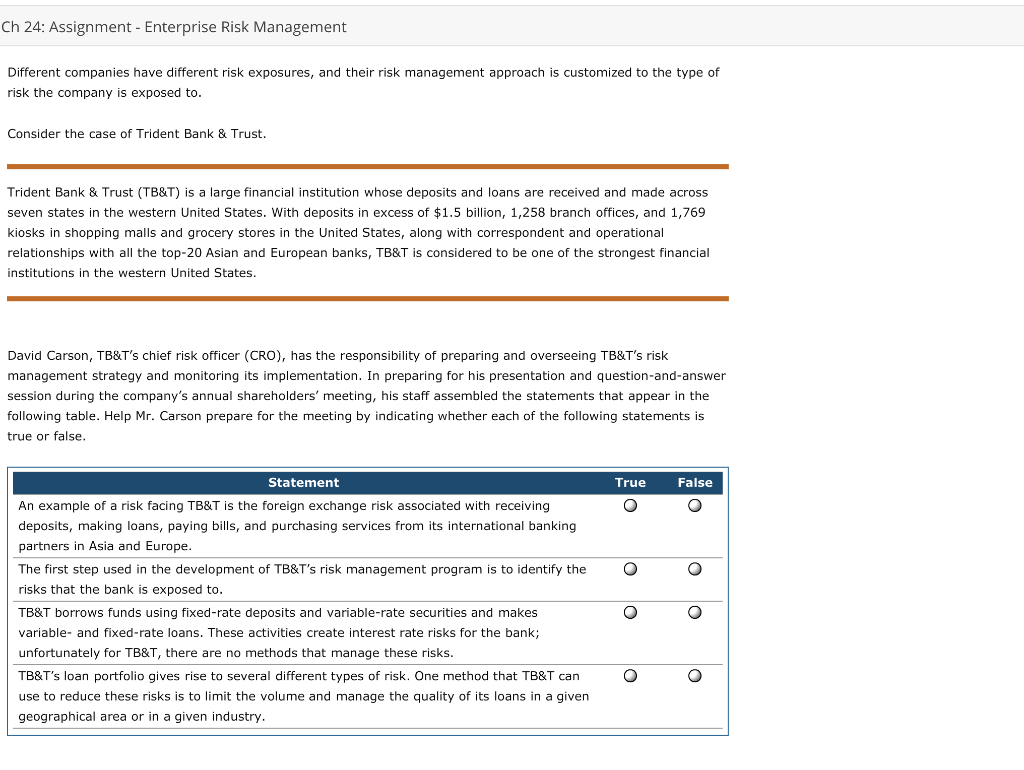

Ch 24: Assignment - Enterprise Risk Management Different companies have different risk exposures, and their risk management approach is customized to the type of risk the company is exposed to. Consider the case of Trident Bank & Trust. Trident Bank & Trust (TB&T) is a large financial institution whose deposits and loans are received and made across seven states in the western United States. With deposits in excess of $1.5 billion, 1,258 branch offices, and 1,769 kiosks in shopping malls and grocery stores in the United States, along with correspondent and operational relationships with all the top-20 Asian and European banks, TB&T is considered to be one of the strongest financial institutions in the western United States. David Carson, TB&T's chief risk officer (CRO), has the responsibility of preparing and overseeing TB&T's risk management strategy and monitoring its implementation. In preparing for his presentation and question-and-answer session during the company's annual shareholders' meeting, his staff assembled the statements that appear in the following table. Help Mr. Carson prepare for the meeting by indicating whether each of the following statements is true or false. True False Statement An example of a risk facing TB&T is the foreign exchange risk associated with receiving deposits, making loans, paying bills, and purchasing services from its international banking partners in Asia and Europe. The first step used in the development of TB&T's risk management program is to identify the risks that the bank is exposed to. TB&T borrows funds using fixed-rate deposits and variable-rate securities and makes variable- and fixed-rate loans. These activities create interest rate risks for the bank; unfortunately for TB&T, there are no methods that manage these risks. TB&T's loan portfolio gives rise to several different types of risk. One method that TB&T can use to reduce these risks is to limit the volume and manage the quality of its loans in a given geographical area or in a given industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts