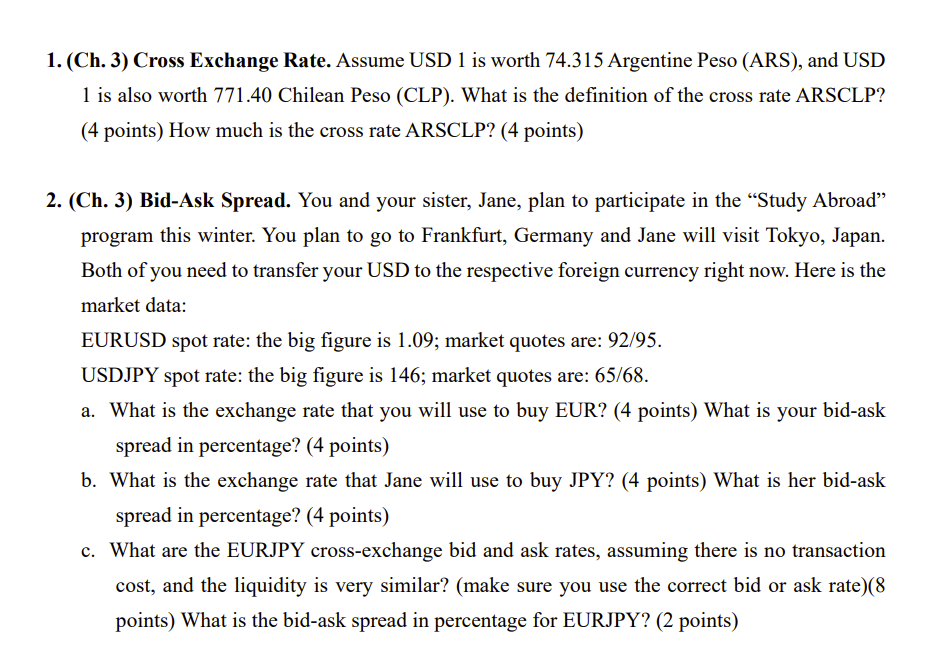

Question: ( Ch . 3 ) Cross Exchange Rate. Assume USD 1 is worth 7 4 . 3 1 5 Argentine Peso ( ARS ) ,

Ch Cross Exchange Rate. Assume USD is worth Argentine Peso ARS and USD Ch Carry Trade

a Explain "carry trade." points

b If the interest rates for the GBP USD, and JPY are and respectively, and you

would like to have a carry trade, which currency would you like to borrow? points Why?

points

c If you have a carry trade, what may you earn? points What risk may you have? points

d What will be expected in practice if everyone in the markets is doing the same thing with

you carry trade points

Ch Aggregate Effects on Exchange Rates. Assume that United States residents invest

heavily in the Australian government and stocks. In addition, Australian residents invest

heavily in the United States.

Because your firm imports goods from Australia, you are assigned to forecast the value of AUD

the Australian dollar against the USD ie you forecast AUDUSD Explain how each of

the following conditions will affect the value of the AUD, holding other things equal. Then,

aggregate all of these impacts to develop an overall forecast of the AUD's movement against

the USD. Please plot a figure to explain each condition, except for question f No figures, no Ch Spot Exchange Rate Movements. Suppose you have a buy AUDUSD" position for

some units of the AUD Australian dollars You bought the AUD with the USD at

AUDUSD on September seven days ago Today is September with

What is the annualized percent change in the AUDUSD exchange

movements in these seven days? Annualize by multiplying Does the AUD

appreciate or depreciate against the USD in these seven days? points

is also worth Chilean Peso CLP What is the definition of the cross rate ARSCLP?

points How much is the cross rate ARSCLP? points

Ch BidAsk Spread. You and your sister, Jane, plan to participate in the "Study Abroad"

program this winter. You plan to go to Frankfurt, Germany and Jane will visit Tokyo, Japan.

Both of you need to transfer your USD to the respective foreign currency right now. Here is the

market data:

EURUSD spot rate: the big figure is ; market quotes are:

USDJPY spot rate: the big figure is ; market quotes are:

a What is the exchange rate that you will use to buy EUR? points What is your bidask

spread in percentage? points

b What is the exchange rate that Jane will use to buy JPY points What is her bidask

spread in percentage? points

c What are the EURJPY crossexchange bid and ask rates, assuming there is no transaction

cost and the liquidity is very similar? make sure you use the correct bid or ask rate

points What is the bidask spread in percentage for EURJPY? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock