Question: Ch. 3 - These are part of one same problem. Required information [The following information applies to the questions displayed below.] Sweeten Company had no

Ch. 3 - These are part of one same problem.

![[The following information applies to the questions displayed below.] Sweeten Company had](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671643844e508_32367164383c7d2f.jpg)

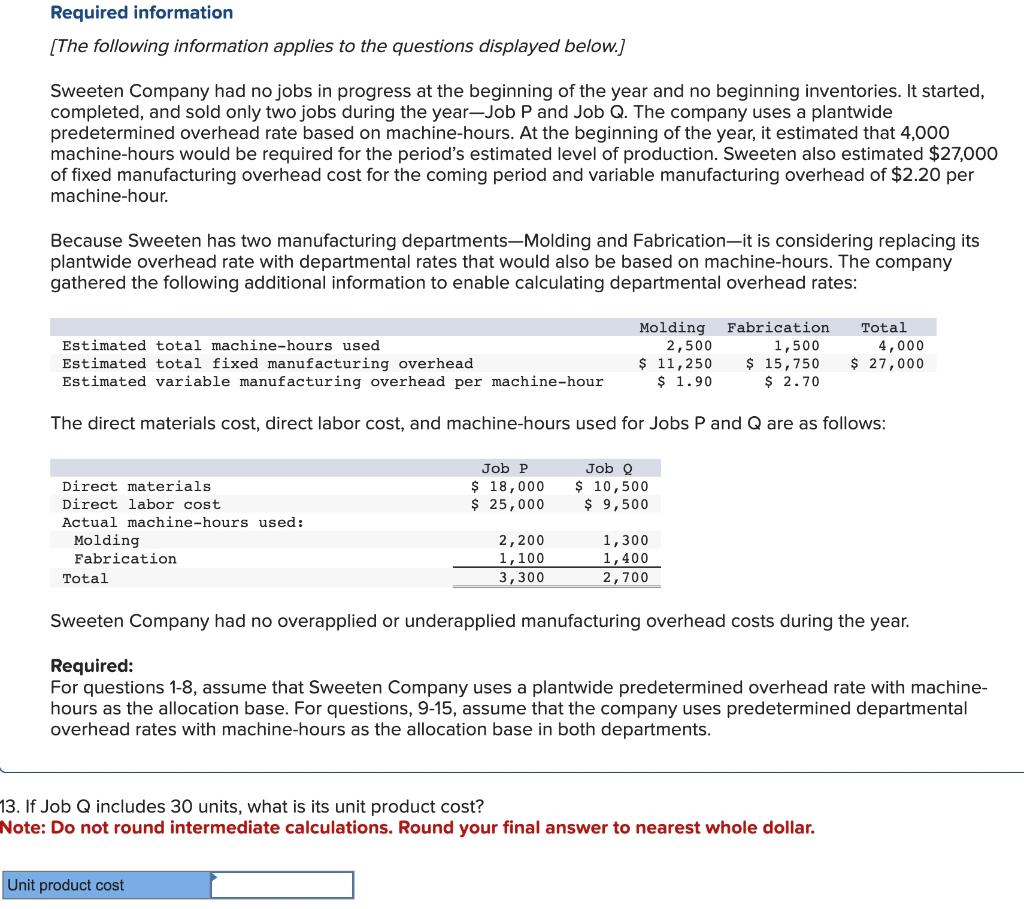

Required information [The following information applies to the questions displayed below.] Sweeten Company had no jobs in progress at the beginning of the year and no beginning inventories. It started, completed, and sold only two jobs during the year-Job P and Job Q. The company uses a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, it estimated that 4,000 machine-hours would be required for the period's estimated level of production. Sweeten also estimated $27,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $2.20 per machine-hour. Because Sweeten has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following additional information to enable calculating departmental overhead rates: The direct materials cost, direct labor cost, and machine-hours used for Jobs P and Q are as follows: Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. 3. If Job Q includes 30 units, what is its unit product cost? lote: Do not round intermediate calculations. Round your final answer to nearest whole dollar. 14. Assume that Sweeten Company uses cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. If Job P includes 20 units and Job Q includes 30 units, what selling price would the company establish for Jobs P and Q ? What are the selling prices for both jobs when stated on a per unit basis? Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. 15. What is Sweeten Company's cost of goods sold for the year? Note: Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts