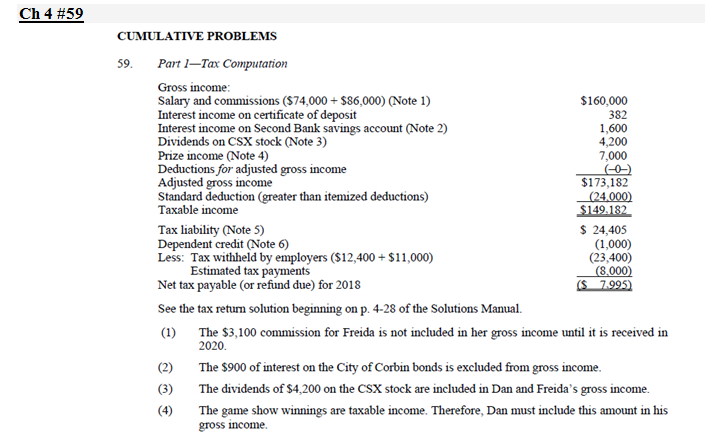

Question: Ch 4 #59 382 CUMULATIVE PROBLEMS 59. Part 1-Tax Computation Gross income: Salary and commissions (74,000 + $86,000) (Note 1) $160,000 Interest income on certificate

Ch 4 #59 382 CUMULATIVE PROBLEMS 59. Part 1-Tax Computation Gross income: Salary and commissions (74,000 + $86,000) (Note 1) $160,000 Interest income on certificate of deposit Interest income on Second Bank savings account (Note 2) 1,600 Dividends on CSX stock (Note 3) 4,200 Prize income (Note 4) 7,000 Deductions for adjusted gross income (0) Adjusted gross income $173,182 Standard deduction (greater than itemized deductions) (24.000) Taxable income $149.182 Tax liability (Note 5) $ 24,405 Dependent credit (Note 6) (1,000) Less: Tax withheld by employers ($12,400 + $11,000) (23,400) Estimated tax payments (8,000) Net tax payable (or refund due) for 2018 $7.995) See the tax retum solution beginning on p. 4-28 of the Solutions Manual (1) The $3,100 commission for Freida is not included in her gross income until it is received in 2020 (2) The $900 of interest on the City of Corbin bonds is excluded from gross income. The dividends of $4,200 on the CSX stock are included in Dan and Freida's gross income. The game show winnings are taxable income. Therefore, Dan must include this amount in his gross income Ch 4 #59 382 CUMULATIVE PROBLEMS 59. Part 1-Tax Computation Gross income: Salary and commissions (74,000 + $86,000) (Note 1) $160,000 Interest income on certificate of deposit Interest income on Second Bank savings account (Note 2) 1,600 Dividends on CSX stock (Note 3) 4,200 Prize income (Note 4) 7,000 Deductions for adjusted gross income (0) Adjusted gross income $173,182 Standard deduction (greater than itemized deductions) (24.000) Taxable income $149.182 Tax liability (Note 5) $ 24,405 Dependent credit (Note 6) (1,000) Less: Tax withheld by employers ($12,400 + $11,000) (23,400) Estimated tax payments (8,000) Net tax payable (or refund due) for 2018 $7.995) See the tax retum solution beginning on p. 4-28 of the Solutions Manual (1) The $3,100 commission for Freida is not included in her gross income until it is received in 2020 (2) The $900 of interest on the City of Corbin bonds is excluded from gross income. The dividends of $4,200 on the CSX stock are included in Dan and Freida's gross income. The game show winnings are taxable income. Therefore, Dan must include this amount in his gross income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts