Question: CH 4 - Homework: Problem 4.4B - EQ Units product cost report - weighted average - using text EQ cost report Summers Mfg uses the

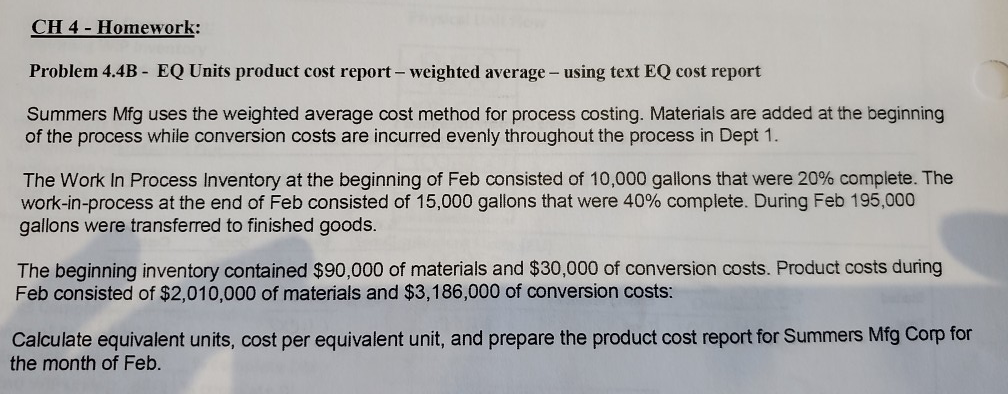

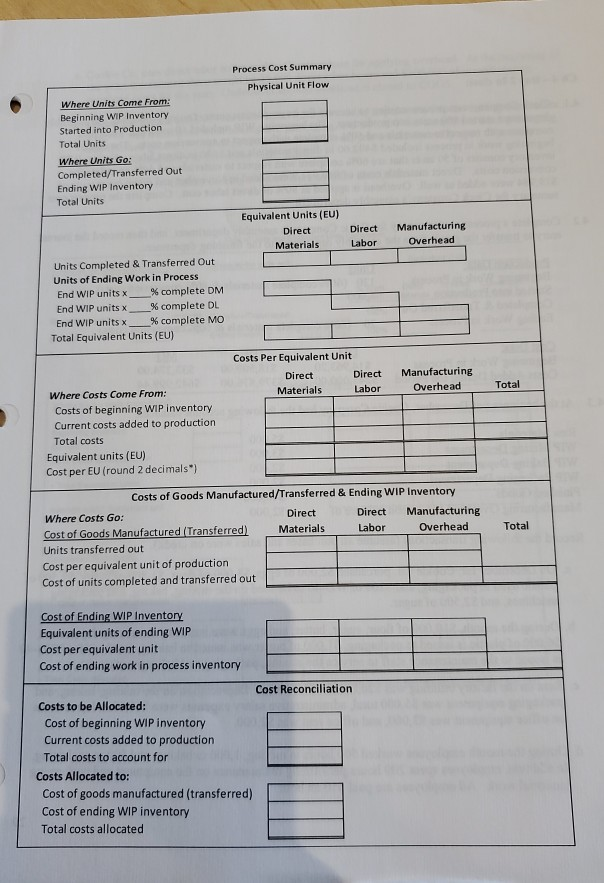

CH 4 - Homework: Problem 4.4B - EQ Units product cost report - weighted average - using text EQ cost report Summers Mfg uses the weighted average cost method for process costing. Materials are added at the beginning of the process while conversion costs are incurred evenly throughout the process in Dept 1. The Work In Process Inventory at the beginning of Feb consisted of 10,000 gallons that were 20% complete. The work-in-process at the end of Feb consisted of 15,000 gallons that were 40% complete. During Feb 195,000 gallons were transferred to finished goods. The beginning inventory contained $90,000 of materials and $30,000 of conversion costs. Product costs during Feb consisted of $2,010,000 of materials and $3,186,000 of conversion costs: Calculate equivalent units, cost per equivalent unit, and prepare the product cost report for Summers Mfg Corp for the month of Feb. Process Cost Summary Physical Unit Flow Where Units Come From: Beginning WIP Inventory Started into Production Total Units Where Units Go: Completed/Transferred Out Ending WIP Inventory Total Units Equivalent Units (EU) Direct Materials Direct Labor Manufacturing Overhead Units Completed & Transferred Out Units of Ending Work in Process End WIP units x % complete DM End WIP units X % complete DL End WIP units x % complete MO Total Equivalent Units (EU) Total Costs Per Equivalent Unit Direct Direct Manufacturing Where Costs Come From: Materials Labor Overhead Costs of beginning WIP inventory Current costs added to production Total costs Equivalent units (EU) Cost per EU (round 2 decimals") Costs of Goods Manufactured/Transferred & Ending WIP Inventory Where Costs Go: Direct Direct Manufacturing Cost of Goods Manufactured (Transferred) Materials Labor Overhead Units transferred out Cost per equivalent unit of production Cost of units completed and transferred out Total Cost of Ending WIP Inventory Equivalent units of ending WIP Cost per equivalent unit Cost of ending work in process inventory Cost Reconciliation Costs to be Allocated: Cost of beginning WIP inventory Current costs added to production Total costs to account for Costs Allocated to: Cost of goods manufactured (transferred) Cost of ending WIP inventory Total costs allocated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts