Question: Ch. 4 MC Can someone please explain the multiple choice answers? 1) On the 2020 consolidation working paper, elimination entry (R) reduces Investment in Salem

Ch. 4 MC Can someone please explain the multiple choice answers?

1) On the 2020 consolidation working paper, elimination entry (R) reduces Investment in Salem by:

a) $3,100,000

b) $5,200,000

c) $6,400,000

d) $8,000,000

2) On the 2020 consolidation working paper, elimination entry (O) increases consolidated operating expenses by:

a) $1,600,000

b) $2,100,000

c) $2,900,000

d) $3,200,000

3) What is 2020 equity in net income of Salem, reported on Portland's books using the complete equity method?

a) $400,000

b) $900,000

c) $1,200,000

d) $2,500,000

4) On Portland's December 31,2020, trial balance, what is the balance in its Investment in Salem account, using the complete equity method?

a) $22,800,000

b) $23,200,000

c) $23,600,000

d) $27,600,000

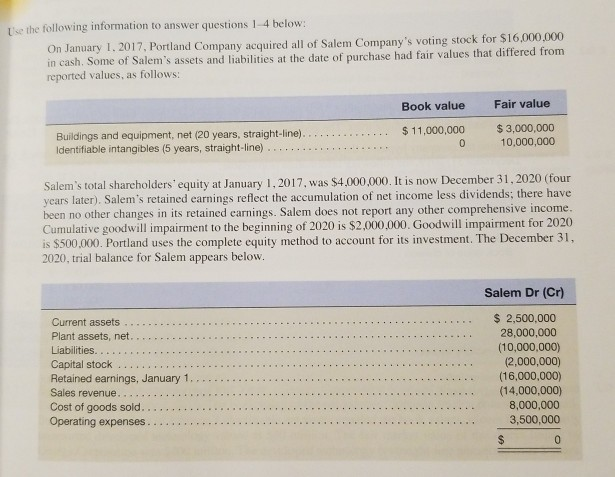

stions 1-4 below Use the following information to answer que 1.2017, Portland Company acquired all of Salem Company's voting stock for $16,000,000 e of Salem's assets and liabilities at the date of purchase had fair values that differed from in cash. Som reported values, as follows: Fair value Book value $11,000,000 3,000,000 10,000,000 Buildings and equipment, net (20 years, straight-line) Identifiable intangibles (5 years, straight-line) Salem's total sharcholders'equity at January 1,2017, was $4.000.000. It is now December 31,2020 (four years later). Salem's retained earnings reflect the accumulation of net income less dividends; there have been no other changes in its retained earnings. Salem does not report any other comprehensive income. Cumulative goodwill impairment to the beginning of 2020 is $2.000,000. Goodwill impairment for 2020 is $500,000. Portland uses the complete equity method to account for its investment. The December 31, 2020, trial balance for Salem appears below. Salem Dr (Cr) $ 2,500,000 28,000,000 (10,000,000) (2,000,000) (16,000,000) (14,000,000) Current assets Plant assets, net. Liabilities Capital stock Retained earnings, January 1.. . 8,000,000 Cost of goods sold. 3,500,000 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts