Question: Ch 5 Example Problem-Adjustable Rate Mortgages [Compatibility Mode] - Word Review View Help Acrobat Tell me what you want to do E. . 21 .

![Ch 5 Example Problem-Adjustable Rate Mortgages [Compatibility Mode] - Word Review](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ee2b8a3a7f7_74566ee2b898d226.jpg)

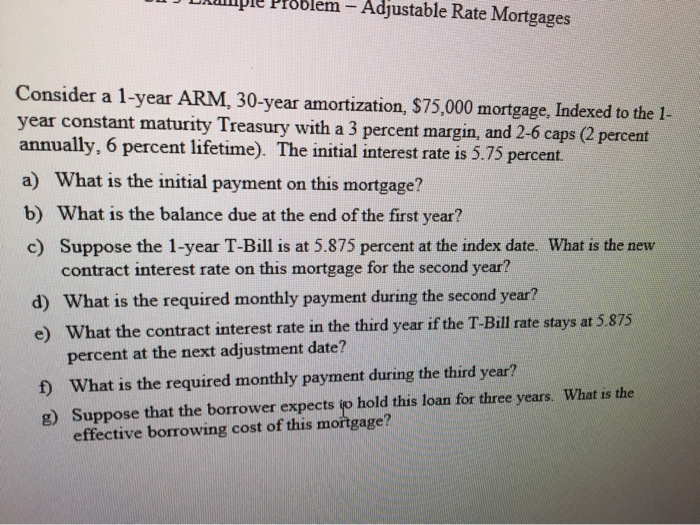

Ch 5 Example Problem-Adjustable Rate Mortgages [Compatibility Mode] - Word Review View Help Acrobat Tell me what you want to do E. . 21 . E Aabbcc AabbCcl AaBbC AaBbCa AaBt 1 Caption Emphasis 1 Heading 1 1 Heading 2 1 Head EE E . Paragraph Styles FIN 365 - Real Estate Finance Ch 5 Example Problem - Adjustable Rate Mortgages 1) Consider a l-year ARM, 30-year amortization, $75,000 mortgage, Indexed to the 1- year constant maturity Treasury with a 3 percent margin, and 2-6 caps (2 percent annually, 6 percent lifetime). The initial interest rate is 5.75 percent. a) What is the initial payment on this mortgage? b) What is the balance due at the end of the first year? c) Suppose the 1-year T-Bill is at 5.875 percent at the index date. What is the new contract interest rate on this mortgage for the second year? d) What is the required monthly payment during the second year? e) What the contract interest rate in the third year if the T-Bill rate stays at 5.875 percent at the next adjustment date? 1) What is the required monthly payment during the third year? Suppose that the borrower expects to hold this loan for three years. What is the effective borrowing cost of this mortgage? D i e Problem - Adjustable Rate Mortgages Consider a 1-year ARM, 30-year amortization, $75,000 mortgage, Indexed to the 1- year constant maturity Treasury with a 3 percent margin, and 2-6 caps (2 percent annually, 6 percent lifetime). The initial interest rate is 5.75 percent. a) What is the initial payment on this mortgage? b) What is the balance due at the end of the first year? c) Suppose the 1-year T-Bill is at 5.875 percent at the index date. What is the new contract interest rate on this mortgage for the second year? d) What is the required monthly payment during the second year? e) What the contract interest rate in the third year if the T-Bill rate stays at 5.875 percent at the next adjustment date? f) What is the required monthly payment during the third year? g) Suppose that the borrower expects ip hold this loan for three years. What is the effective borrowing cost of this mortgage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts