Question: Ch 6 Sec 5: Problem 14 Previous Problem Problem List Next Problem (1 point) Your rich uncle bequests to you a continuous, constant income stream

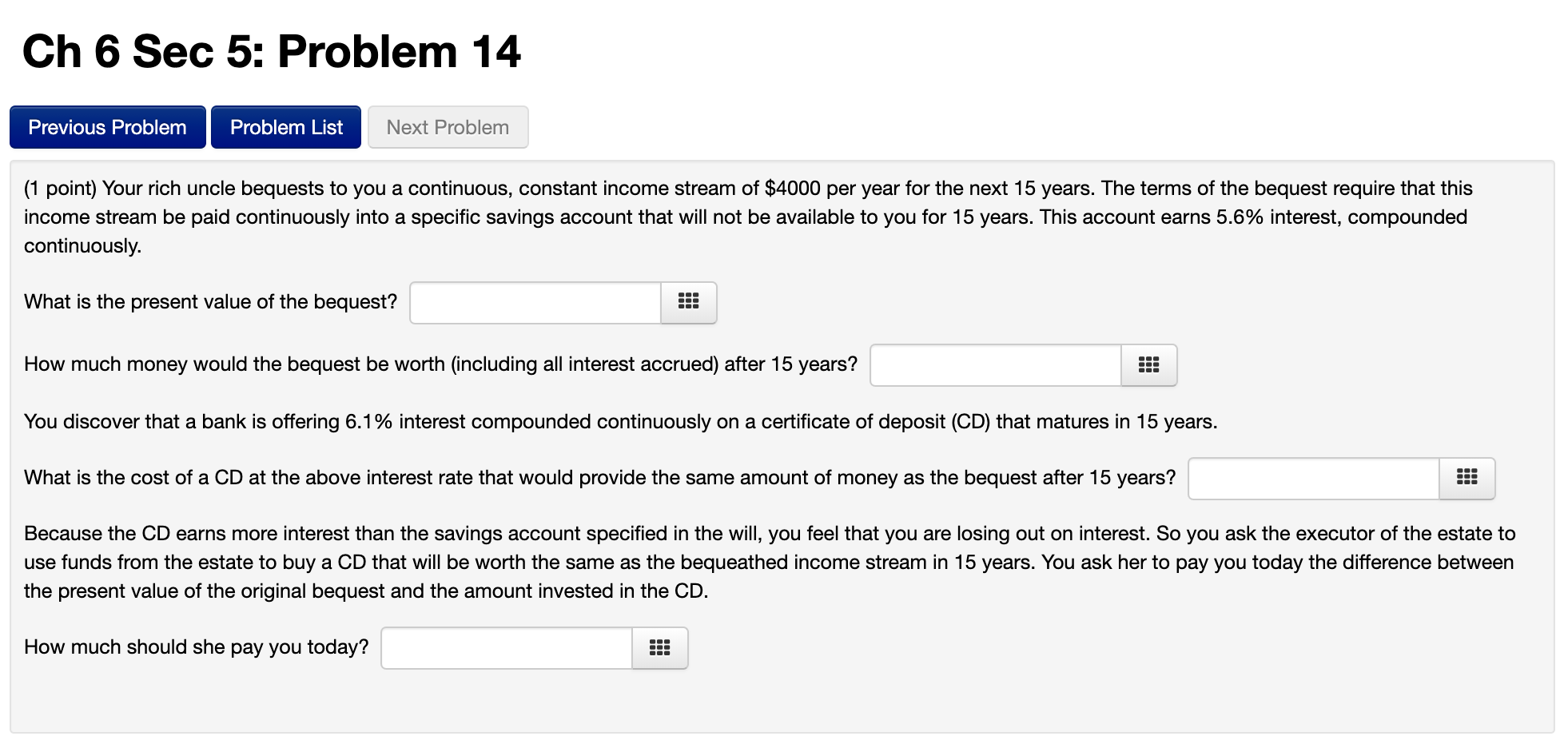

Ch 6 Sec 5: Problem 14 Previous Problem Problem List Next Problem (1 point) Your rich uncle bequests to you a continuous, constant income stream of $4000 per year for the next 15 years. The terms of the bequest require that this income stream be paid continuously into a specific savings account that will not be available to you for 15 years. This account earns 5.6% interest, compounded continuously. What is the present value of the bequest? 1 How much money would the bequest be worth (including all interest accrued) after 15 years? You discover that a bank is offering 6.1% interest compounded continuously on a certificate of deposit (CD) that matures in 15 years. What is the cost of a CD at the above interest rate that would provide the same amount of money as the bequest after 15 years? Because the CD earns more interest than the savings account specified in the will, you feel that you are losing out on interest. So you ask the executor of the estate to use funds from the estate to buy a CD that will be worth the same as the bequeathed income stream in 15 years. You ask her to pay you today the difference between the present value of the original bequest and the amount invested in the CD. How much should she pay you today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts