Question: CH. 7 #5 TABLE 7.1 TABLE 7.2 Maggie Vitteta, single, works 40 hours per week at $8.00 an hour. How much is taken out for

CH. 7

#5

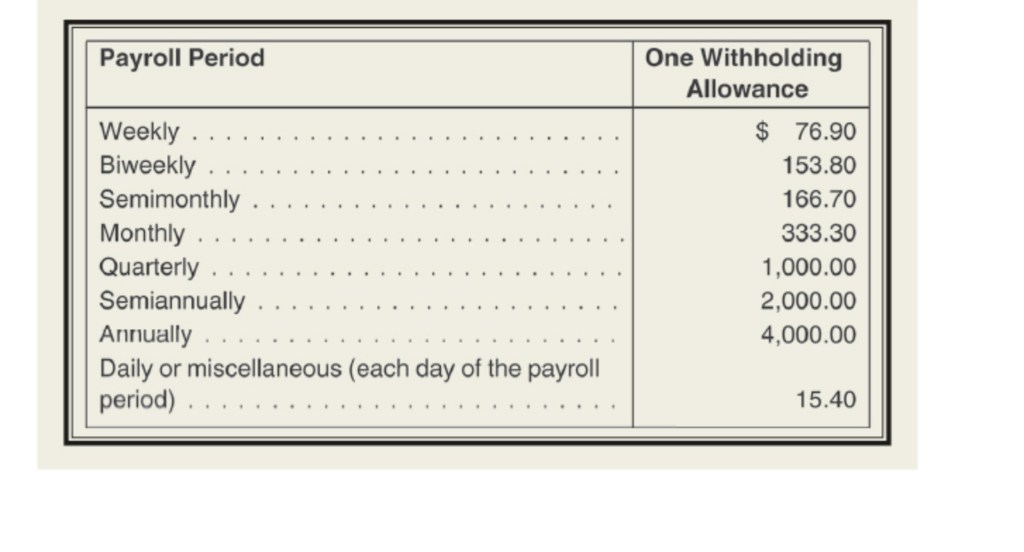

TABLE 7.1

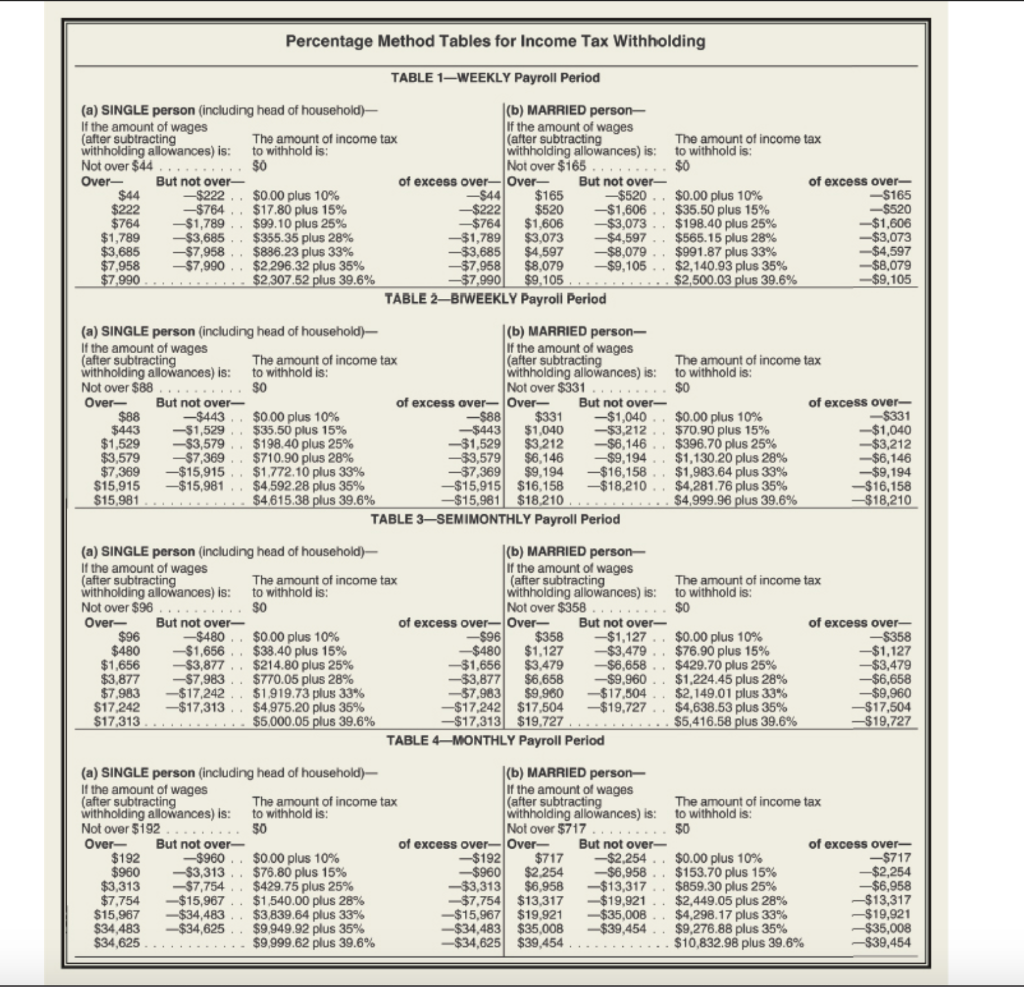

TABLE 7.2

Maggie Vitteta, single, works 40 hours per week at $8.00 an hour. How much is taken out for federal income tax with one withholding exemption? (Use Table 71 and Table 7.2) (Round your answer to the nearest cent.) Amount Payroll Period One Withholding Allowance Weekly Biweekly .. . $ 76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 Monthly Daily or miscellaneous (each day of the payroll period) 15.40 Percentage Method Tables for Income Tax Withholding TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household- If the amount of withholding allowances) is: OverBut not over_ (b) MARRIED person- If the amount of wages (after su withholding allowances) is: Not over $165 The amount of income tax to withhold is S0 The amount of income tax to withhold is: $0 over of excess over-Over-But not over- of excess over- $165 -$222 -$764 $000 plus 10% $17.80 plus 15% $99, 10 plus 25% $355.35 plus 28% $886.23 plus 33% $2296.32 plus 35% -5520 , , $0.00 plus 10% , . -$222| -$764| -$1,789| -53,685| -$7,958| $520-$1.606 .. $1.606-$3,073 , $3,073-$4,597 $4.597-$8,079 . $8.079-$9.105 $35.50 plus 15% $198.40 plus 25% $565, 15 plus 28% $991.87 plus 33% $2,140.93 plus 35% .. $764 --$1,789 . $1 . $1,789 --$3,685 $3,685 --$7,958 $7.958-$7,990 $3,073 $4,597 -$8,079 -59, 105 , , 990 2,500.03 plus 39.6% TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household If the amount of wages (b) MARRIED person- amount of income tax withholding allowances) is: Not over $88 to withhold is S0 withholding allowances) is: to withhold is: Over-But not over_ of excess over- Over-But not over-_ of excess over- excess over-|Not Overngalowances) s: The $88 $443-51,529 $1,529-53579 $3.579-$7,369 $7,369-515915 $15.915-$15.981 $35.50 plus 15% $19840 plus 25% $710.90 plus 28% $177210 plus 33% $4592.28 plus 35% $4615.38 plus 39.6% -$88| -5443| -81,529| -53,579| -$7,369| -$15,915| $331-51040 $0.00 plus 10% $1,040-53,212.570 90 plus 15% $3.212-$6,146 $396.70 plus 25% $6,146 _$9,194 $1,130.20 plus 28% $9,194 --$16,158 $1,983.64 plus 33% $16.158 --$18.210, $4.281.76 plus 35% -$3,212 -$9,194 $4,999.96 plus 39.6% TABLE 3 SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household)- If the amount of wages (b) MARRIED person- If the amount of wages The amount of income tax to withhold is: The amount of income tax withholding allowances) is: Not over $96 Over-But not over_ withholding allowances) is: to withhold is Not over of excess over-OverBut not over_ $358-$1,127 , , of excess over- $96 -$480 --$1,656 $000 plus 10% $38.40 plus 15% $214.80 plus 25% $770.05 plus 28% $1.919.73 plus 33% $4975.20 plus 35% $5000.05 plus 39.6% --$96| -$480| $480 $1,656 --$3,877 . , $3,877 --$7,983 . . $7.983-$17,242 , $1,127-$3,479 $3,479-$6,658 $6.658-$9.960.. $9.960 $0.00 plus 10% $76.90 plus 15% $429.70 plus 25% $1,224.45 plus 28% $2,149.01 plus 33% $4,638.53 plus 35% $5,416.58 -$1,127 -$6,658 $9 -$1,656| -53.8771 -57.963| --$17.504 --$19,727.. $17.242-$17,313 , S17.313 -$17.242| $17,504 $17,313 $19,727 19,727 TABLE 4 MONTHLY Payroll Period (a) SINGLE person (including head of household)- If the amount of wages (b) MARRIED person- If the amount of wages The amount of income tax to withhold is: withholding allowances) is: to withhold is $0 withholding allowances) is: Not over $717 over But not over-_ -$960 of excess over- OverBut not over- $717-$2.254.. of excess over-- $000 plus 10% $78.80 plus 15% $429.75 plus 25% $1,540.00 plus 28% $3839.64 plus 33% $9949.92 plus 35% $9999.62 plus 39.6% -$192| -5960| -53,313| -57,754| -$15,967| -$34,483| $0.00 plus 10% $153.70 plus 15% $859.30 plus 25% $2,449.05 plus 28% $4.298.17plus 33% $9,276.88 plus 35% $10,832.98 plus 39.6% 960-53313.. $2.254-$6.958 , $6.958 --$13,317, $13.317-$19.921.. -$6,958 -$19,921 -$39,454 $3,313-57,754 $7.754-515,967 . . $15,967-$34,483 , $34.483-$34,625 , $19.921-$35,008 $35,008-$39,454 . $34,625 $34,625 $39,454

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts