Question: ch .7, ch 8 You find a zero coupon bond with a par value of $10,000 and 13 years to maturity. The yield to maturity

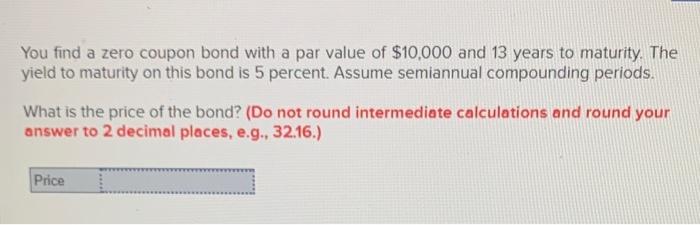

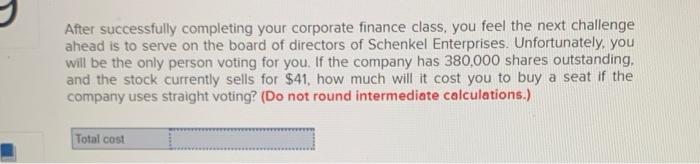

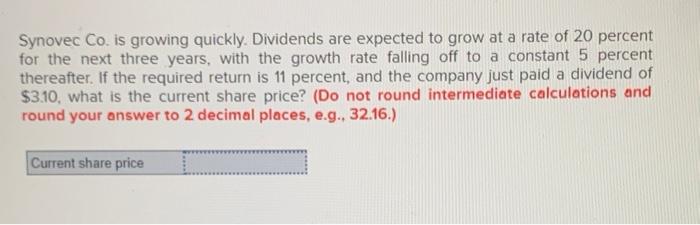

You find a zero coupon bond with a par value of $10,000 and 13 years to maturity. The yield to maturity on this bond is 5 percent. Assume semiannual compounding periods. What is the price of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Price After successfully completing your corporate finance class, you feel the next challenge ahead is to serve on the board of directors of Schenkel Enterprises. Unfortunately, you will be the only person voting for you. If the company has 380,000 shares outstanding, and the stock currently sells for $41, how much will it cost you to buy a seat if the company uses straight voting? (Do not round intermediate calculations.) Total cost Synovec Co. is growing quickly. Dividends are expected to grow at a rate of 20 percent for the next three years, with the growth rate falling off to a constant 5 percent thereafter. If the required return is 11 percent, and the company just paid a dividend of $3.10, what is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current share price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts