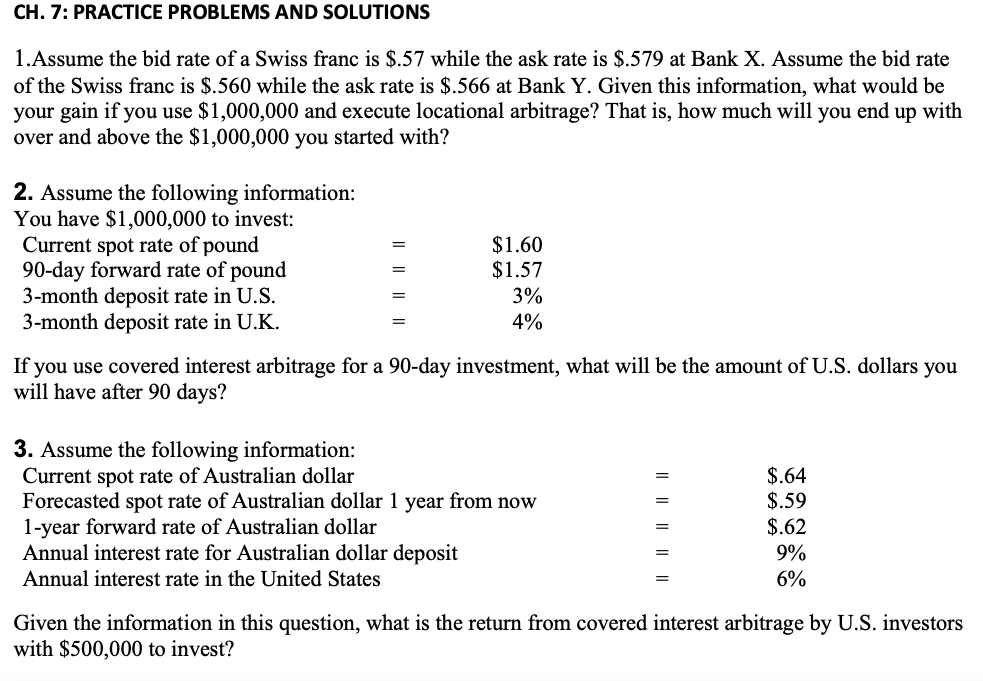

Question: CH. 7: PRACTICE PROBLEMS AND SOLUTIONS 1. Assume the bid rate of a Swiss franc is $.57 while the ask rate is $.579 at Bank

CH. 7: PRACTICE PROBLEMS AND SOLUTIONS 1. Assume the bid rate of a Swiss franc is $.57 while the ask rate is $.579 at Bank X. Assume the bid rate of the Swiss franc is $.560 while the ask rate is $.566 at Bank Y. Given this information, what would be your gain if you use $1,000,000 and execute locational arbitrage? That is, how much will you end up with over and above the $1,000,000 you started with? == = 2. Assume the following information: You have $1,000,000 to invest: Current spot rate of pound $1.60 90-day forward rate of pound $1.57 3-month deposit rate in U.S. 3% 3-month deposit rate in U.K. 4% If you use covered interest arbitrage for a 90-day investment, what will be the amount of U.S. dollars you will have after 90 days? = 3. Assume the following information: Current spot rate of Australian dollar Forecasted spot rate of Australian dollar 1 year from now 1-year forward rate of Australian dollar Annual interest rate for Australian dollar deposit Annual interest rate in the United States $.64 $.59 $.62 9% 6% Given the information in this question, what is the return from covered interest arbitrage by U.S. investors with $500,000 to invest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts