Question: Ch 8 Q 1 &7 I only need help on a small problem. land & Cash 2) gain on sales of machines Ch 8 Q

Ch 8 Q 1 &7

I only need help on a small problem.

- land & Cash

- 2) gain on sales of machines

Ch 8 Q 1 &7

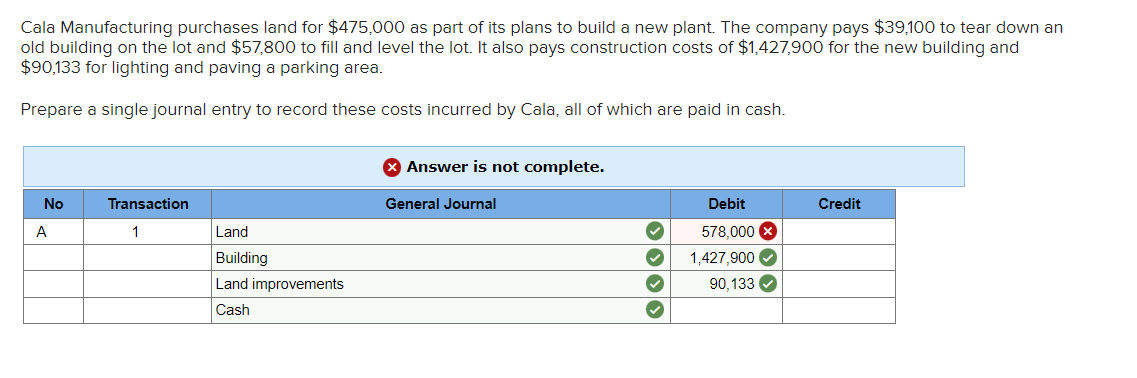

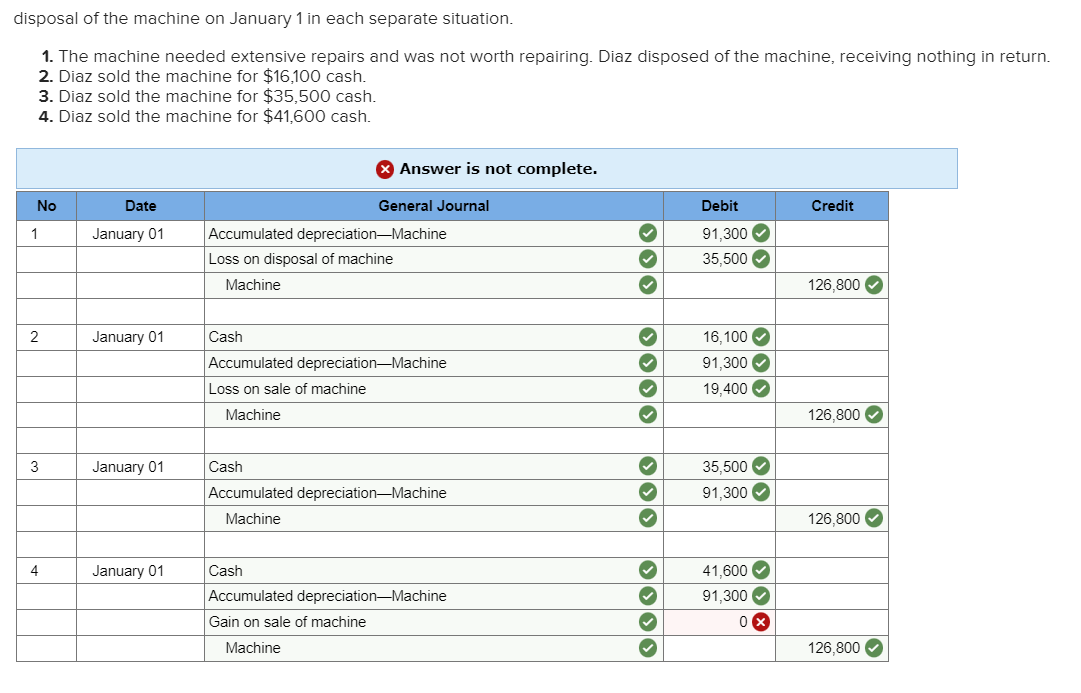

Cala Manufacturing purchases land for $475,000 as part of its plans to build a new plant. The company pays $39,100 to tear down an old building on the lot and $57,800 to fill and level the lot. It also pays construction costs of $1,427,900 for the new building and $90,133 for lighting and paving a parking area. Prepare a single journal entry to record these costs incurred by Cala, all of which are paid in cash. disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $16,100 cash. 3. Diaz sold the machine for $35,500 cash. 4. Diaz sold the machine for $41,600 cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts