Question: Ch. 8/ Study Guide - Assignment Problems The executor has also asked you to determine the cost amounts of the above assets to the Q

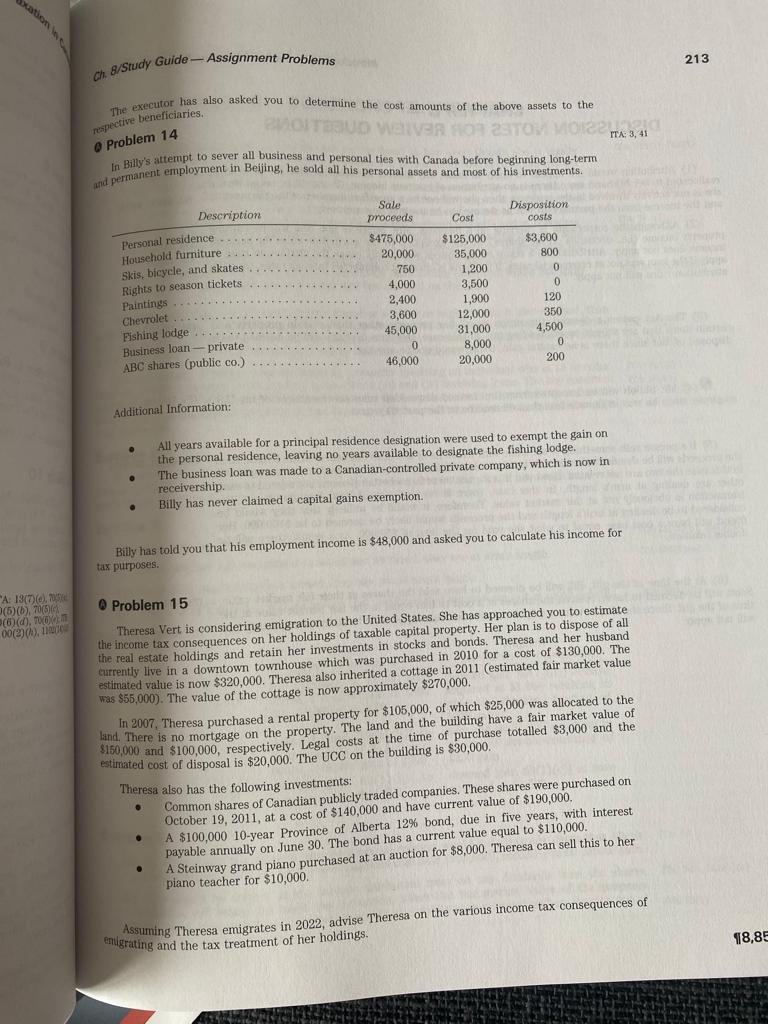

Ch. 8/ Study Guide - Assignment Problems The executor has also asked you to determine the cost amounts of the above assets to the Q 0 pript ctive beneficiaries. Problem 14 TT ;3,41 In Billy's attempt to sever all business and personal ties with Canada before beginning long-term i permanent employment in Bejjing, he sold all his personal assets and most of his investments. Additional Information: - All years available for a principal residence designation were used to exempt the gain on the personal residence, leaving no years available to designate the fishing lodge. - The business loan was made to a Canadian-controlled private company, which is now in receivership. - Billy has never claimed a capital gains exemption. Billy has told you that his employment income is $48,000 and asked you to calculate his income for tax purposes. Q Problem 15 Theresa Vert is considering emigration to the United States. She has approached you to estimate the income tax consequences on her holdings of taxable capital property. Her plan is to dispose of all the real estate holdings and retain her investments in stocks and bonds. Theresa and her husband currently live in a downtown townhouse which was purchased in 2010 for a cost of $130,000. The estimated value is now $320,000. Theresa also inherited a cottage in 2011 (estimated fair market value was $55,000 ). The value of the cottage is now approximately $270,000. In 2007 . Theresa purchased a rental property for $105,000, of which $25,000 was allocated to the land. There is no mortgage on the property. The land and the building have a fair market value of $150,000 and $100,000, respectively. Legal costs at the time of purchase totalled $3,000 and the estimated cost of disposal is $20,000. The UCC on the building is $30,000. Theresa also has the following investments: - Common shares of Canadian publicly traded companies. These shares were purchased on October 19,2011 , at a cost of $140,000 and have current value of $190,000. - A $100,000 10-year Province of Alberta 12% bond, due in five years, with interest payable annually on June 30 . The bond has a current value equal to $110,000. - A Steinway grand piano purchased at an auction for $8,000. Theresa can sell this to her piano teacher for $10,000. Assuming Theresa emigrates in 2022, advise Theresa on the various income tax consequences of entigrating and the tax treatment of her holdings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts