Question: Ch07 Exercises & Problems : Question 2 6 Chrome File Edit View History Bookmarks Profiles Tab Window Help 9 @J 6 L >3 -. '3

Ch07 Exercises & Problems : Question 2

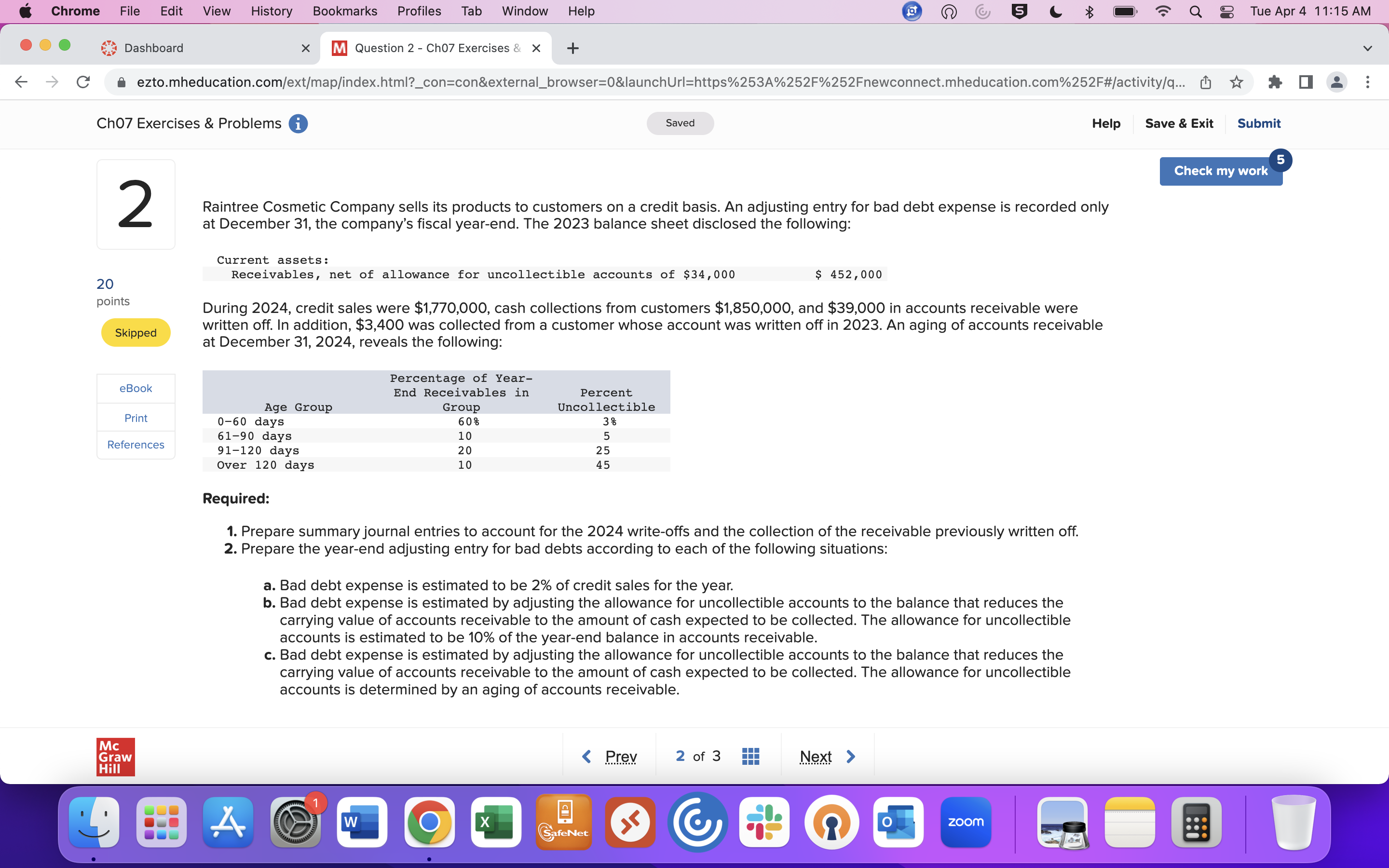

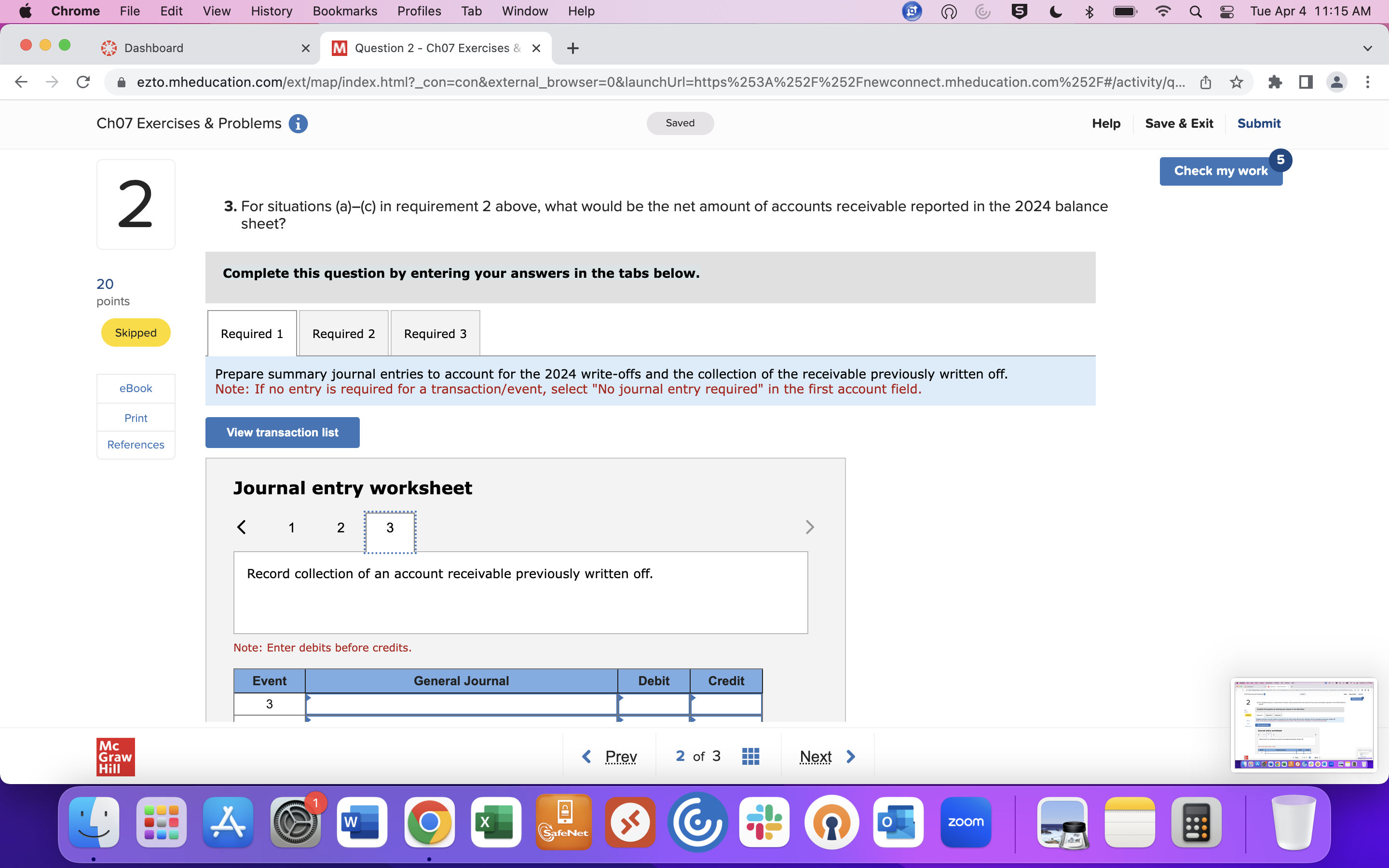

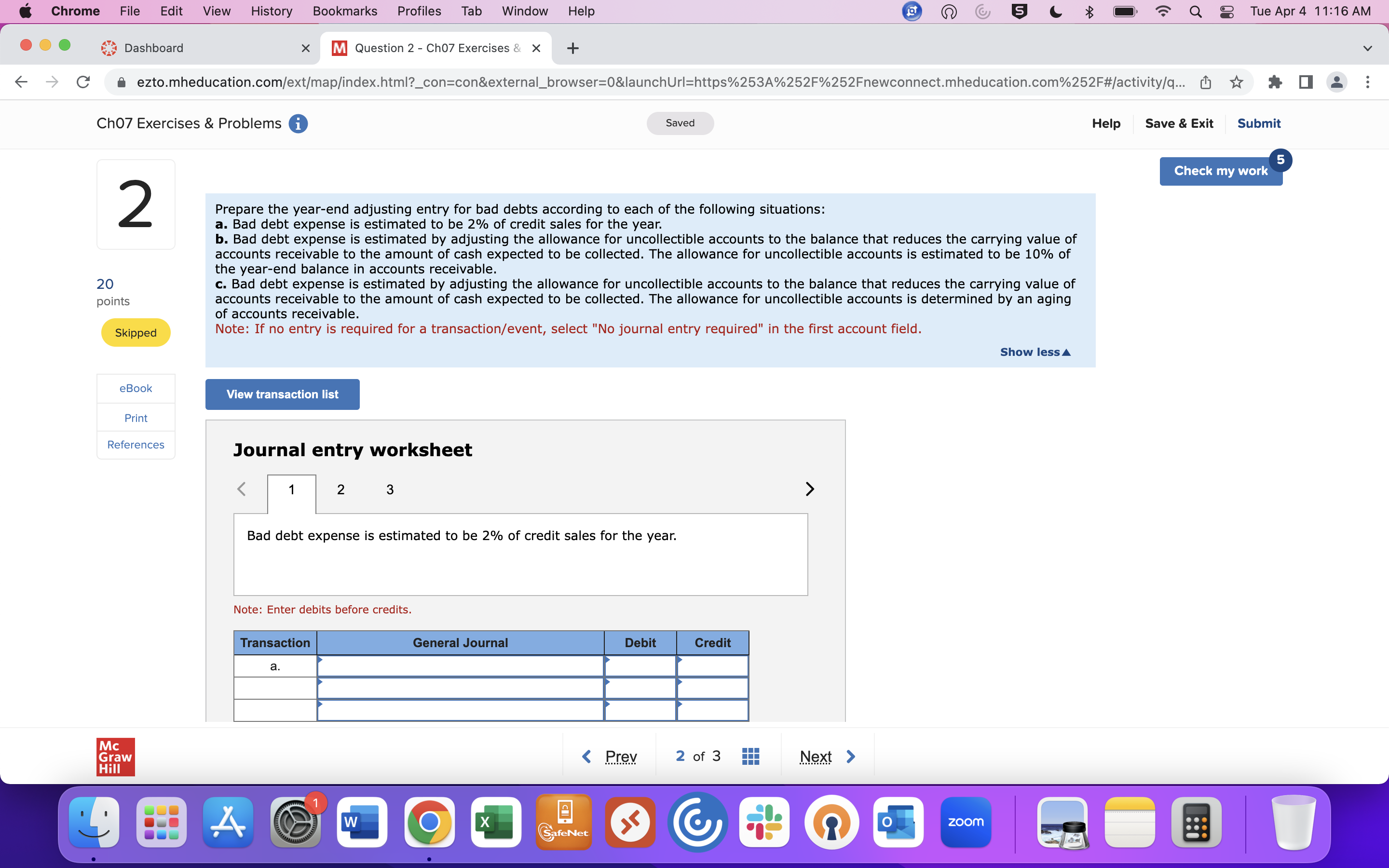

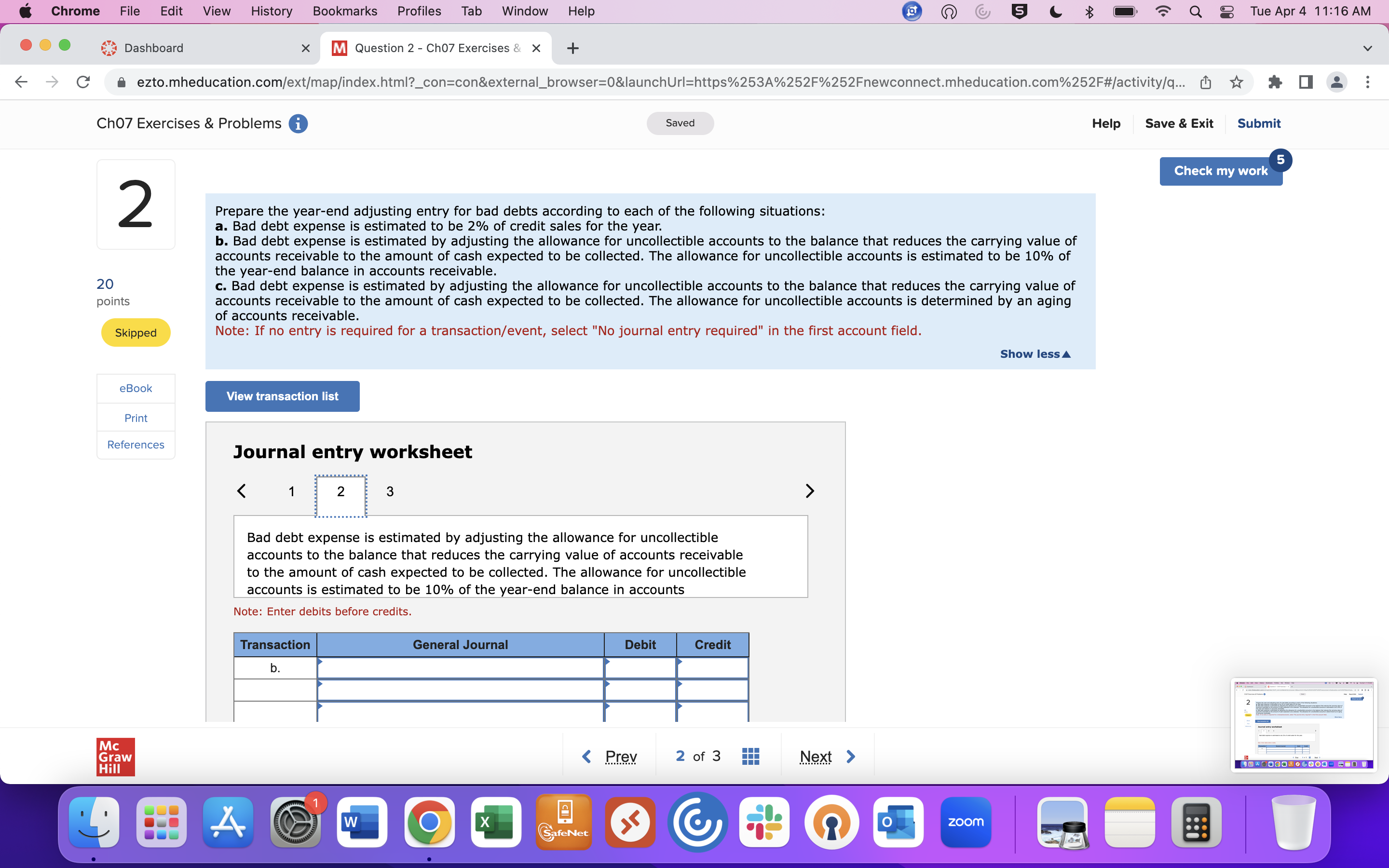

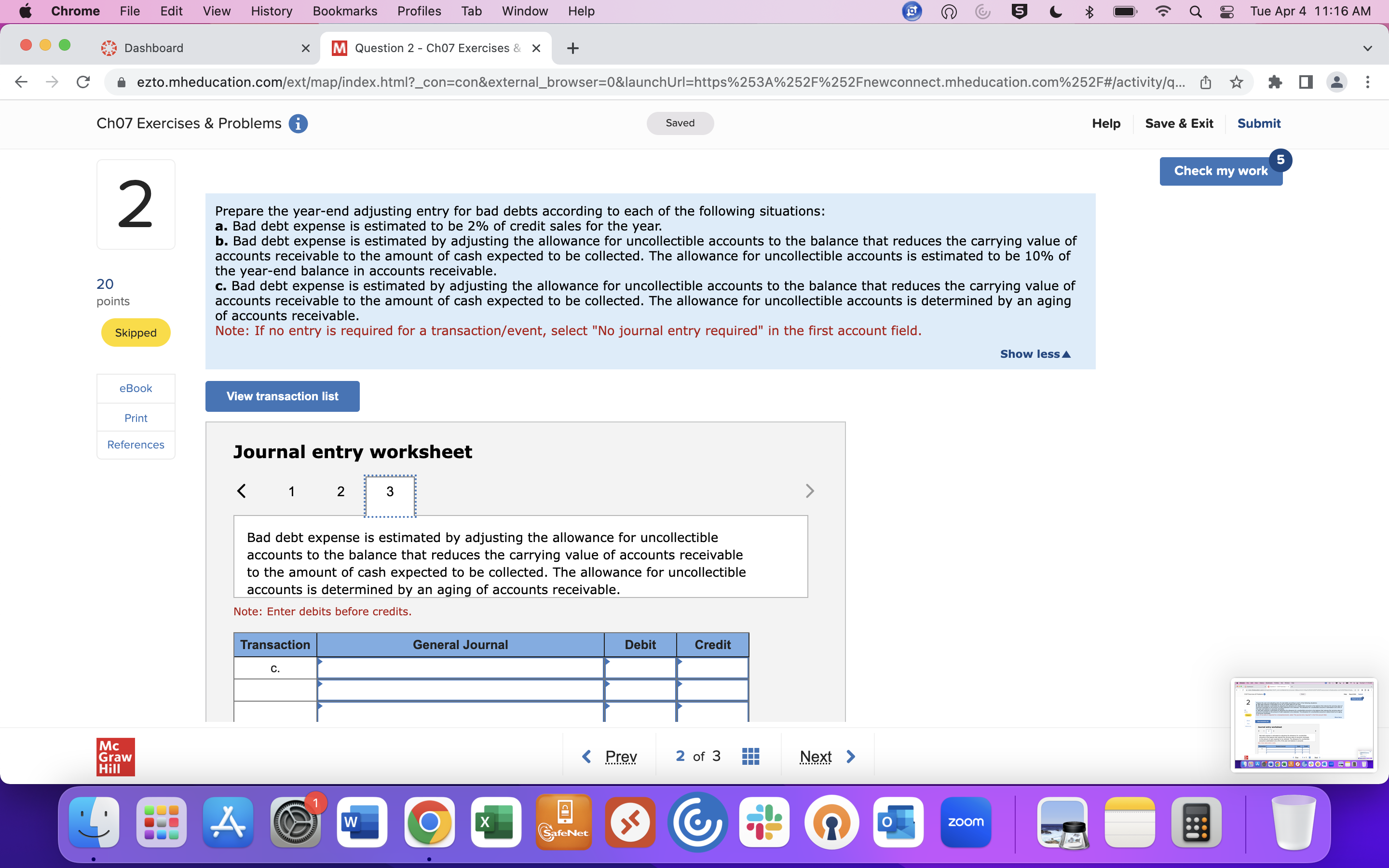

6 Chrome File Edit View History Bookmarks Profiles Tab Window Help 9 @J 6 L >3 -. '3\" Q 8 TueApr411:15AM r 1 . ~ . 0 6:3 Dashboard X m Question 2- Ch07 Exercises x + v C a ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q... ( * * 0 8 : Ch07 Exercises & Problems i Saved Help Save & Exit Submit Check my work 2 3. For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts receivable reported in the 2024 balance sheet? Complete this question by entering your answers in the tabs below. 20 points Skipped Required 1 Required 2 Required 3 Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off. eBook Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Print View transaction list References Journal entry worksheet 1 2 3 Record accounts receivable written off during the year 2024 Note: Enter debits before credits. Event General Journal Debit Credit Mc Graw 2 of 3 Next > Hill C a ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q... ( * * 0 8 : Ch07 Exercises & Problems i Saved Help Save & Exit Submit Check my work 2 3. For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts receivable reported in the 2024 balance sheet? Complete this question by entering your answers in the tabs below. 20 points Skipped Required 1 Required 2 Required 3 Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off. eBook Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Print View transaction list References Journal entry worksheet Record entry to reinstate an account receivable previously written off. Note: Enter debits before credits. Event General Journal Debit Credit 2 2 2 Mc Graw 2 of 3 Hill A C w X O O zoom SafeNetChrome File Edit View History Bookmarks Profiles Tab Window Help Q Tue Apr 4 11:15 AM Dashboard x M Question 2 - Ch07 Exercises & X + - > C a ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q... ( * * 0 8 : Ch07 Exercises & Problems i Saved Help Save & Exit Submit Check my work 2 3. For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts receivable reported in the 2024 balance sheet? Complete this question by entering your answers in the tabs below. 20 points Skipped Required 1 Required 2 Required 3 Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off. eBook Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Print View transaction list References Journal entry worksheet A C w X SafeNet O O zoom chrome File Edit View History Bookmarks Profiles Tab Window Help 9 6 L '3 -' '8 Q g TueApr411:16AM r 1 . - , . 6:5 Dashboard X m Question 2- Ch07 Exercises x + v (- C i ezto.mheducation.com/ext/map/index.htm|?_con=con&externa|_browser=0&launchUr|=https%253A%252F%252Fnewconnectmheducation.com%252F#/activity/q... ) 3'} I I] A E Ch07 Exercises & Problems 0 Saved Help Save 8. Exit Submit 2 Prepare the year-end adjusting entry for bad debts according to each of the following situations: a. Bad debt expense is estimated to be 2% of credit sales for the year. b. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is estimated to be 10% of the year-end balance in accounts receivable. 20 c. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is determined by an aging points of accounts receivable. skipped Note: If no entry is required for a transaction/event, select \"No journal entry required\" in the rst account field. Show lessA eBook View transaction list Print WWW\" Journal entry worksheet Bad debt expense is estimated to be 2% of credit sales for the year. Note: Enter debits before credis. Chrome File Edit View History Bookmarks Profiles Tab Window Help Q Tue Apr 4 11:16 AM Dashboard X M Question 2 - Ch07 Exercises & X + - > C a ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q... ( * * 0 8 : Ch07 Exercises & Problems i Saved Help Save & Exit Submit Check my work 2 Prepare the year-end adjusting entry for bad debts according to each of the following situations: a. Bad debt expense is estimated to be 2% of credit sales for the year. b. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is estimated to be 10% of the year-end balance in accounts receivable. 20 c. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of points accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is determined by an aging of accounts receivable. Skipped Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Show less eBook View transaction list Print References Journal entry worksheet Hill A X O zoom SafeNet OChrome File Edit View History Bookmarks Profiles Tab Window Help Q Tue Apr 4 11:16 AM Dashboard X M Question 2 - Ch07 Exercises & X + - > C a ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q... ( * * 0 8 : Ch07 Exercises & Problems i Saved Help Save & Exit Submit Check my work 2 Prepare the year-end adjusting entry for bad debts according to each of the following situations: a. Bad debt expense is estimated to be 2% of credit sales for the year. b. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is estimated to be 10% of the year-end balance in accounts receivable. 20 c. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of points accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is determined by an aging of accounts receivable. Skipped Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Show less eBook View transaction list Print References Journal entry worksheet Hill A X O zoom SafeNet OChrome File Edit View History Bookmarks Profiles Tab Window Help Q Tue Apr 4 11:16 AM Dashboard X M Question 2 - Ch07 Exercises & X + - > C a ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q... ( * * 0 8 : Ch07 Exercises & Problems i Saved Help Save & Exit Submit Check my work 2 a. Bad debt expense is estimated to be 2% of credit sales for the year. b. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible 20 accounts is estimated to be 10% of the year-end balance in accounts receivable. points c. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible Skipped accounts is determined by an aging of accounts receivable. 3. For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts receivable reported in the 2024 balance eBook sheet? Print References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts receivable reported in the 2024 balance sheet? Net accounts receivable reported a. C. Mc Graw 2 of 3 Hill A W X O O zoom SafeNet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts