Question: Ch11 Help 7 Exercise 11-32 Goodwill valuation and impairment Chapters 10 and 11 [L011-8] acqulred all of the outstanding common stock of Harman, Inc., for

![and 11 [L011-8] acqulred all of the outstanding common stock of Harman,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fb9606307af_97366fb9605aca97.jpg)

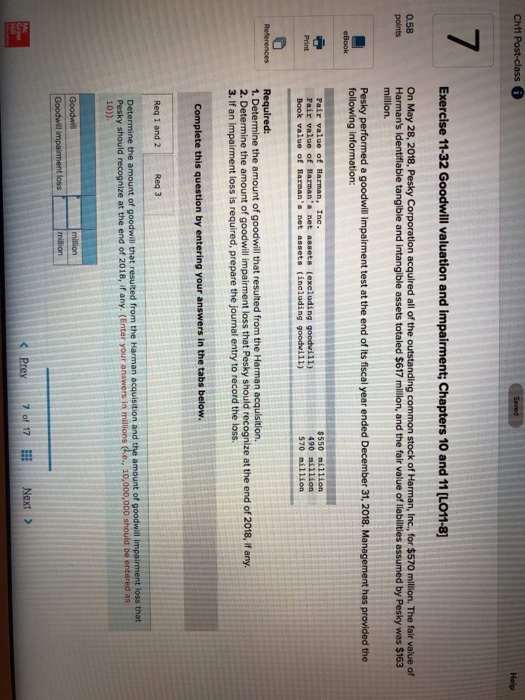

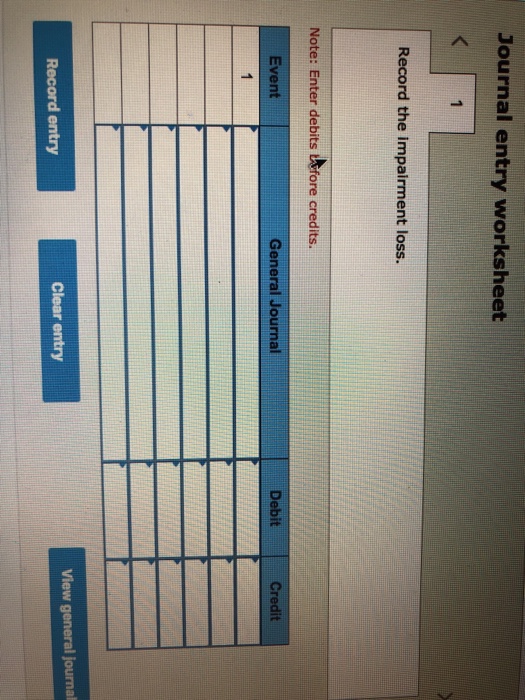

Ch11 Help 7 Exercise 11-32 Goodwill valuation and impairment Chapters 10 and 11 [L011-8] acqulred all of the outstanding common stock of Harman, Inc., for $570 million. The fair value of On May 28, 2018, Pesky Harman's identifiable tangible and intangible assets totaled $617 million, and the fair value of liabilities assumed by Pesky was $163 million. 0.58 Pesky performed a goodwill impairment test at the end of its fiscal year ended December 31, 2018. Management has provided the eBook following information: $550 mi1lion 490 sillion 570 nillion Inc Fair value of Barman's net assets (excluding goodwill) Book value of Print s Requlred: 1. Determine the amount of goodwill that resulted from the Harman acquisition. 2. Determine the amount of goodwill impairment loss that Pesky should recognize at the end of 2018, if any. 3. If an impairment loss is required, prepare the journal entry to record the loss Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 the amount of goodwill that resulted from the Harman acquisition and the amount of goodwill impairment loss 10,000,000 should be entered as Pesky should recognize at the end of 2018, if any. (Enter your answers in millions C.e., 1 10))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts