Question: ch11-22a sensitivity analysis McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $846 per set and have

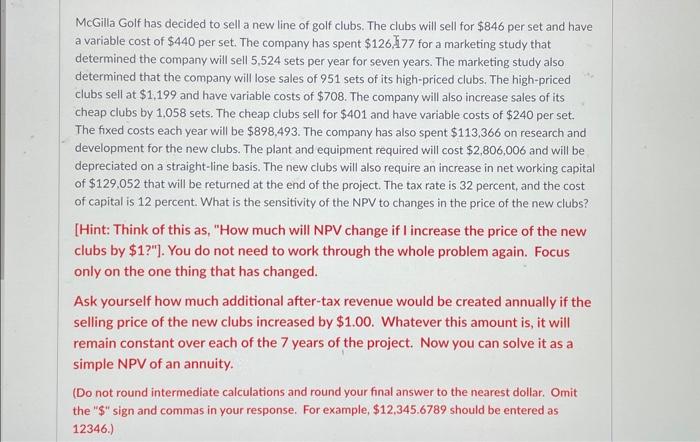

McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $846 per set and have a variable cost of $440 per set. The company has spent $126,177 for a marketing study that determined the company will sell 5,524 sets per year for seven years. The marketing study also determined that the company will lose sales of 951 sets of its high-priced clubs. The high-priced clubs sell at $1,199 and have variable costs of $708. The company will also increase sales of its cheap clubs by 1,058 sets. The cheap clubs sell for $401 and have variable costs of $240 per set. The fixed costs each year will be $898,493. The company has also spent $113,366 on research and development for the new clubs. The plant and equipment required will cost $2,806,006 and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $129,052 that will be returned at the end of the project. The tax rate is 32 percent, and the cost of capital is 12 percent. What is the sensitivity of the NPV to changes in the price of the new clubs? [Hint: Think of this as, "How much will NPV change if I increase the price of the new clubs by $1 ?"]. You do not need to work through the whole problem again. Focus only on the one thing that has changed. Ask yourself how much additional after-tax revenue would be created annually if the selling price of the new clubs increased by $1.00. Whatever this amount is, it will remain constant over each of the 7 years of the project. Now you can solve it as a simple NPV of an annuity. (Do not round intermediate calculations and round your final answer to the nearest dollar. Omit the "\$" sign and commas in your response. For example, $12,345.6789 should be entered as 12346) McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $846 per set and have a variable cost of $440 per set. The company has spent $126,177 for a marketing study that determined the company will sell 5,524 sets per year for seven years. The marketing study also determined that the company will lose sales of 951 sets of its high-priced clubs. The high-priced clubs sell at $1,199 and have variable costs of $708. The company will also increase sales of its cheap clubs by 1,058 sets. The cheap clubs sell for $401 and have variable costs of $240 per set. The fixed costs each year will be $898,493. The company has also spent $113,366 on research and development for the new clubs. The plant and equipment required will cost $2,806,006 and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $129,052 that will be returned at the end of the project. The tax rate is 32 percent, and the cost of capital is 12 percent. What is the sensitivity of the NPV to changes in the price of the new clubs? [Hint: Think of this as, "How much will NPV change if I increase the price of the new clubs by $1 ?"]. You do not need to work through the whole problem again. Focus only on the one thing that has changed. Ask yourself how much additional after-tax revenue would be created annually if the selling price of the new clubs increased by $1.00. Whatever this amount is, it will remain constant over each of the 7 years of the project. Now you can solve it as a simple NPV of an annuity. (Do not round intermediate calculations and round your final answer to the nearest dollar. Omit the "\$" sign and commas in your response. For example, $12,345.6789 should be entered as 12346)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts