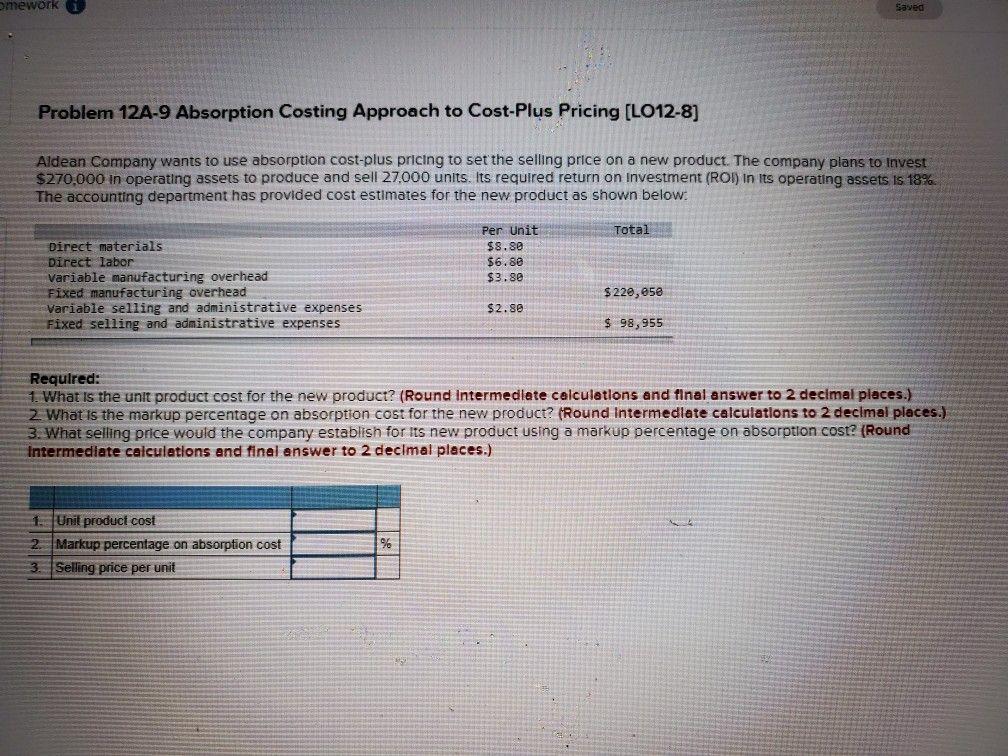

Question: ch12 que 7 omework Saved Problem 12A-9 Absorption Costing Approach to Cost-Plus Pricing [LO12-8] Aldean Company wants to use absorption cost-plus pricing to set the

ch12 que 7

![Cost-Plus Pricing [LO12-8] Aldean Company wants to use absorption cost-plus pricing to](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e876822f0fe_72166e8768158bfc.jpg)

omework Saved Problem 12A-9 Absorption Costing Approach to Cost-Plus Pricing [LO12-8] Aldean Company wants to use absorption cost-plus pricing to set the selling price on a new product. The company plans to Invest $270.000 in operating assets to produce and sell 27,000 units. Its required return on Investment (ROI) In its operating assets is 18% The accounting department has provided cost estimates for the new product as shown below: Per Unit $8.80 $6.80 $3.80 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $2.80 $220,05 $ 98,955 Required: 1. What is the unit product cost for the new product? (Round Intermediate calculations and final answer to 2 decimal places.) 2. What is the markup percentage on absorption cost for the new product? (Round Intermedlate calculations to 2 decimal places.) 3. What selling price would the company establish for its new product using a markup percentage on absorption cost? (Round Intermediate calculations and final answer to 2 decimal places.) 1. Unit product cost 2. Markup percentage on absorption cost 3. Selling price per unit CONCELLI III Saved Problem 12A-9 Absorption Costing Approach to Cost-Plus Pricing (LO12-8] Aldean Company wants to use absorption cost-plus pricing to set the selling price on a new product. The company plans to invest $270,000 in operating assets to produce and sell 27,000 units. Its required return on investment (ROI) In its operating assets is 18%. The accounting department has provided cost estimates for the new product as shown below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses Per Unit $8.80 $6.80 $3.80 $220, e5e $2.80 $ 98,955 Required: 1. What is the unit product cost for the new product? (Round Intermediate calculations and final answer to 2 decimal places.) 2. What is the markup percentage on absorption cost for the new product? (Round Intermediate calculations to 2 decimal places 3. What selling price would the company establish for its new product using a markup percentage on absorption cost? (Round Intermediate calculations and final answer to 2 decimal places.) Unit product cost Markup percentage on absorption cost 3. Selling price per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts