Question: ch.12 question 2 please show step by step Cherryt is evaluating a capital budgeting project that will last for 4 years. The project requires $340,000

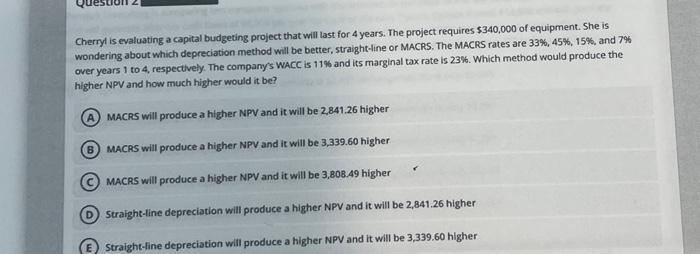

Cherryt is evaluating a capital budgeting project that will last for 4 years. The project requires $340,000 of equipment. She is wondering about which depreciation method will be better, straight-fine or MACRS. The MACRS rates are 33\%, 45\%, 15\%, and 7% over years 1 to 4 , respectively. The company's WACC is 11% and its marginal tax rate is 23%. Which method would produce the higher NPV and how much higher would it be? MACRS will produce a higher NPV and it will be 2,841.26 higher MACRS will produce a higher NPV and it will be 3,339.60 higher MACAS will produce a higher NPV and it will be 3,808.49 higher Straight-line depreciation will produce a higher NPV and it will be 2,841.26 higher (E) Straight-fine depreciation will produce a higher NPV and it will be 3,339.60 higher Cherryt is evaluating a capital budgeting project that will last for 4 years. The project requires $340,000 of equipment. She is wondering about which depreciation method will be better, straight-fine or MACRS. The MACRS rates are 33\%, 45\%, 15\%, and 7% over years 1 to 4 , respectively. The company's WACC is 11% and its marginal tax rate is 23%. Which method would produce the higher NPV and how much higher would it be? MACRS will produce a higher NPV and it will be 2,841.26 higher MACRS will produce a higher NPV and it will be 3,339.60 higher MACAS will produce a higher NPV and it will be 3,808.49 higher Straight-line depreciation will produce a higher NPV and it will be 2,841.26 higher (E) Straight-fine depreciation will produce a higher NPV and it will be 3,339.60 higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts