Question: Ch.14 Basic 4 Calculating, Paying and Accoutning for Dividends Krull Corporation presented the following selected information. The company has a calendar year end. Before considering

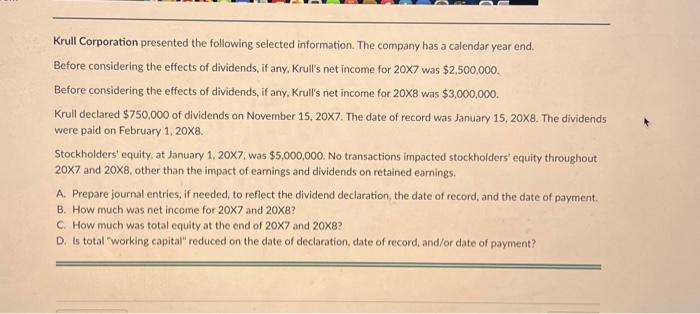

Krull Corporation presented the following selected information. The company has a calendar year end. Before considering the effects of dividends, if any, Krull's net income for 207 was $2,500,000. Before considering the effects of dividends, if any, Krull's net income for 208 was $3,000,000. Krull declared $750,000 of dividends on November 15, 20X7. The date of record was January 15,208. The dividends were paid on February 1, 20X8. Stockholders' equity, at January 1, 20X7, was $5,000,000. No transactions impacted stockholders' equity throughout 207 and 208, other than the impact of eamings and dividends on retained earnings. A. Prepare journal entries, if needed, to reflect the dividend deciaration, the date of record, and the date of payment. B. How much was net income for 207 and 208 ? C. How much was total equity at the end of 207 and 208 ? D. Is total "working capital" reduced on the date of declaration, date of record, and/or date of payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts