Question: Ch2 Case Study Assignment - Part 3 Ratio Problem for Two Companies (2pts - Completed Ratio Problem) The following information is available from the

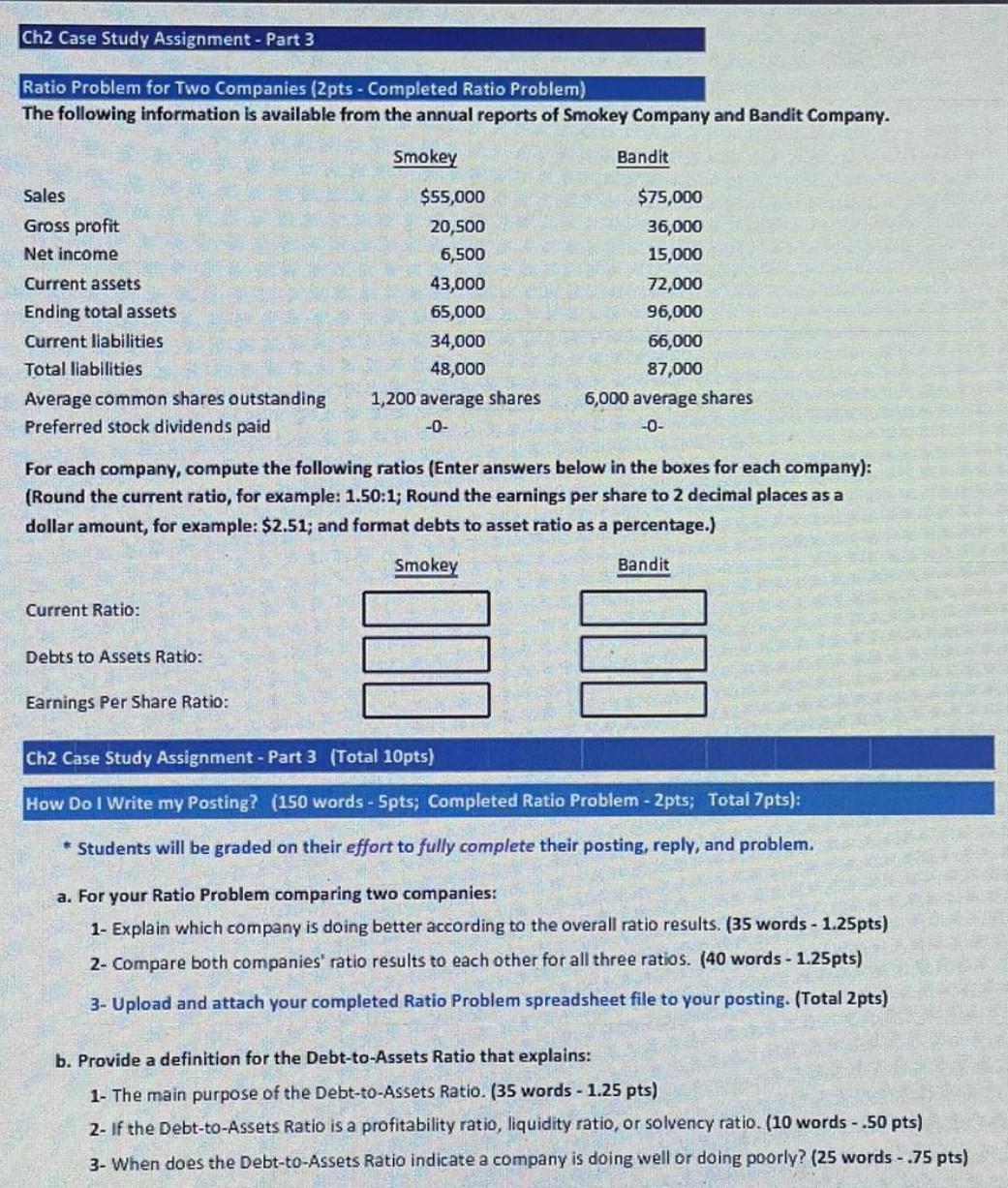

Ch2 Case Study Assignment - Part 3 Ratio Problem for Two Companies (2pts - Completed Ratio Problem) The following information is available from the annual reports of Smokey Company and Bandit Company. Smokey Sales Gross profit Net income Current assets Ending total assets Current liabilities Total liabilities Average common shares outstanding Preferred stock dividends paid Current Ratio: Debts to Assets Ratio: $55,000 20,500 6,500 43,000 65,000 34,000 48,000 1,200 average shares -0- For each company, compute the following ratios (Enter answers below in the boxes for each company): (Round the current ratio, for example: 1.50:1; Round the earnings per share to 2 decimal places as a dollar amount, for example: $2.51; and format debts to asset ratio as a percentage.) Smokey Earnings Per Share Ratio: Bandit $75,000 36,000 15,000 72,000 96,000 66,000 87,000 6,000 average shares -0- Bandit Ch2 Case Study Assignment - Part 3 (Total 10pts) How Do I Write my Posting? (150 words - Spts; Completed Ratio Problem - 2pts; Total 7pts): * Students will be graded on their effort to fully comp their posting, reply, and problem. a. For your Ratio Problem comparing two companies: 1- Explain which company is doing better according to the overall ratio results. (35 words - 1.25pts) 2- Compare both companies' ratio results to each other for all three ratios. (40 words - 1.25pts) 3- Upload and attach your completed Ratio Problem spreadsheet file to your posting. (Total 2pts) b. Provide a definition for the Debt-to-Assets Ratio that explains: 1- The main purpose of the Debt-to-Assets Ratio. (35 words - 1.25 pts) 2- If the Debt-to-Assets Ratio is a profitability ratio, liquidity ratio, or solvency ratio. (10 words -.50 pts) 3- When does the Debt-to-Assets Ratio indicate a company is doing well or doing poorly? (25 words -.75 pts)

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts