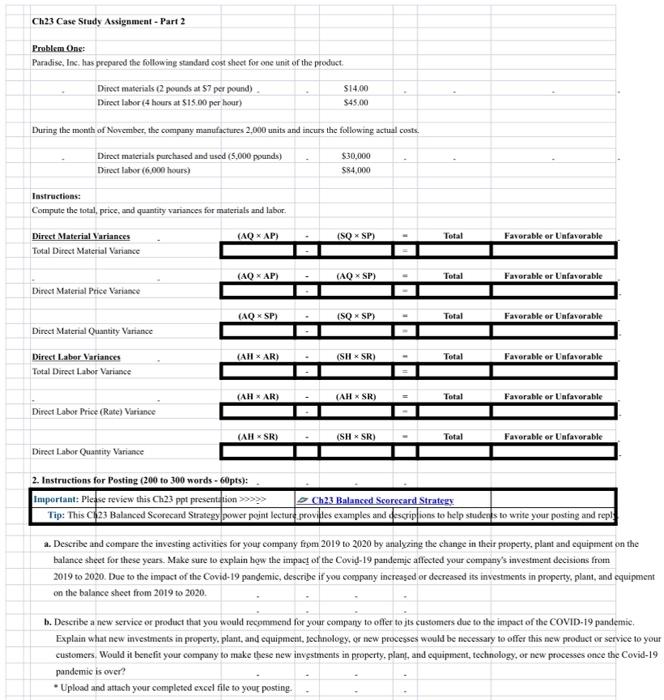

Question: Ch23 Case Study Assignment - Part 2 Problem One: Paradise, Inc. has prepared the following standard cost sheet for one unit of the product Direct

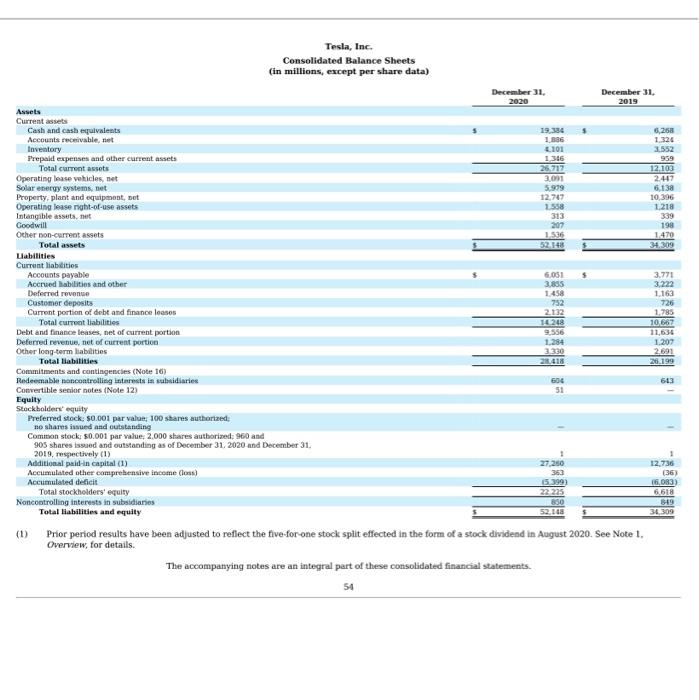

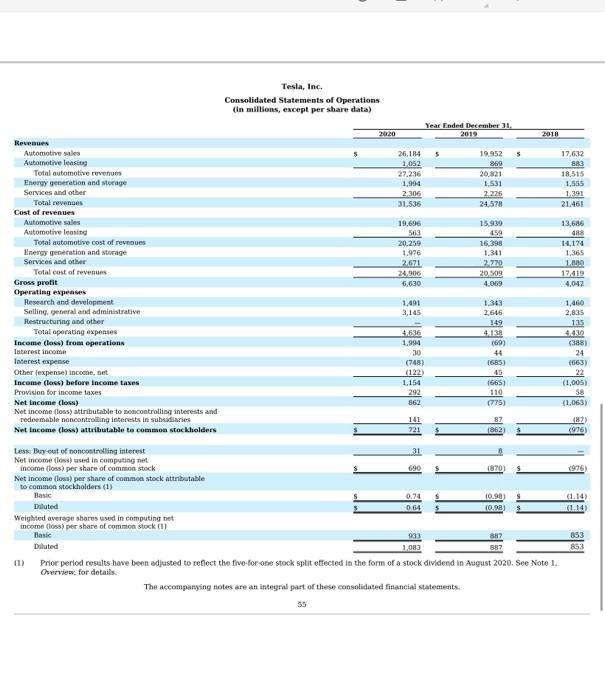

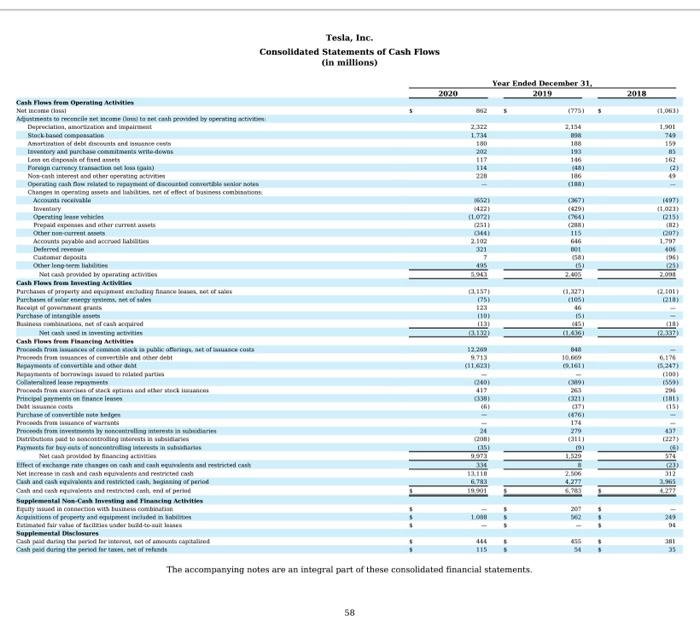

Ch23 Case Study Assignment - Part 2 Problem One: Paradise, Inc. has prepared the following standard cost sheet for one unit of the product Direct materials (2 pounds at 57 per pound) Direct labor (4 hours at $15.00 per hour) $45.00 $14.00 During the month of November, the company manufactures 2,000 units and incurs the following actual costs Direct materials purchased and used (5,000 pounds) $30,000 Direct labor (6.000 hours) 584,000 Instructions: Compute the total, price, and quantity variances for materials and labor (AQ AP) (SO SP) Total Favorable or Unfavorable Direct Material Variances Total Direct Material Variance (AQ X AP) (AOX SP) Total Favorable or Unfavorable Direct Material Price Variance (AOX SP) (SQXSP Total Favorable or Unfavorable Direct Material Quantity Variance (AHAR) (SH SR) Total Favorable or Unfavorable Direct Labor Variances Total Direct Labor Variance (AHAR) (AH SR) Total Favorable or Unfavorable Direct Labor Price (Rate) Variance (AHSR) (SHSR) Total Favorable or Unfavorable Direct Labor Quantity Variance 2. Instructions for Posting (200 to 300 words - 60pts): Important: Please review this Ch23 ppi presentation >>>>> Ch23 Balanced Scorecard Strategy Tip: This C 23 Balanced Scorecard Strategy power point lecture provides examples and descriptions to help students to write your posting and reply 1. Describe and compare the investing activities for your company from 2019 to 2020 by analyzing the change in their property, plant and equipment on the balance sheet for these years. Make sure to explain how the impact of the Covi-19 pandemic affected your company's investment decisions from 2019 to 2020. Due to the impact of the Covid-19 pangemie, describe if you company increased or decreased its investments in property, plant, and equipment on the balance sheet from 2019 to 2020. b. Describe a new service or product that you would recommend for your company to offer to jts customers due to the impact of the COVID-19 pandemie, Explain what new investments in property, plant, and equipment, sechnology, or new processes would be necessary to offer this new product or service to your customers. Would it benelit your company to make these new investments in property, plant, and equipment, technology, or new processes once the Covid-19 pandemic is over? Upload and attach your completed excel file to your posting 313 752 Tesla, Inc. Consolidated Balance Sheets (in millions, except per share data) December 31, December 31. 2020 2019 Assets Current assets Cash and cash equivalents 19.384 5,250 Accounts receivable, et 136 1.324 Inventory 4101 3.552 Prepaid expenses and other current assets 1 346 959 Total current assets 26.717 12.103 Operating lease vehicles, net 3.001 2447 Solar energy systems, net 5.979 6.138 Property, plant and equipment, Det 12.747 10,396 Operating lease right-of-use assets 1.558 1218 Intangible assets, met 339 Goodwill 207 198 Other non-current assets 1.470 Total assets 52 148 34.309 Liabilities Current liabilities Accounts payable 6.051 3.771 Accrued abilities and other 3.855 3.222 Deferred revenge 1.458 1.163 Customer deposits 726 Current portion of debt and finance leases 2.132 1,785 Total current liabilities 14218 10,667 Debt and finance leases, net of current portion 9.556 11.634 Deferred revenue, net of current portion 1.284 1.200 Other long-term liabilities 3.330 2.691 Total liabilities 27.418 26199 Commitments and contingencies (Note 10) Redeemable encontrolling interests in subsidiaries GOC 613 Convertible senior notes (Note 12 51 Equity Stockholders' equity Preferred stock: 50.001 par value 100 shares authorized ne shares issued and outstanding Common stock: 0.001 par value: 2.000 shares authorized: 960 and 905 shares issued and outstanding as of December 31, 2020 and December 31. 2019, respectively (1) Additional paid in capital (1) 27.250 12.736 Accumulated other comprehensive income (los) 363 (36) Accumulated deficit 5.399 16,083) Total stockholders' equity 22 225 6.518 Noncontrolling interests in subsidiaries 830 549 Total liabilities and equity 52.48 34309 (1) Prior period results have been adjusted to reflect the five-for-one stock spilt effected in the form of a stock dividend in August 2020. See Note 1, Overview, for details. The accompanying notes are an integral part of these consolidated financial statements 54 Tesla, Inc. Consolidated Statements of Operations (in millions, except per share data) 2020 Year Ended December 31. 2019 2018 5 5 26.184 1,052 27.236 1,994 2.306 31,536 19.952 869 20.821 1.531 2.226 24,578 17,632 883 18,515 1.555 1,391 21.461 19,696 563 20.259 1.976 2.621 24.000 6.630 15.939 459 16.398 1.341 220 20.509 4.069 13,686 488 14,174 1.365 1.100 13.419 4,042 Revenues Automotive sales Automotive leasing Total automotive revenues Energy generation and storage Services and other Total revenues Cost of revenues Automotive sales Automotive leasing Total automotive cost of revenues Energy generation and storage Services and other Total cost of revenues Gross profit Operating expenses Research and development Selling general and administrative Hestructuring and other Total operating expenses Income (loss) from operations Interest income Interest expense Other expense) income, bet Income (loss) before income taxes Provision for income taxes Net Income (loss) Net income foss) attributable to noncontrolling interests and redeemable no controlling interests in subsidiaries Net Income (los) attributable to common stockholders 1.491 3,145 4.636 1,994 30 (748) (122 1,343 2.646 149 4.13 (69) 44 (685) 1,460 2,835 135 4,430 (388) 24 4563) 22 (1,0053 58 11,063) 292 862 1665) 110 (775) 141 221 87 (862) (87) (976 (1.14 Less Day out of noncontrolling interest 31 Net income (los) used in computing net income (los) per share of common stock 690 1870 Net Income (los) per share of common stock attributable to common stockholders (1) 0.74 s 10.90 Diluted 0.64 (0.38) Weighted average shares used in computing net income (los) per share of common stock (1) Basic 933 887 Diluted 1,083 887 (1) Prior period results have been adjusted to reflect the five-for one stock split effected in the form of a stock dividend in August 2020. See Note 1. Overview for details The accompanying notes are an integral part of these consolidated financial statements. 55 353 853 Tesla, Inc. Consolidated Statements of Cash Flows (in millions) 2020 Year Ended December 31. 2019 2018 7253 5 (10) 2,154 2322 L734 180 202 117 114 220 188 193 146 140) 186 (100) 422) 2011 2.102 321 495 500 (211 115 66 01 08 15) (2.2017 LIST: 125) 123 110) Cash Moes from Operating Activities Net Mets to come to an ended by protingai Depreciation, amortice and past Stabd.com Amortitions of debt encounter end taventory and purchased commitments weite-dewas Lom offendamets Foncurrency transaction et al) None con interest and other operating activim Operating hosted to repayment of counted contenantis Change in eines and bits netellect of business combinations Accounts receivable Inventary Operating on his Prespanderer Ocher Accounts payable and create Deferred Customer dois Other long term Natch provided by price Cash Flows from investing Activities Thuretuat prorary and stating haran tear theat Purchase of me Tot of gown Purchase of intangible Tainaat arintens, nat ifat aurad Nitashining with Cash Plows from Financing Activities Procedures of comme Machia publicering to co Proceeds from times of convertible and other debt payanai olar Huy of borrowing and related parties Collide lease rep Proceeds from ears of stackaptam and there was Principalements on finance les Pirche verilen tegen Proceeds from stance of warrant Proceeds from tives by ruling interesi bidane LANBAtles past D A E aislature um for youts et continguts Netcash provided by financing activ Effect of charge to change on chalet end restricted cash Netcrease in handesh equivalents and restricted ca Cash and ca equivalents and restricted cash, Segingo period Cash and conducts and restrictement of prod Supplemental No Cash Investing and Financing Activities pated in a wis tutte contain Artritis of reperty and equipment needed in bei Tatimad fair value of taciales de buditos Supplemental Disclosures cah areas the paradi Ir unitariat, rat means Captaitiat Casheld during the periode met of refund (127) (105) 46 151 6451 (1.66 21321 88028si fageanca Sanja (FOR 3*** BIB 32.269 9.73 (11.3 0401 417 (9) 26 D 06 (762 174 279 c) 00 con 151 13.110 6.73 1901 1 2.506 4.277 The accompanying notes are an integral part of these consolidated financial statements. 58

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts