Question: Ch2&3HWK Saved Help Save & Exit Submit Consider the following two banks: 10 Bank 1 has assets composed solely of a 10-year, 11.00 percent coupon,

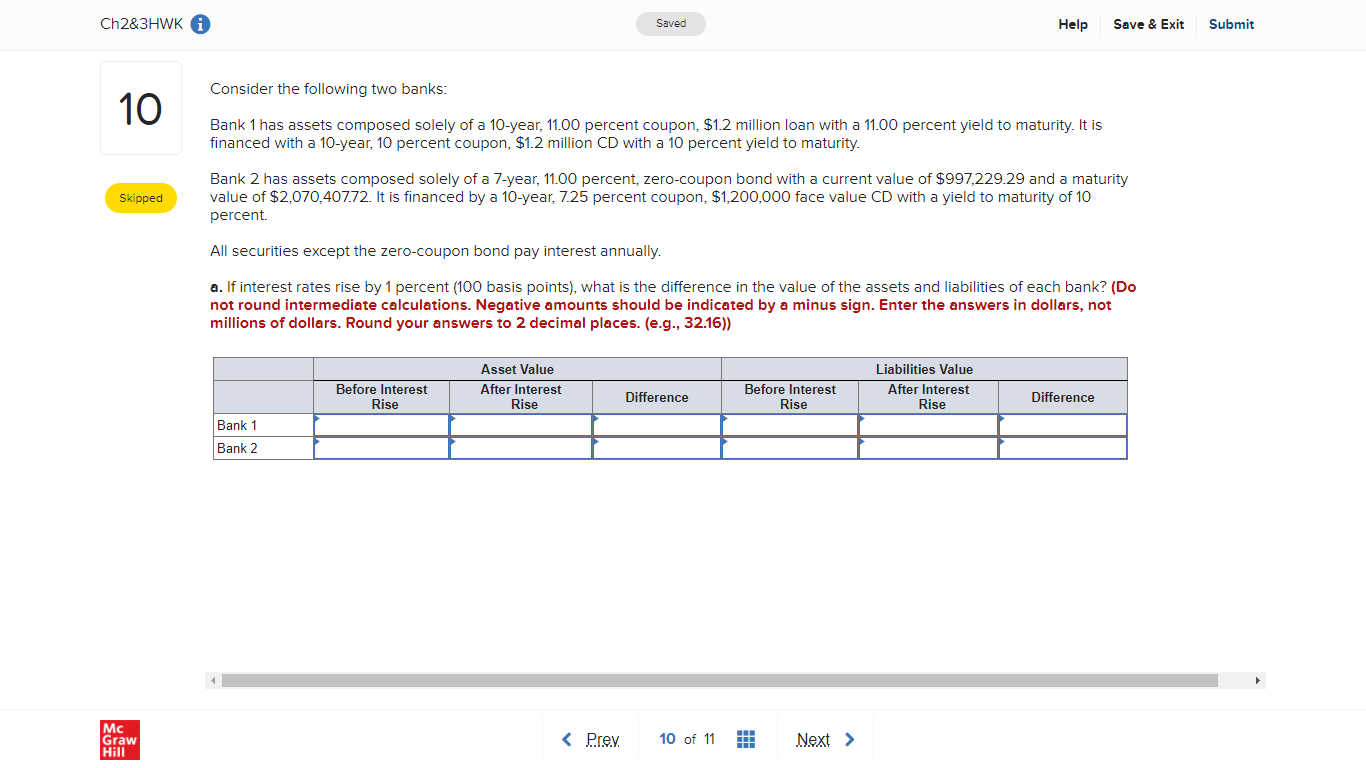

Ch2&3HWK Saved Help Save & Exit Submit Consider the following two banks: 10 Bank 1 has assets composed solely of a 10-year, 11.00 percent coupon, $1.2 million loan with a 11.00 percent yield to maturity. It is financed with a 10-year, 10 percent coupon, $1.2 million CD with a 10 percent yield to maturity. Skipped Bank 2 has assets composed solely of a 7-year, 11.00 percent, zero-coupon bond with a current value of $997,229.29 and a maturity value of $2,070,407.72. It is financed by a 10-year, 7.25 percent coupon, $1,200,000 face value CD with a yield to maturity of 10 percent All securities except the zero-coupon bond pay interest annually. a. If interest rates rise by 1 percent (100 basis points), what is the difference in the value of the assets and liabilities of each bank? (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Enter the answers in dollars, not millions of dollars. Round your answers to 2 decimal places. (e.g., 32.16)) Before Interest Rise Asset Value After Interest Rise Liabilities Value After Interest Rise Before Interest Rise Difference Difference Bank 1 Bank 2 Mc Graw Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts