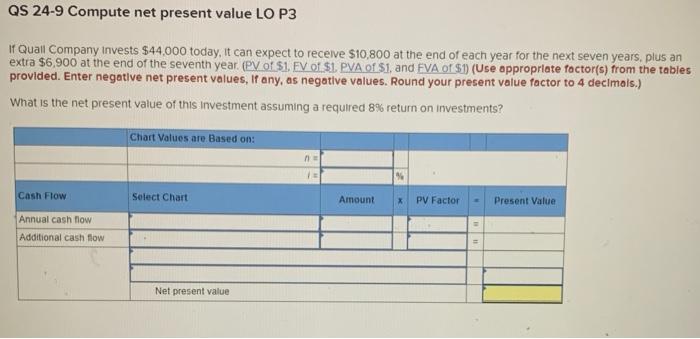

Question: ch.24 q5 QS 24-9 Compute net present value LO P3 It Quall Company invests $44.000 today, it can expect to receive $10,800 at the end

ch.24 q5

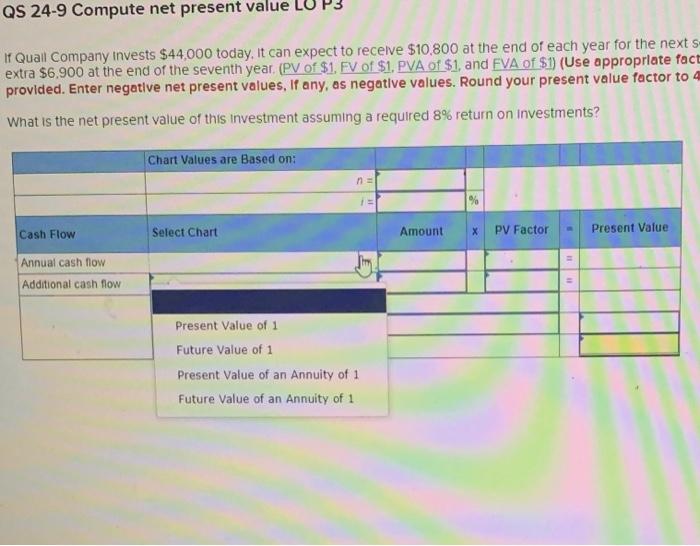

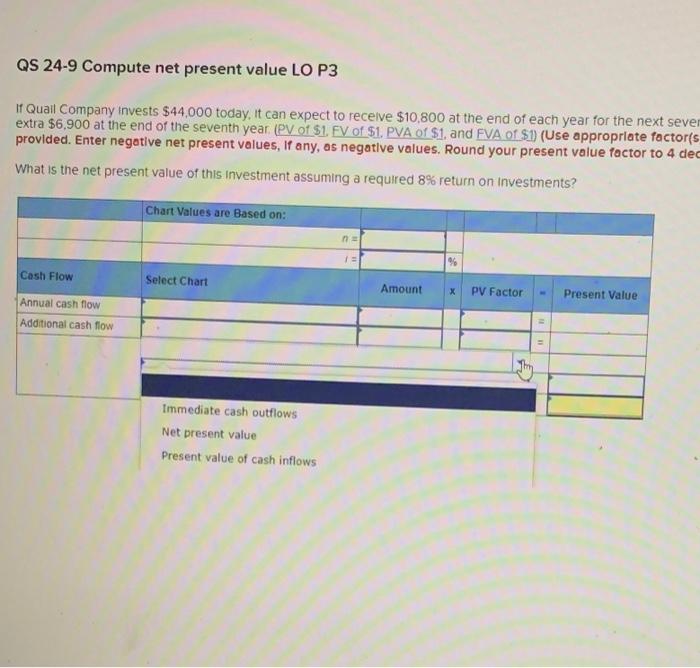

ch.24 q5QS 24-9 Compute net present value LO P3 It Quall Company invests $44.000 today, it can expect to receive $10,800 at the end of each year for the next seven years, plus an extra $6,900 at the end of the seventh year. (PV of $1. FV of $1 PVA of $1, and FVA of $1) (Use appropriate foctor(s) from the tables provided. Enter negative net present values, if any, as negative values. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 8% return on investments? Chart Values are Based on: Cash Flow Select Chart Amount X PV Factor Present Value Annual cash flow Additional cash flow Net present value QS 24-9 Compute net present value If Quail Company invests $44,000 today, it can expect to receive $10,800 at the end of each year for the next s- extra $6.900 at the end of the seventh year (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate fact provided. Enter negative net present values, If any, as negative values. Round your present value factor to 4 What is the net present value of this investment assuming a required 8% return on investments? Chart Values are Based on: n Cash Flow Select Chart Amount * PV Factor Present Value Annual cash flow Additional cash flow Present Value of 1 Future Value of 1 Present Value of an Annuity of 1 Future Value of an Annuity of 1 QS 24-9 Compute net present value LO P3 If Quail Company invests $44,000 today. It can expect to receive $10,800 at the end of each year for the next sever extra $6.900 at the end of the seventh year (PV of $1. FV of $1. PVA of $1. and FVA of $1 (Use appropriate factors provided. Enter negative net present values, if any, as negative values. Round your present value factor to 4 dec What is the net present value of this Investment assuming a required 8% return on investments? Chart Values are Based on: n % Cash Flow Select Chart Amount X PV Factor Present Value Annual cash flow Additional cash flow Immediate cash outflows Net present value Present value of cash inflows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts