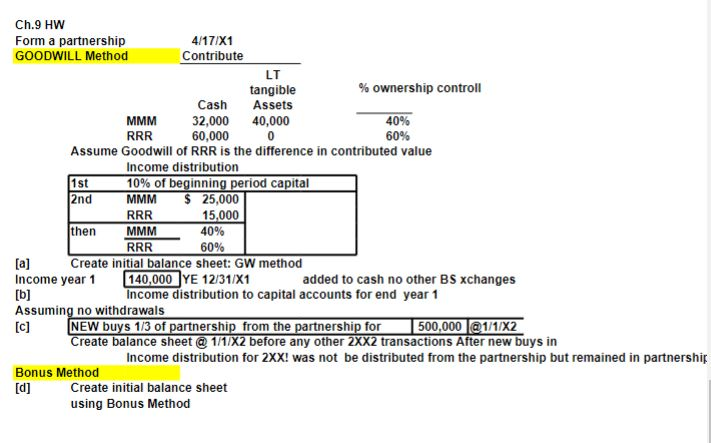

Question: Ch.9 HW Form a partnership 4/17/X1 GOODWILL Method Contribute LT tangible % ownership controll Cash Assets MMM 32,000 40,000 40% RRR 60,000 0 60% Assume

Ch.9 HW Form a partnership 4/17/X1 GOODWILL Method Contribute LT tangible % ownership controll Cash Assets MMM 32,000 40,000 40% RRR 60,000 0 60% Assume Goodwill of RRR is the difference in contributed value Income distribution 1st 10% of beginning period capital 2nd MMM $ 25,000 RRR 15,000 then MMM RRR 60% [a] Create initial balance sheet: GW method Income year 1 140,000 JYE 12/31/X1 added to cash no other BS xchanges [b] Income distribution to capital accounts for end year 1 Assuming no withdrawals NEW buys 1/3 of partnership from the partnership for 500,000 @1/1/X2 Create balance sheet @ 1/1/X2 before any other 2XX2 transactions After new buys in Income distribution for 2XX! was not be distributed from the partnership but remained in partnership Bonus Method Create initial balance sheet using Bonus Method 40% [d] Ch.9 HW Form a partnership 4/17/X1 GOODWILL Method Contribute LT tangible % ownership controll Cash Assets MMM 32,000 40,000 40% RRR 60,000 0 60% Assume Goodwill of RRR is the difference in contributed value Income distribution 1st 10% of beginning period capital 2nd MMM $ 25,000 RRR 15,000 then MMM RRR 60% [a] Create initial balance sheet: GW method Income year 1 140,000 JYE 12/31/X1 added to cash no other BS xchanges [b] Income distribution to capital accounts for end year 1 Assuming no withdrawals NEW buys 1/3 of partnership from the partnership for 500,000 @1/1/X2 Create balance sheet @ 1/1/X2 before any other 2XX2 transactions After new buys in Income distribution for 2XX! was not be distributed from the partnership but remained in partnership Bonus Method Create initial balance sheet using Bonus Method 40% [d]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts