Question: Challenge Exercise 4-1 (Part Level Submission) Smithson, Inc. produces two types of gas grills: a family model and a deluxe model. Smithson's controller has decided

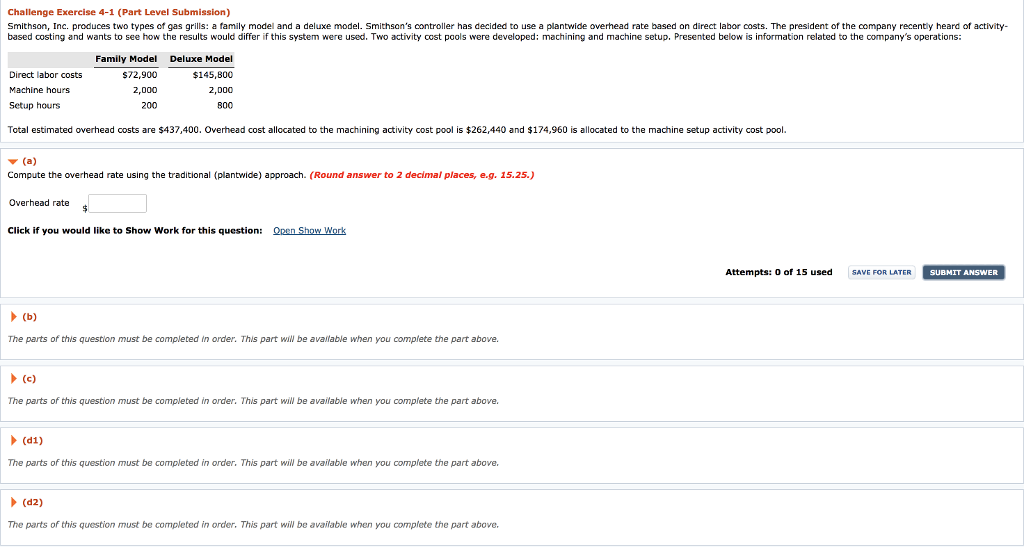

Challenge Exercise 4-1 (Part Level Submission) Smithson, Inc. produces two types of gas grills: a family model and a deluxe model. Smithson's controller has decided to use a plantwide overhead rate based on direct labor costs. The president of the company recently heard of activity based costing and wants to see how the results would differ if this system were used. Two activity cost pools were developed: machining and machine setup. Presented below is information related to the company's operations Direct labor costs Machine hours Setup hours Family Model $72,900 2,000 200 Deluxe Model $145,800 2,D00 800 Total estimated overhead costs are $437,400. Overhead cost allocated to the machining activity cost pool is $262,440 and $174,960 is allocated to the machine setup activity cost pool. (a) Compute the overhead rate using the traditional (plantwide) approach. (Round answer to 2 declmal places, e.g. 15.25.) Overhead rate Click if you would like to Show Work for this qucstion: Open Show Work Attempts: 0 of 15 used SAVE FOR LATER SUBMIT The parts of this question must be completed in order. This part wil be avallable when you complete the part above. The parts of this question must be completed in order. This part wil be available when you complete the part above. (d1) The parts of this question must be completed in order. This part will be available when you complete the part above. (d2) The parts of this question must be completed in order. This part wil be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts