Question: Challenging Problems 23-26 6-23 Maritime Construction needs to borrow $50 million for 5 years. The company estimates that Bond Valuation the real rate of return

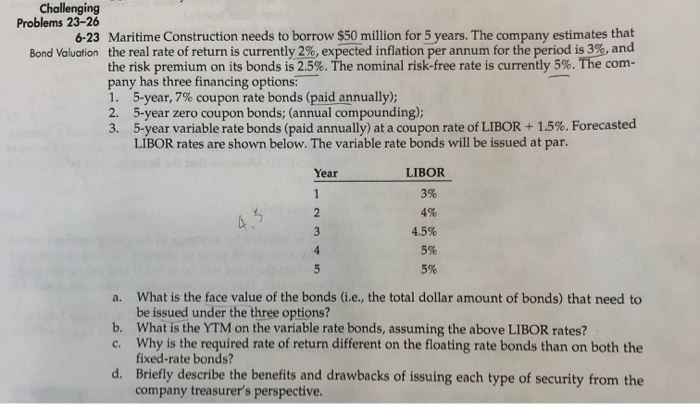

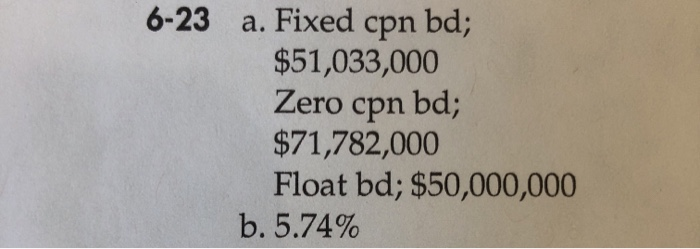

Challenging Problems 23-26 6-23 Maritime Construction needs to borrow $50 million for 5 years. The company estimates that Bond Valuation the real rate of return is currently 2%, expected inflation per annum for the period is 3%, and the risk premium on its bonds is 2.5%. The nominal risk-free rate is currently 5%. The com- pany has three financing options: 1. 5-year, 7% coupon rate bonds (paid annually); 2. 5-year zero coupon bonds; (annual compounding); 3. 5-year variable rate bonds (paid annually) at a coupon rate of LIBOR + 1.5%. Forecasted LIBOR rates are shown below. The variable rate bonds will be issued at par. Year LIBOR 3% 2 4% 4.5% 5% 5% a. What is the face value of the bonds (i.e., the total dollar amount of bonds) that need to be issued under the three options? b. What is the YTM on the variable rate bonds, assuming the above LIBOR rates? c. Why is the required rate of return different on the floating rate bonds than on both the fixed-rate bonds? d. Briefly describe the benefits and drawbacks of issuing each type of security from the company treasurer's perspective. 6-23 a. Fixed cpn bd; $51,033,000 Zero cpn bd; $71,782,000 Float bd; $50,000,000 b. 5.74%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts