Question: Change in Sales Mox and Contribution Margin Head Pops Inc., manufactures two models of solar powered, noise-canceling headphones: Sun Sound and Ear Bling models. The

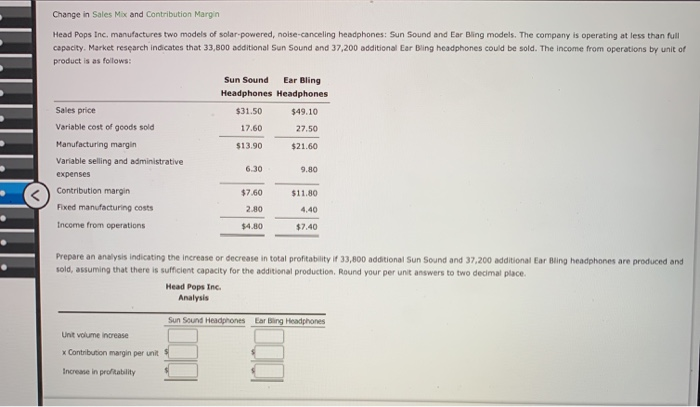

Change in Sales Mox and Contribution Margin Head Pops Inc., manufactures two models of solar powered, noise-canceling headphones: Sun Sound and Ear Bling models. The company is operating at less than full capacity. Market research indicates that 33,800 additional Sun Sound and 37,200 additional Ear Bling headphones could be sold. The income from operations by unit of product is as follows: Sales price Variable cost of goods sold Sun Sound Ear Bling Headphones Headphones $31.50 $49.10 17.60 27.50 $13.90 $21.60 Manufacturing margin 9.80 Variable selling and administrative expenses Contribution margin $7.60 $11.80 Fixed manufacturing costs 2.80 Income from operations $4.80 $7.40 Prepare an analysis indicating the increase or decrease in total profitability if 33,800 additional Sun Sound and 37,200 additional Ear Bling headphones are produced and sold, assuming that there is sufficient capacity for the additional production. Round your per unit answers to two decimal place Head Pops Inc. Analysis Sun Sound Headphones taring Headphones Unit volume increase Contribution margin erunt Increase in profitability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts