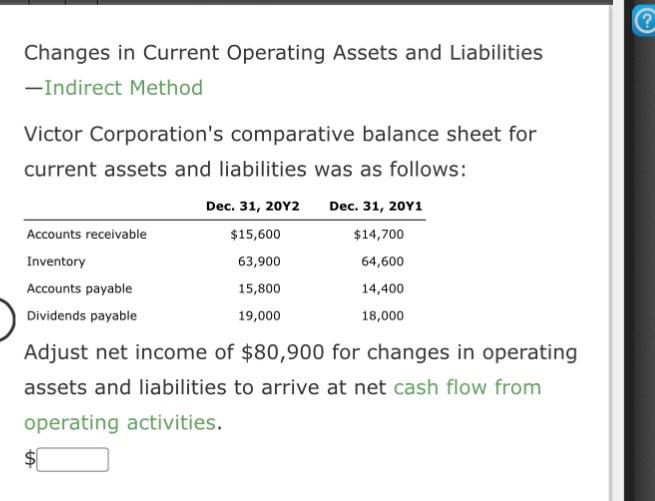

Question: Changes in Current Operating Assets and Liabilities -Indirect Method Victor Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, 2012

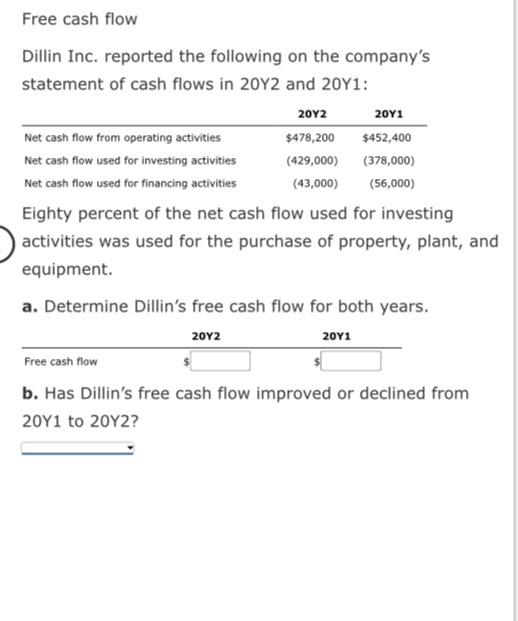

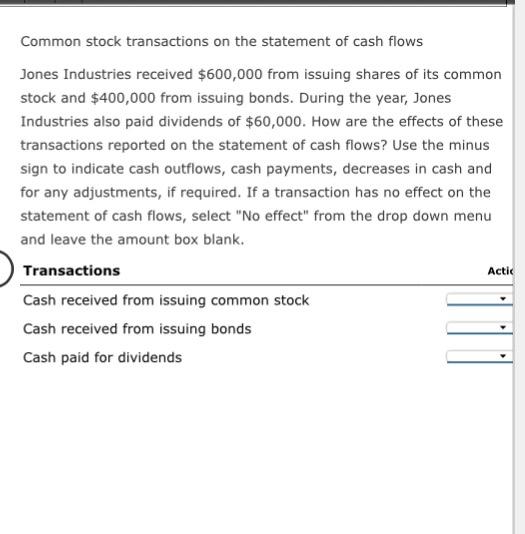

Changes in Current Operating Assets and Liabilities -Indirect Method Victor Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, 2012 $15,600 63,900 Accounts receivable Inventory Accounts payable Dividends payable Dec. 31, 2011 $14,700 64,600 14,400 18,000 15,800 19,000 Adjust net income of $80,900 for changes in operating assets and liabilities to arrive at net cash flow from operating activities. $ Free cash flow Dillin Inc. reported the following on the company's statement of cash flows in 2012 and 20Y1: 20Y2 2011 Net cash flow from operating activities $478,200 $452,400 Net cash flow used for investing activities (429,000) (378,000) Net cash flow used for financing activities (43,000) (56,000) Eighty percent of the net cash flow used for investing activities was used for the purchase of property, plant, and equipment. a. Determine Dillin's free cash flow for both years. 2012 2011 Free cash flow b. Has Dillin's free cash flow improved or declined from 20Y1 to 20Y2? Common stock transactions on the statement of cash flows Jones Industries received $600,000 from issuing shares of its common stock and $400,000 from issuing bonds. During the year, Jones Industries also paid dividends of $60,000. How are the effects of these transactions reported on the statement of cash flows? Use the minus sign to indicate cash outflows, cash payments, decreases in cash and for any adjustments, if required. If a transaction has no effect on the statement of cash flows, select "No effect" from the drop down menu and leave the amount box blank. Transactions Cash received from issuing common stock Cash received from issuing bonds Cash paid for dividends Actic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts