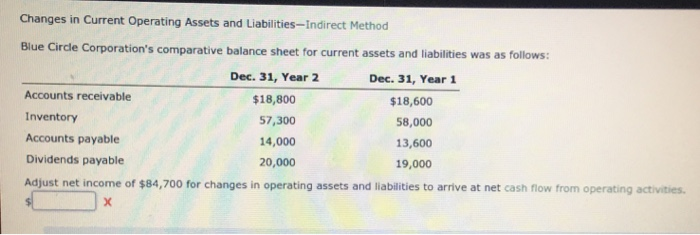

Question: Changes in Current Operating Assets and Liabilities-indirect Method Blue Circle Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, Year

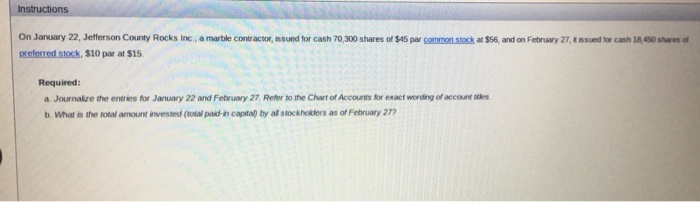

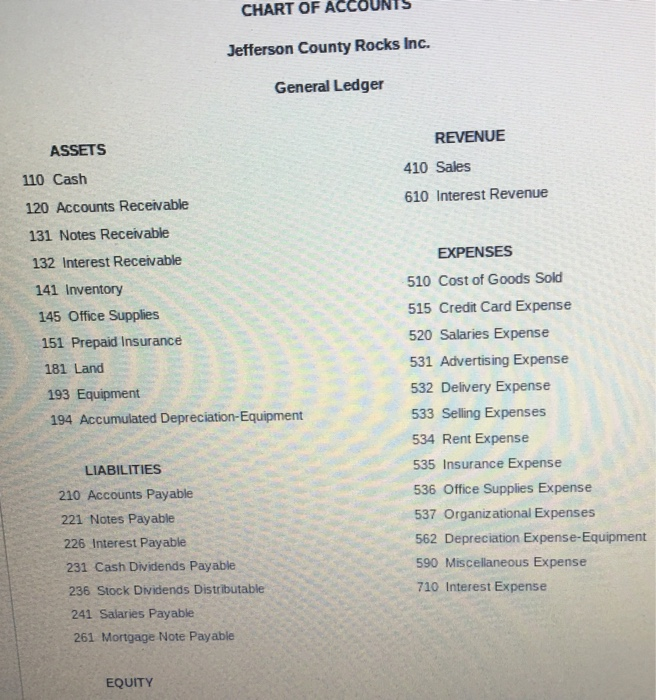

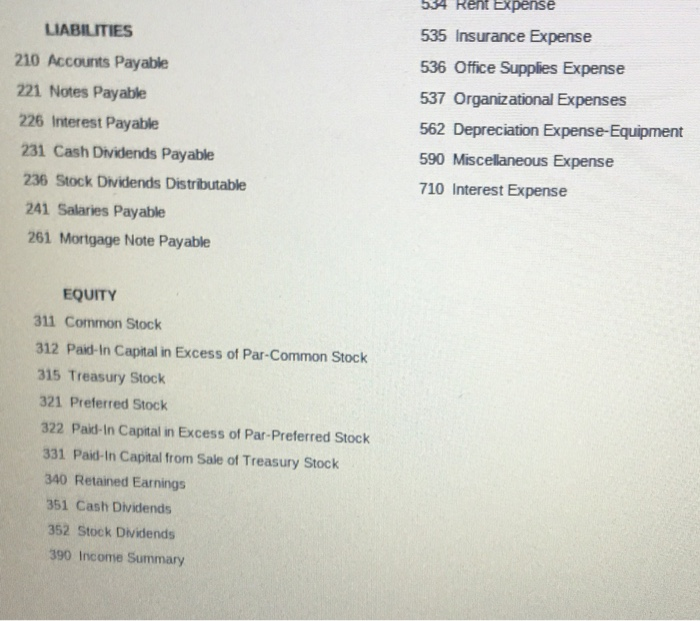

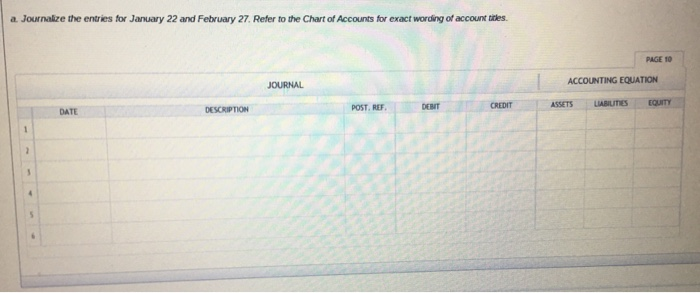

Changes in Current Operating Assets and Liabilities-indirect Method Blue Circle Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, Year 2 Dec. 31, Year 1 Accounts receivable $18,800 $18,600 Inventory 57,300 58,000 Accounts payable 14,000 13,600 Dividends payable 20,000 19,000 Adjust net income of $84,700 for changes in operating assets and liabilities to arrive at net cash flow from operating activities. Instructions On January 22, Jefferson County Rocks Inc, a marble contractor, issued for cash 70,300 shares of $45 par common stock at $56, and on February 27, issued for cash 18.450 shares of preferred stock. $10 par at $15 Required: a Journakze the entries for January 22 and February 27. Refer to the Chart of Accounts for exact wording of account thes. b. What is the total amount invested (tot paid-in capita) by ad stockholders as of February 27? CHART OF AC Jefferson County Rocks Inc. General Ledger REVENUE ASSETS 410 Sales 110 Cash 610 Interest Revenue 120 Accounts Receivable 131 Notes Receivable 132 Interest Receivable 141 Inventory 145 Office Supplies 151 Prepaid Insurance 181 Land 193 Equipment 194 Accumulated Depreciation Equipment EXPENSES 510 Cost of Goods Sold 515 Credit Card Expense 520 Salaries Expense 531 Advertising Expense 532 Delivery Expense 533 Selling Expenses 534 Rent Expense 535 Insurance Expense 536 Office Supplies Expense 537 Organizational Expenses 562 Depreciation Expense-Equipment 590 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 221 Notes Payable 226 Interest Payable 231 Cash Dividends Payable 236 Stock Dividends Distributable 241 Salaries Payable 261 Mortgage Note Payable EQUITY LIABILITIES 210 Accounts Payable 221 Notes Payable 226 Interest Payable 231 Cash Dividends Payable 236 Stock Dividends Distributable 241 Salaries Payable 261 Mortgage Note Payable 34 Rent Expense 535 Insurance Expense 536 Office Supplies Expense 537 Organizational Expenses 562 Depreciation Expense-Equipment 590 Miscellaneous Expense 710 Interest Expense EQUITY 311 Common Stock 312 Paid In Capital in Excess of Par-Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid In Capital in Excess of Par-Preferred Stock 331 Paid-in Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock Dividends 390 Income Summary a. Journalize the entries for January 22 and February 27. Refer to the Chart of Accounts for exact wording of account titles. PAGE 10 JOURNAL ACCOUNTING EQUATION DEBIT CREDIT ASSETS LIABILITIES DESCRIPTION EQUITY POST. REF DATE 2 6 Final Question b. What is the total amount invested (total paid.in capital) by al stockhokers as of February 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts