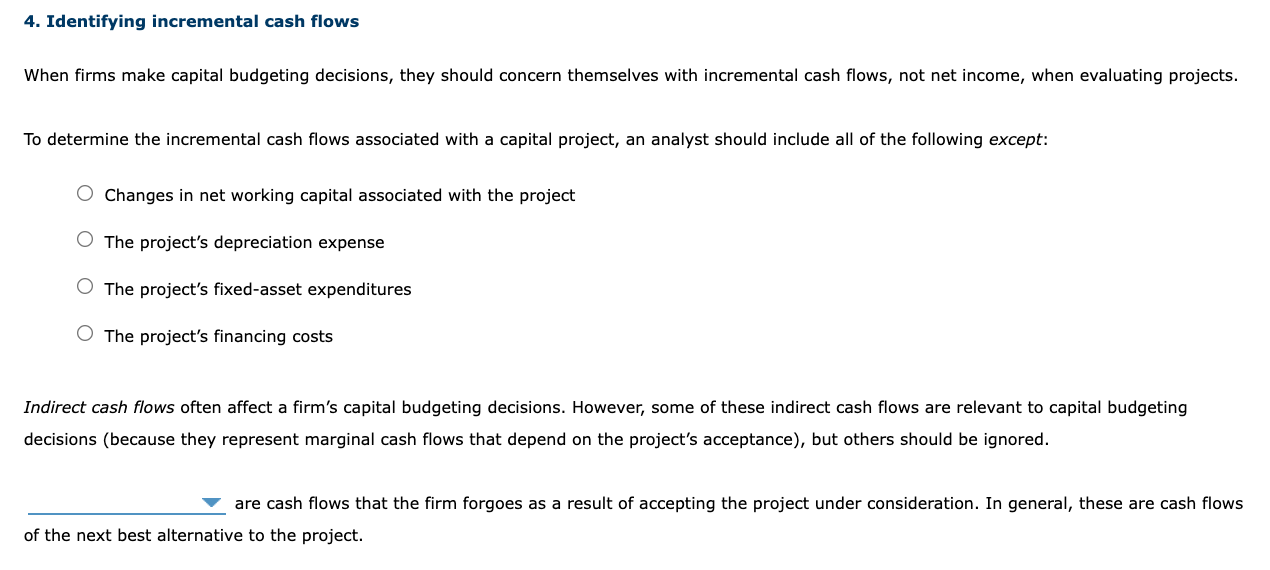

Question: Changes in net working capital associated with the project The project's depreciation expense The project's fixed-asset expenditures The project's financing costs decisions (because they represent

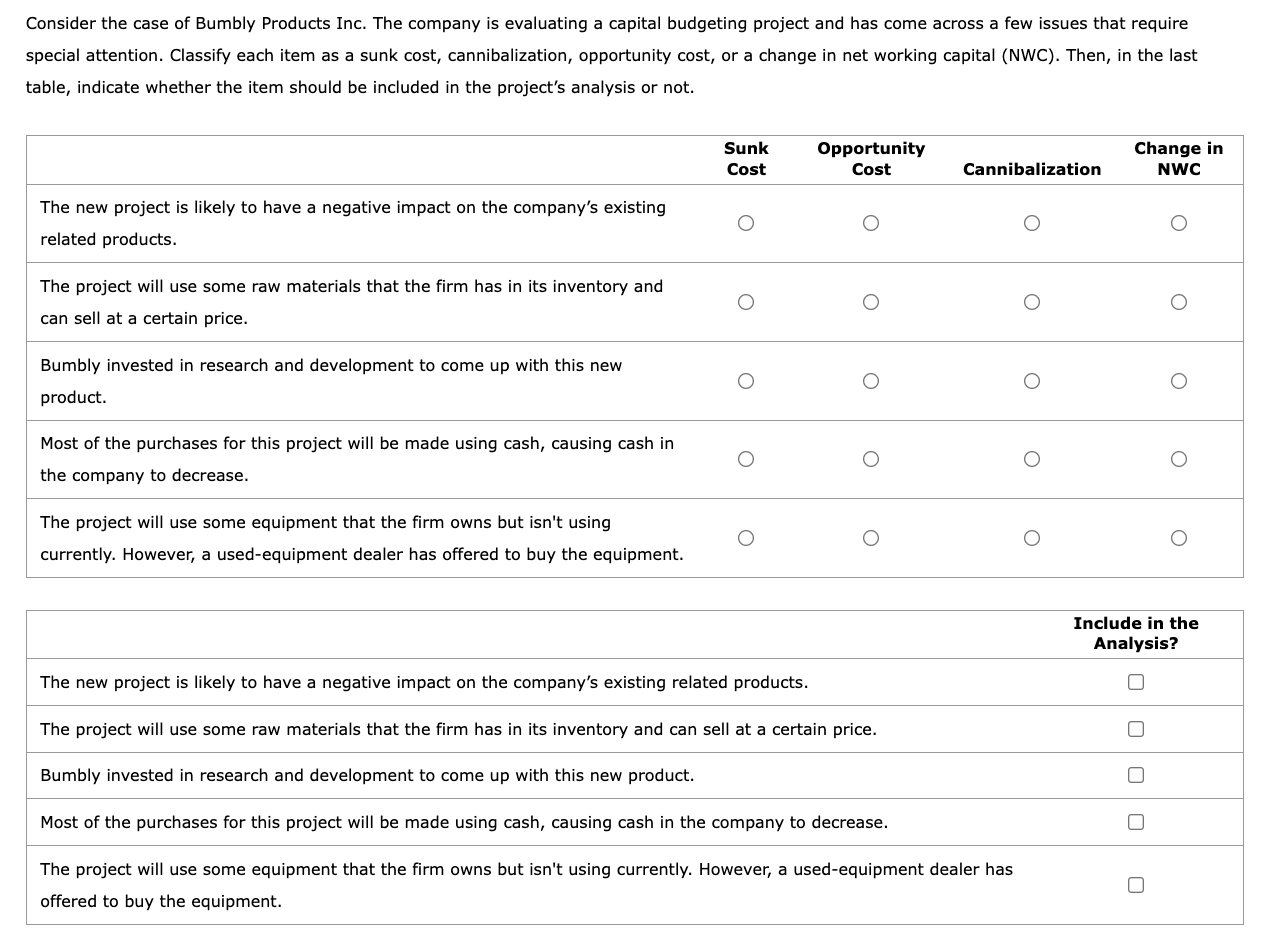

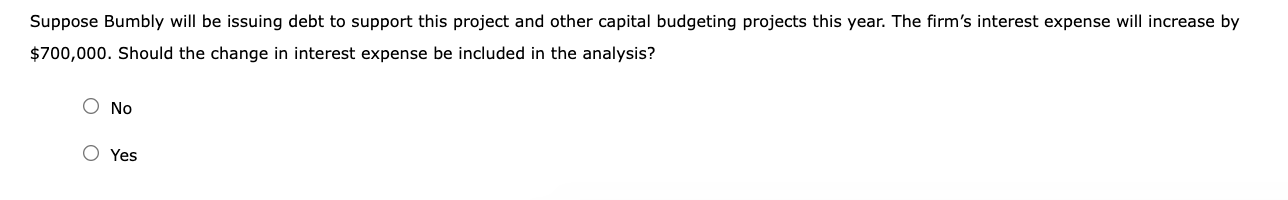

Changes in net working capital associated with the project The project's depreciation expense The project's fixed-asset expenditures The project's financing costs decisions (because they represent marginal cash flows that depend on the project's acceptance), but others should be ignored. are cash flows that the firm forgoes as a result of accepting the project under consideration. In general, these are cash flows of the next best alternative to the project. Consider the case of Bumbly Products Inc. The company is evaluating a capital budgeting project and has come across a few issues that require table, indicate whether the item should be included in the project's analysis or not. Suppose Bumbly will be issuing debt to support this project and other capital budgeting projects this year. The firm's interest expense will increase by $700,000. Should the change in interest expense be included in the analysis? No Yes Changes in net working capital associated with the project The project's depreciation expense The project's fixed-asset expenditures The project's financing costs decisions (because they represent marginal cash flows that depend on the project's acceptance), but others should be ignored. are cash flows that the firm forgoes as a result of accepting the project under consideration. In general, these are cash flows of the next best alternative to the project. Consider the case of Bumbly Products Inc. The company is evaluating a capital budgeting project and has come across a few issues that require table, indicate whether the item should be included in the project's analysis or not. Suppose Bumbly will be issuing debt to support this project and other capital budgeting projects this year. The firm's interest expense will increase by $700,000. Should the change in interest expense be included in the analysis? No Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts