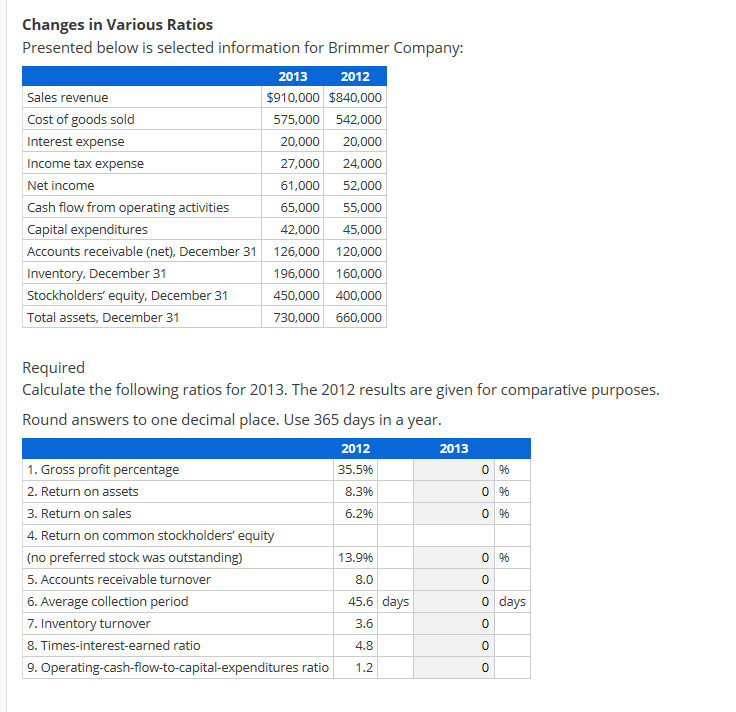

Question: Changes in Various Ratios Presented below is selected information for Brimmer Company: Sales revenue Cost of goods sold Interest expense Income tax expense Net income

Changes in Various Ratios Presented below is selected information for Brimmer Company: Sales revenue Cost of goods sold Interest expense Income tax expense Net income Cash flow from operating activities Capital expenditures Accounts receivable (net), December 31 Inventory, December 31 Stockholders' equity, December 31 Total assets, December 31 2013 2012 $910,000 $840,000 575,000 542,000 20,000 20,000 27,000 24,000 61,000 52,000 65,000 55,000 42,000 45,000 126,000 120,000 196,000 160,000 450,000 400,000 730,000 660,000 Required Calculate the following ratios for 2013. The 2012 results are given for comparative purposes. Round answers to one decimal place. Use 365 days in a year. 2012 2013 1. Gross profit percentage 35.5% 0 % 2. Return on assets 8.39 0 % 3. Return on sales 6.296 096 4. Return on common stockholders' equity (no preferred stock was outstanding) 13.996 0 % 5. Accounts receivable turnover 8.0 6. Average collection period 45.6 days 0 days 7. Inventory turnover 8. Times-interest-earned ratio 4.8 9. Operating-cash-flow-to-capital-expenditures ratio 1.2 3.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts