Question: Changing compounding frequency. Using annual, semiannual, and quarterly compounding periods, (1) calculate the future value if $5,000 is deposited initially at 12% annual interest for

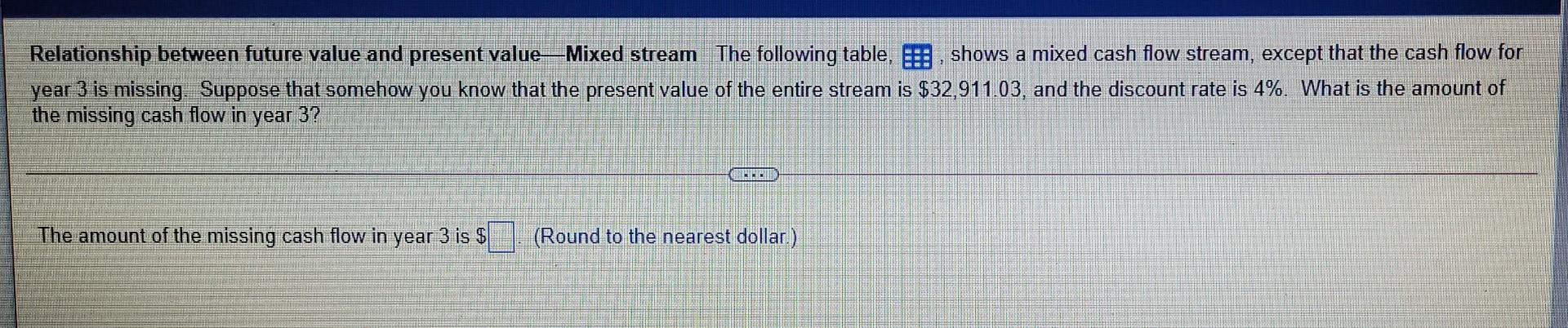

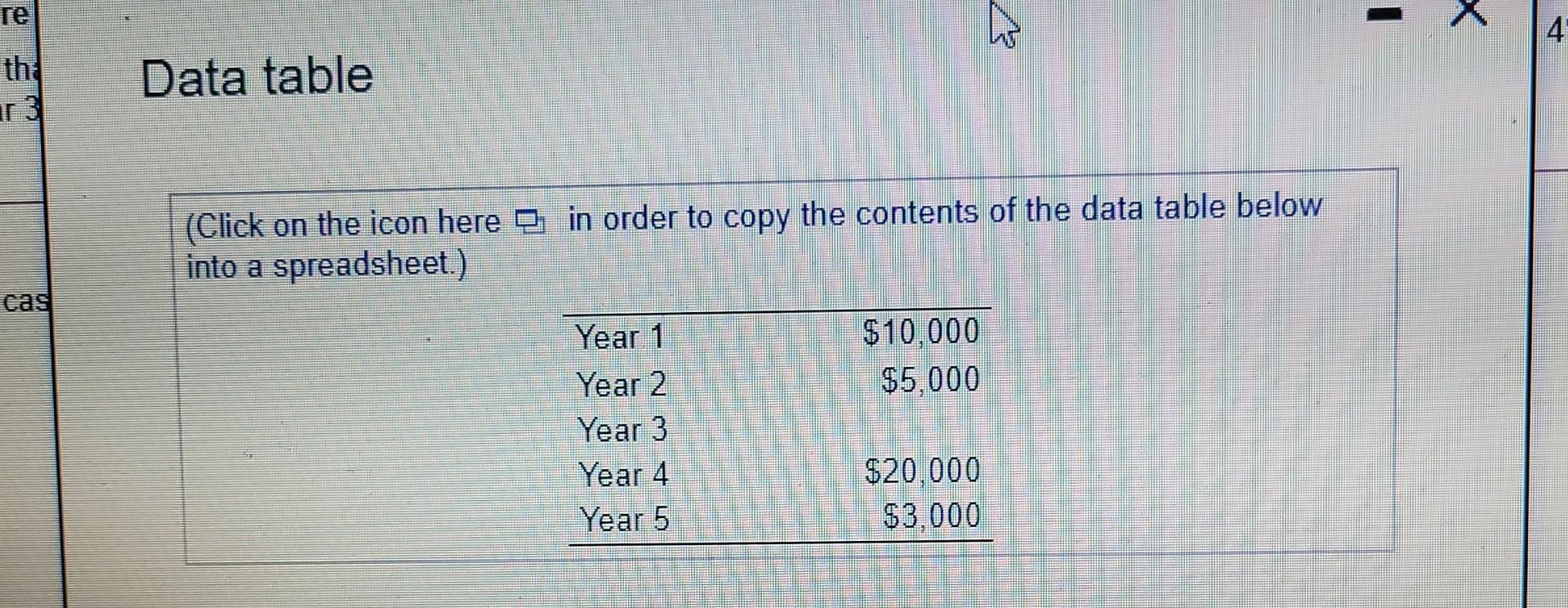

Changing compounding frequency. Using annual, semiannual, and quarterly compounding periods, (1) calculate the future value if $5,000 is deposited initially at 12% annual interest for 5 years, and (2) determine the effective annual rate (EAR). Annual Compounding ectio (1) The future value, FV, is $. (Round to the nearest cent) Relationship between future value and present value-Mixed stream The following table, .. shows a mixed cash flow stream, except that the cash flow for year 3 is missing. Suppose that somehow you know that the present value of the entire stream is $32,911.03, and the discount rate is 4%. What is the amount of the missing cash flow in year 3? The amount of the missing cash flow in year 3 is $ (Round to the nearest dollar.) re X 4 Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) cas $10,000 $5,000 Year 1 Year 2 Year 3 Year 4 Year 5 $20.000 $3,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts