Question: CHAP 14 - Q8 PLEASE ANSWER EVERYTHING IS THE SAME QUESTION IN DIFFERENT SECTIONS DROPDOWN OPTIONS ARE 1- 36,000 - 24,570 - 32,760 - 27,000

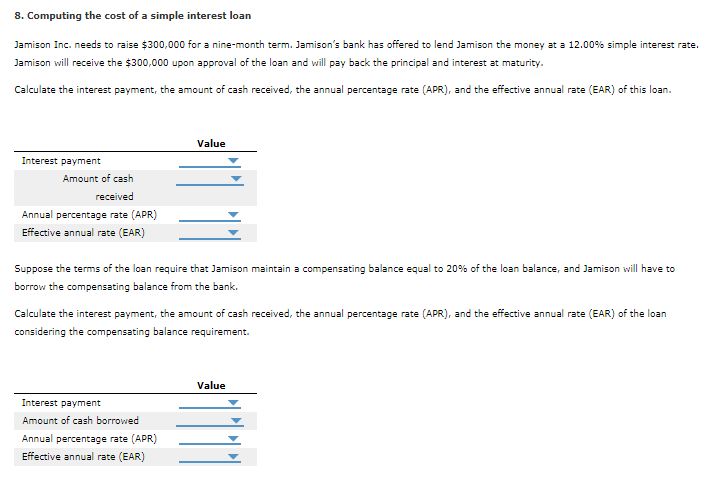

CHAP 14 - Q8

PLEASE ANSWER EVERYTHING IS THE SAME QUESTION IN DIFFERENT SECTIONS

DROPDOWN OPTIONS ARE

1- 36,000 - 24,570 - 32,760 - 27,000

2- 273,000 - 267,240 - 300,000 - 327,000

3- 9.00% - 12.00% - 6.75% - 10.00%

4- 9.00% - 6.68% - 12.00% - 12.18%

5- 27,000 - 40,500 - 54,000 - 33,750

6- 300,000 - 450,000 - 600,000 - 375,000

7- 2.35% - 1.55% - 0.75 - 15.00%

8- 15.87% - 17.47% - 15.27% - 16.67%

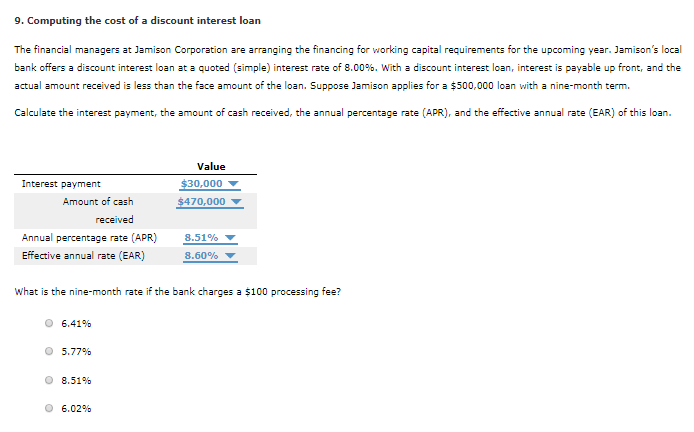

9- 6.41% - 5.77% - 8.51% - 6.02%

8. Computing the cost of a simple interest loan Jamison Inc. needs to raise $300,000 for a nine-month term. Jamison's bank has offered to lend Jamison the money at a 12.00% simple interest rate. Jamison will receive the $300,000 upon approval of the loan and will pay back the principal and interest at maturity. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Value Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) Suppose the terms of the loan require that Jamison maintain a compensating balance equal to 20% of the loan balance, and Jamison will have to borrow the compensating balance from the bank. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of the loan considering the compensating balance requirement. Value Interest payment Amount of cash borrowed Annual percentage rate (APR) Effective annual rate (EAR) 9. Computing the cost of a discount interest loan The financial managers at Jamison Corporation are arranging the financing for working capital requirements for the upcoming year. Jamison's local bank offers a discount interest loan at a quoted (simple) interest rate of 8.00%. With a discount interest loan, interest is payable up front, and the actual amount received is less than the face amount of the loan. Suppose Jamison applies for a $500,000 loan with a nine-month term. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Value $30,000 $470,000 Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) 8.51% 8.60% What is the nine-month rate if the bank charges a $100 processing fee? 6.41% 5.77% 8.51% 6.02%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts