Question: (Chap 25) Similar to the example in class on How much should you charge for a lease?, assume that you have computed Total Cash Flow

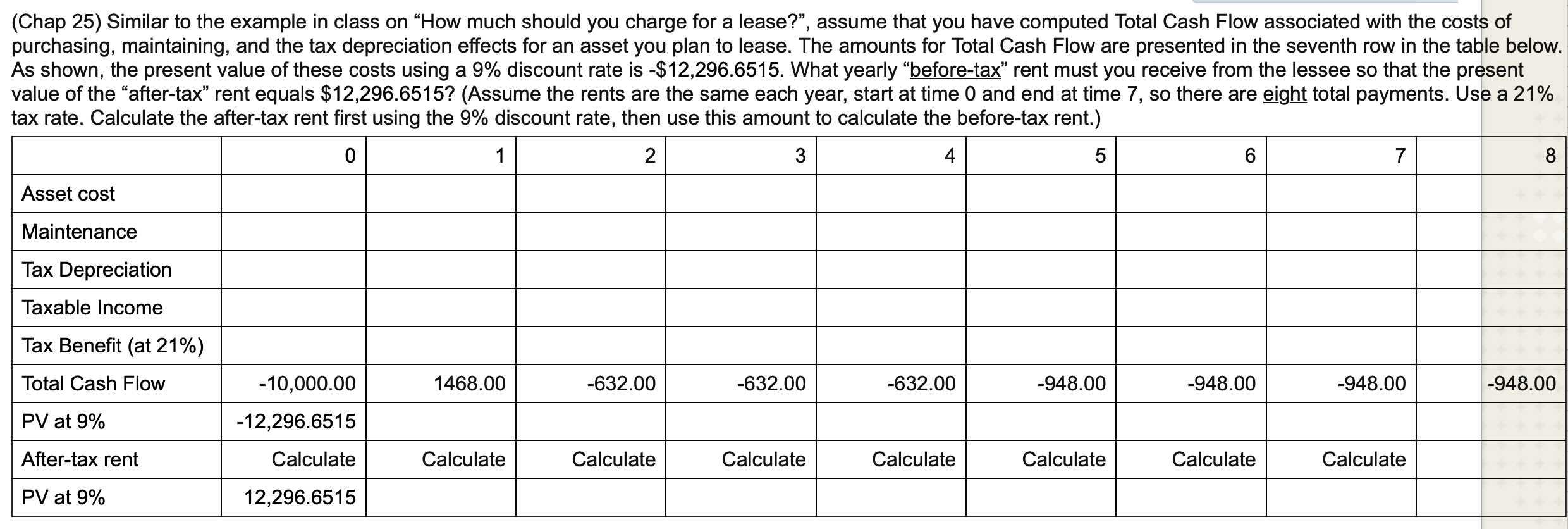

(Chap 25) Similar to the example in class on "How much should you charge for a lease?", assume that you have computed Total Cash Flow associated with the costs of purchasing, maintaining, and the tax depreciation effects for an asset you plan to lease. The amounts for Total Cash Flow are presented in the seventh row in the below. As shown, the present value of these costs using a 9% discount rate is $12,296.6515. What yearly "before-tax" rent must you receive from the lessee so that the present value of the "after-tax" rent equals $12,296.6515 ? (Assume the rents are the same each year, start at time 0 and end at time 7 , so there are eight total payments. Use a 21% tax rate. Calculate the after-tax rent first using the 9% discount rate, then use this amount to calculate the before-tax rent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts