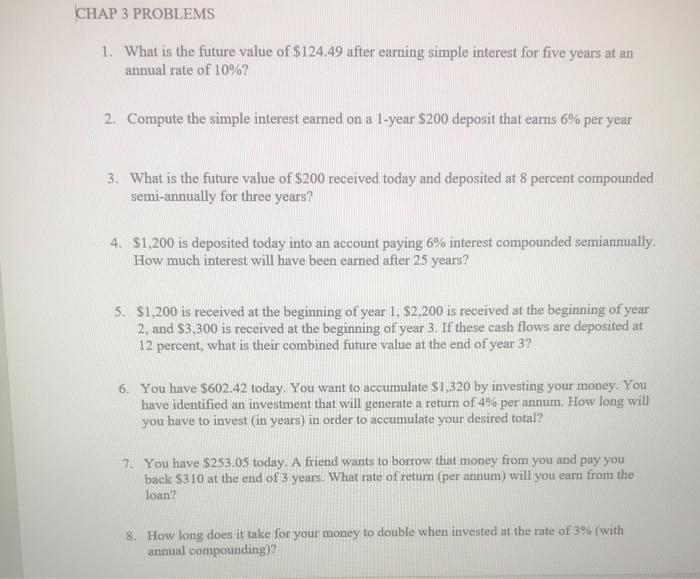

Question: CHAP 3 PROBLEMS 1. What is the future value of $124.49 after earning simple interest for five years at an annual rate of 10%? 2.

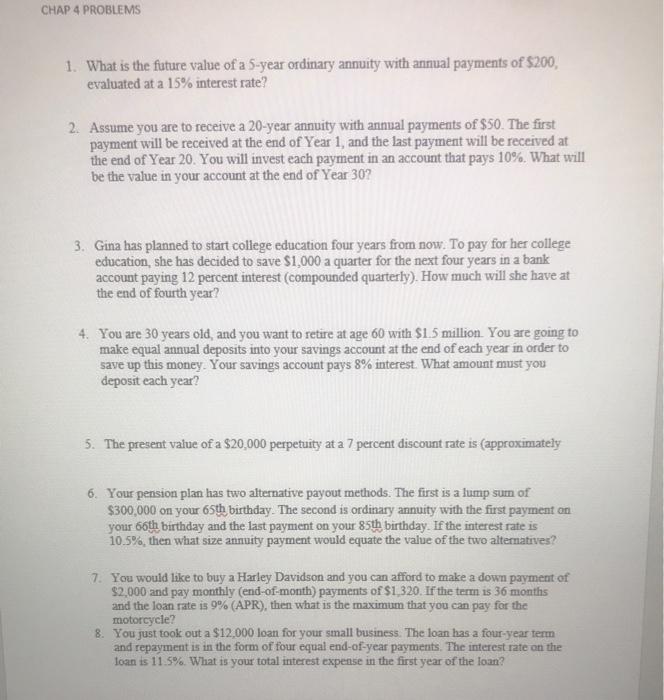

CHAP 3 PROBLEMS 1. What is the future value of $124.49 after earning simple interest for five years at an annual rate of 10%? 2. Compute the simple interest eamed on a 1-year $200 deposit that earns 6% per year 3. What is the future value of $200 received today and deposited at 8 percent compounded semi-annually for three years? 4. $1,200 is deposited today into an account paying 6% interest compounded semiannually. How much interest will have been earned after 25 years? 5. $1,200 is received at the beginning of year 1, $2,200 is received at the beginning of year 2. and $3,300 is received at the beginning of year 3. If these cash flows are deposited at 12 percent, what is their combined future value at the end of year 3? 6. You have $602.42 today. You want to accumulate $1,320 by investing your money. You have identified an investment that will generate a return of 4% per annum, How long will you have to invest (in years) in order to accumulate your desired total? 7. You have $253.05 today. A friend wants to borrow that money from you and pay you back $310 at the end of 3 years. What rate of return (per annum) will you earn from the loan? 8. How long does it take for your money to double when invested at the rate of 3% (with annual compounding)? CHAP 4 PROBLEMS 1. What is the future value of a 5-year ordinary annuity with annual payments of $200, evaluated at a 15% interest rate? 2. Assume you are to receive a 20-year annuity with annual payments of $50. The first payment will be received at the end of Year 1, and the last payment will be received at the end of Year 20. You will invest each payment in an account that pays 10%. What will be the value in your account at the end of Year 307 3. Gina has planned to start college education four years from now. To pay for her college education, she has decided to save $1,000 a quarter for the next four years in a bank account paying 12 percent interest (compounded quarterly), How much will she have at the end of fourth year? 4. You are 30 years old, and you want to retire at age 60 with $1.5 million. You are going to make equal annual deposits into your savings account at the end of each year in order to save up this money. Your savings account pays 8% interest. What amount must you deposit each year? 5. The present value of a $20.000 perpetuity at a 7 percent discount rate is (approximately 6. Your pension plan has two alternative payout methods. The first is a lump sum of $300,000 on your 65th birthday. The second is ordinary annuity with the first payment on your 65th birthday and the last payment on your 85th birthday. If the interest rate is 10.5%, then what size annuity payment would equate the value of the two alternatives? 7. You would like to buy a Harley Davidson and you can afford to make a down payment of $2,000 and pay monthly (end-of-month) payments of $1.320. If the term is 36 months and the loan rate is 9% (APR), then what is the maximum that you can pay for the motorcycle? 8. You just took out a $12,000 loan for your small business. The loan has a four-year term and repayment is in the form of four equal end-of-year payments. The interest rate on the loan is 11.5%. What is your total interest expense in the first year of the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts