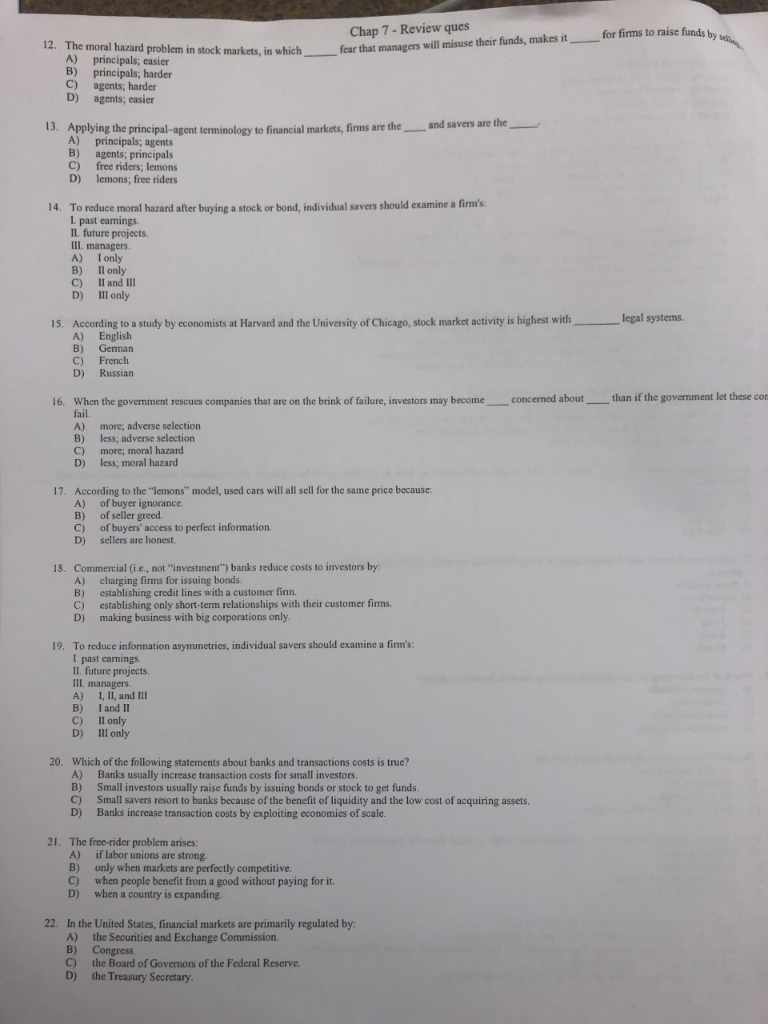

Question: Chap 7 - Review ques fear that managers will misuse their funds, makes it for firms to raise funds by vll 12. The moral hazard

Chap 7 - Review ques fear that managers will misuse their funds, makes it for firms to raise funds by vll 12. The moral hazard problem in stock markets, in which A) principals; easier B) principals; harder C) agents; harder D) agents; easier 13. Applying the and savers are the agent terminology financial markets, firms are the A) principals; agents B) agents; principals C) free riders; lemons DY lemons; free riders 14. To reduce moral hazard after buying a stock or bond, individual savers should examine a firm's: L past eamings. II. future projects. III. managers Il only C) II and II D' Ill only legal systems. According to a study by economists at Harvard and the University of Chicago, stock market activity is highest with 15. B) Gennan French Cl D) Russian than if the government let these con n the government rescues companies that are on the brink of failure, investors may become fail. concerned about 16 A) more; adverse selection B) less; adverse selection rd ta: moral hazard D) According to the "lemons" model, used cars will of buyer ignorance of seller greed of buyers' access to perfect information sell sell for the same price because: 17 A) B) Commercial (i.e., not "investment") banks reduce costs to investors by: A) charging firms for issuing bonds. establishing credit lines with a customer tin heir customer firms B) 18. making business with big corporations only D) To reduce information asymmetries, individual savers should examine a firm's: I past earnings Turure projects. 19. A) B) I, II, and III I and II C) Il only III only 20. Which of the following statements about banks and transactions costs is true? A) Banks usually increase transaction costs for small investors Small investors usually raise funds by issuing bonds or stock to get funds. Small savers resort to banks because of the benefit of liquidity and the low cost of acquiring assets. Banks increase transaction costs by exploiting economies of scale. B D 21. The free-rider problem arises: if labor unions are strong only when markets are perfectly competitive. when people benefit from a good without paying for it. when a country is expanding. A) C) 22. In the United States, financial markets are primarily regulated by Congres and Exchange Commission. B) C) the Board of Governors of the Federal Reserve. the Treasury Secretary D)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts