Question: Chapman Machine Shop is considering a 4-year project to improve its production efficiency. Buying a new machine press for $576,000 is estimated to result in

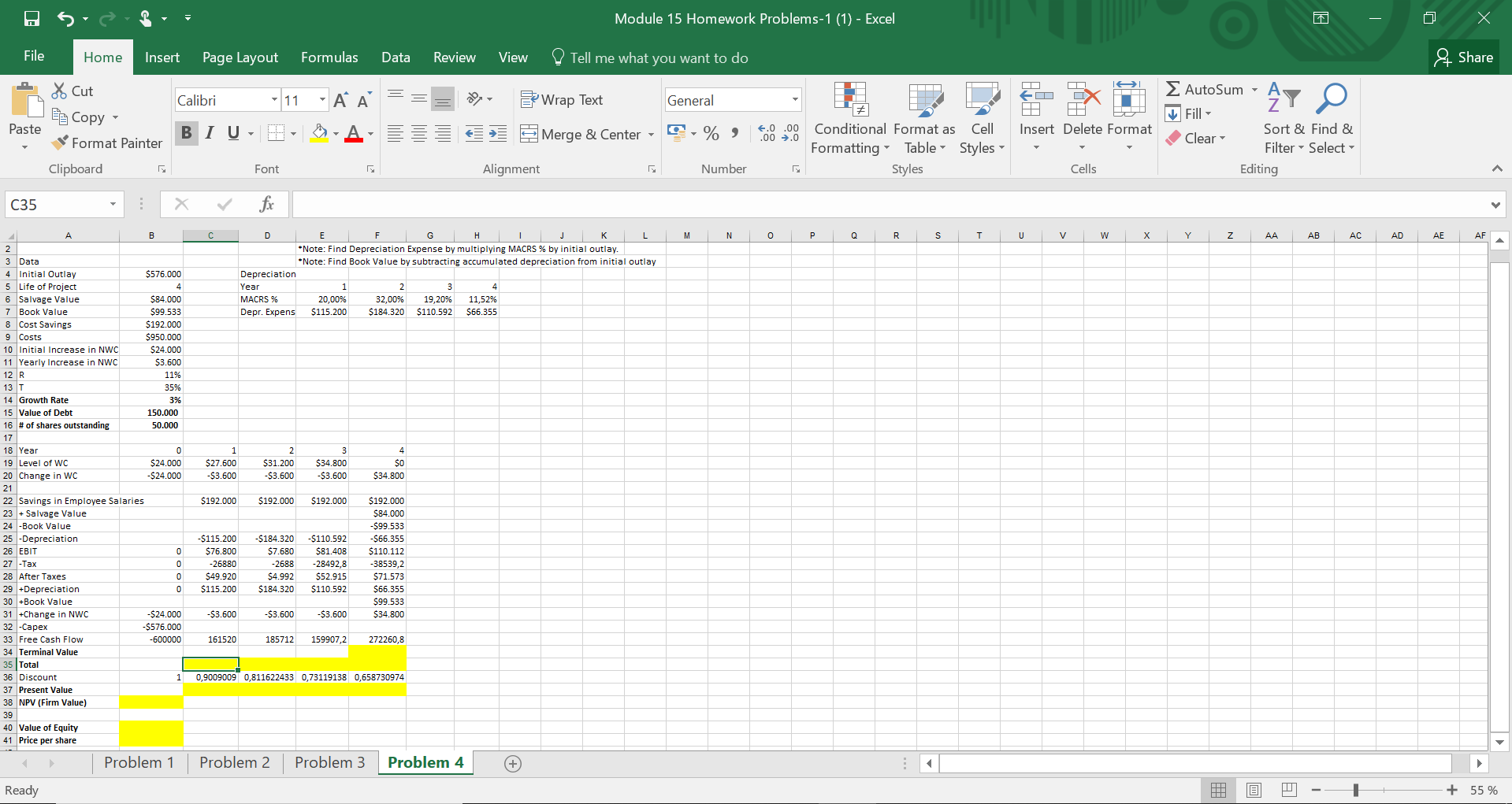

Chapman Machine Shop is considering a 4-year project to improve its production efficiency. Buying a new machine press for $576,000 is estimated to result in $192,000 in annual pretax cost savings. The press falls in the MACRS 5-year class, and it will have a salvage value at the end of the project of $84,000. The press also requires an initial investment in spare parts inventory of $24,000, along with an additional $3,600 in inventory for each succeeding year of the project. The inventory will return to its original level when the project ends. The shop's tax rate is 35% and its discount rate is 11%. Should the firm buy and install the machine press?

Assume that Chapman machine shop is expected to grow at a rate of 3% after year 4. If the value of debt is $150,000, and there are 50,000 shares outstanding, what is the price per share of Chapmans common stock?

Module 15 Homework Problems-1 (1) - Excel 0 - 0 X File Home Insert Page Layout Formulas Data Review View Tell me what you want to do Share X Cut Calibri Calibri -17 - A A === 11. AA = Wrap Text General F X EDOX i Autosum AY O General - % Paste B IU - B - A Merge & Center - , Insert Delete Format Eg Copy Format Painter Clipboard - 10Conditional Format as Cell Formatting Table Styles Styles Auto Sum - A Fill- Clear Sort & Find & Filter - Select Editing Font Alignment Number Cells C35 X fx C M N O P Q R S T U V W X Y Z AA AB AC AD AE AF $576.000 D E F G H I J K L *Note: Find Depreciation Expense by multiplying MACRS % by initial outlay. *Note: Find Book Value by subtracting accumulated depreciation from initial outlay Depreciation Year MACRS % 20,00% 32,00% 19,20% 11,52% Depr. Expens $115.200 $184.320 $110.592 $66.355 3 Data 4 Initial Outlay 5 Life of Project 6 Salvage Value 7 Book Value 8 Cost Savings 9 Costs 10 Initial Increase in NWC 11 Yearly Increase in NWC 12 R 13 T 14 Growth Rate 15 Value of Debt 16 # of shares outstanding $84.000 $99.533 $192.000 $950.000 $24.000 $3.600 11% 35% 3% 150.000 50.000 17 18 Year 19 Level of WC 20 Change in WC $24.000 -$24.000 $27.600 $3.600 $31.200 $3.600 $34.800 $3.600 $0 $34.800 21 $192.000 $192.000 $192.000 $115.200 $76.800 -26880 $49.920 $115.200 $184.320 $7.680 -2688 $4.992 $184.320 $110.592 $81.408 -28492,8 $52.915 $110.592 22 Savings in Employee Salaries 23 + Salvage Value 24 -Book Value 25 -Depreciation 26 EBIT 0 27 -Tax 0 28 After Taxes 0 29 Depreciation 0 30 +Book Value 31 +Change in NWC -$24.000 32 -Capex -$576.000 33 Free Cash Flow -600000 34 Terminal Value 35 Total 36 Discount 1 37 Present Value 38 NPV (Firm Value) $192.000 $84.000 -$99.533 $66.355 $110.112 -38539,2 $71.573 $66.355 $99.533 $34.800 $3.600 $3.600 $3.600 161520 185712 159907,2 272260,8 0,9009009 0,811622433 0,73119138 0,658730974 39 40 Value of Equity 41 Price per share Problem 1 Problem 2 Problem 3 Problem 4 + Ready @ J -- H - + 55 % Module 15 Homework Problems-1 (1) - Excel 0 - 0 X File Home Insert Page Layout Formulas Data Review View Tell me what you want to do Share X Cut Calibri Calibri -17 - A A === 11. AA = Wrap Text General F X EDOX i Autosum AY O General - % Paste B IU - B - A Merge & Center - , Insert Delete Format Eg Copy Format Painter Clipboard - 10Conditional Format as Cell Formatting Table Styles Styles Auto Sum - A Fill- Clear Sort & Find & Filter - Select Editing Font Alignment Number Cells C35 X fx C M N O P Q R S T U V W X Y Z AA AB AC AD AE AF $576.000 D E F G H I J K L *Note: Find Depreciation Expense by multiplying MACRS % by initial outlay. *Note: Find Book Value by subtracting accumulated depreciation from initial outlay Depreciation Year MACRS % 20,00% 32,00% 19,20% 11,52% Depr. Expens $115.200 $184.320 $110.592 $66.355 3 Data 4 Initial Outlay 5 Life of Project 6 Salvage Value 7 Book Value 8 Cost Savings 9 Costs 10 Initial Increase in NWC 11 Yearly Increase in NWC 12 R 13 T 14 Growth Rate 15 Value of Debt 16 # of shares outstanding $84.000 $99.533 $192.000 $950.000 $24.000 $3.600 11% 35% 3% 150.000 50.000 17 18 Year 19 Level of WC 20 Change in WC $24.000 -$24.000 $27.600 $3.600 $31.200 $3.600 $34.800 $3.600 $0 $34.800 21 $192.000 $192.000 $192.000 $115.200 $76.800 -26880 $49.920 $115.200 $184.320 $7.680 -2688 $4.992 $184.320 $110.592 $81.408 -28492,8 $52.915 $110.592 22 Savings in Employee Salaries 23 + Salvage Value 24 -Book Value 25 -Depreciation 26 EBIT 0 27 -Tax 0 28 After Taxes 0 29 Depreciation 0 30 +Book Value 31 +Change in NWC -$24.000 32 -Capex -$576.000 33 Free Cash Flow -600000 34 Terminal Value 35 Total 36 Discount 1 37 Present Value 38 NPV (Firm Value) $192.000 $84.000 -$99.533 $66.355 $110.112 -38539,2 $71.573 $66.355 $99.533 $34.800 $3.600 $3.600 $3.600 161520 185712 159907,2 272260,8 0,9009009 0,811622433 0,73119138 0,658730974 39 40 Value of Equity 41 Price per share Problem 1 Problem 2 Problem 3 Problem 4 + Ready @ J -- H - + 55 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts