Question: Chapter 0 9 ( i ) Help Sove 8 Exit Submit January 8 , the end of the first weekly pay period of the year,

Chapter i

Help

Sove Exit

Submit

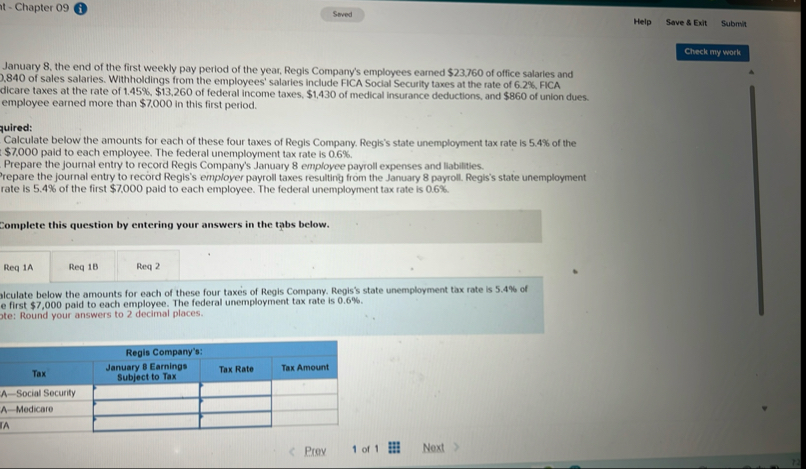

January the end of the first weekly pay period of the year, Regis Company's employees eamed $ of office salaries and of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of FICA dicare taxes at the rate of $ of federal income taxes, $ of medical insurance deductions, and $ of union dues. employee earned more than $ in this first period.

quired:

Calculate below the amounts for each of these four taxes of Regis Company. Regis's state unemployment tax rate is of the $ paid to each employee. The federal unemployment tax rate is

Prepare the journal entry to record Regis Company's January employee payroll expenses and llabilities.

repare the journal entry to record Regis's employer payroll taxes resulting from the January payroll. Regis's state unemployment rate is of the first $ paid to each employee. The federal unemployment tax rate is

Complete this question by entering your answers in the tabs below.

Req A

Iculate below the amounts for each of these four taxes of Regis Company. Regis's state unemployment tax rate is of e first $ paid to each employee. The federal unemployment tax rate is

te: Round your answers to decimal places.

tabletableRegis Company's:January EarningsSubject to TaxTaxTax Rate,Tax AmountASocial Security,,,AMedicare,,,IA

Prov

of Complete this question by entering your answers in the tabs below.

repare the journal entry to record Regis Company's January employee payroll expenses and liabilities.

lote: Round your answers to decimal places.

Journal entry worksheet

Record the employee payroll expenses and liabilities for the first weekly pay period of the year.

Note: Enter debits before credits.

tableSNoDateAccount Title,Debit,CreditJanuary

Prex

of

Nexteq A

Req B

Req

pare the journal entry to record Regis's employer payroll taxes resulting from the January payroll. Regis's state unemployment tax is of the first $ paid to each employee. The federal unemployment tax rate is

e: Round your answers to decimal places.

ournal entry worksheet

Record the employer's payroll expenses and liabilities for the first weekly pay period of the year.

te: Enter debits before credits.

tableSNoiDate,Account Title,Debit,CreditJanuary

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock