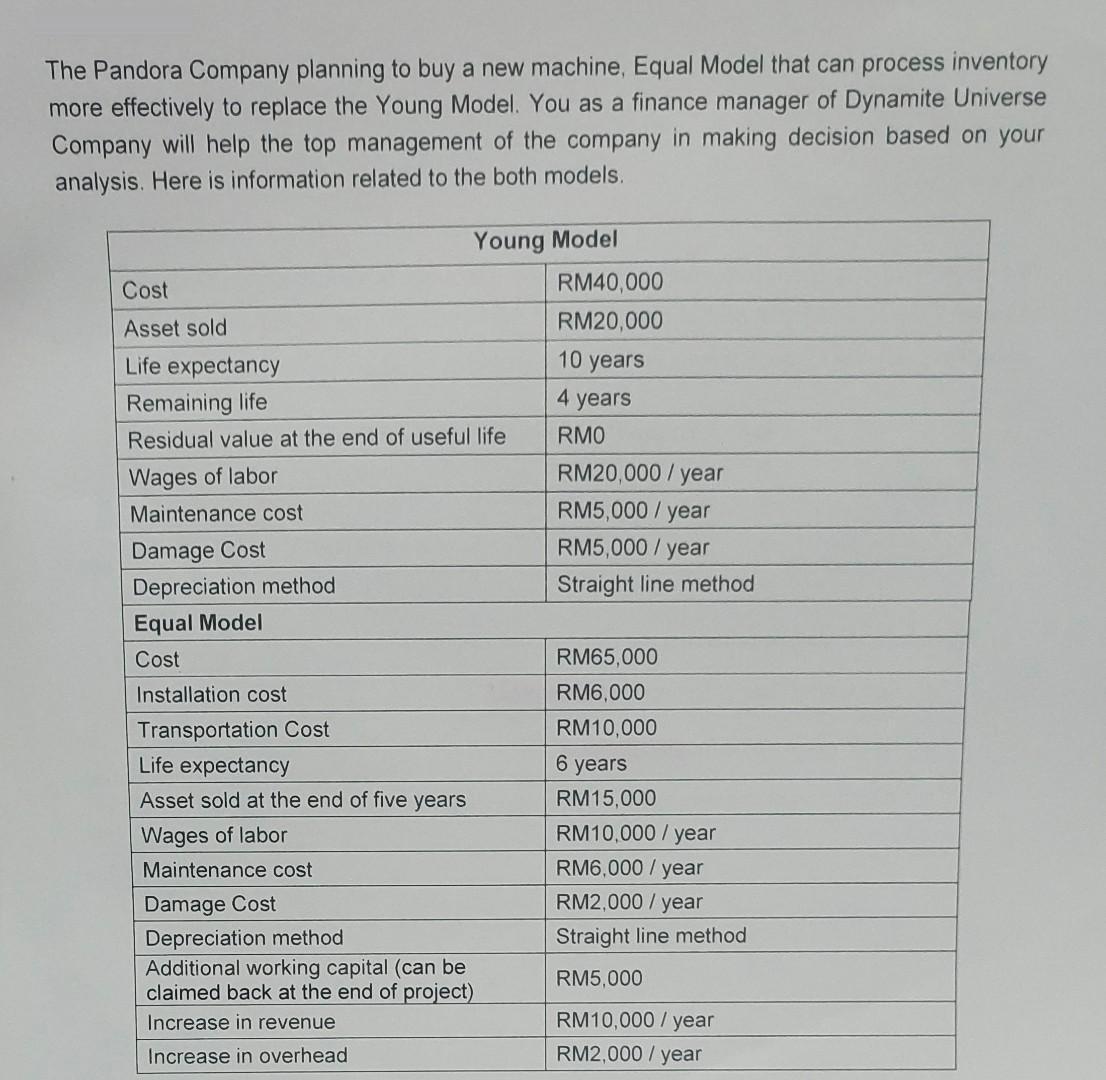

Question: The Pandora Company planning to buy a new machine, Equal Model that can process inventory more effectively to replace the Young Model. You as

The Pandora Company planning to buy a new machine, Equal Model that can process inventory more effectively to replace the Young Model. You as a finance manager of Dynamite Universe Company will help the top management of the company in making decision based on your analysis. Here is information related to the both models. Cost Asset sold Life expectancy Remaining life Residual value at the end of useful life Wages of labor Maintenance cost Damage Cost Depreciation method Equal Model Cost Young Model Installation cost Transportation Cost Life expectancy Asset sold at the end of five years Wages of labor Maintenance cost Damage Cost Depreciation method Additional working capital (can be claimed back at the end of project) Increase in revenue Increase in overhead RM40,000 RM20,000 10 years 4 years RMO RM20,000/year RM5,000/year RM5,000/year Straight line method RM65,000 RM6,000 RM10,000 6 years RM15,000 RM10,000/year RM6,000/year RM2,000/year Straight line method RM5,000 RM10,000/year RM2,000/year Based on the information above with marginal taxes rate 25% and investment taxes credit 20%, perform a complete report for Pandora Company using the correct format by calculating: a) Initial investment b) Cash flow difference c) Terminal cash flow d) Incremental cash flows Come out (10 marks) (10 marks) (4 marks) (6 marks)

Step by Step Solution

3.33 Rating (141 Votes )

There are 3 Steps involved in it

a Initial Investment of Equal model Initial invest... View full answer

Get step-by-step solutions from verified subject matter experts