Question: Chapter 04 - Introduction to Valuation.... 0 Saved Help Save & Exit Submi 7 Imprudential, Inc., has an unfunded pension liability of $765 million that

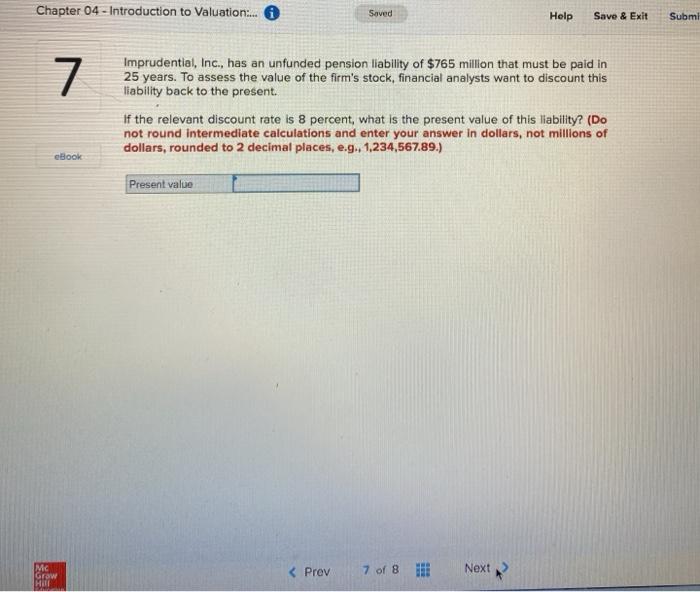

Chapter 04 - Introduction to Valuation.... 0 Saved Help Save & Exit Submi 7 Imprudential, Inc., has an unfunded pension liability of $765 million that must be paid in 25 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. If the relevant discount rate is 8 percent, what is the present value of this liability? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) Book Present value M Grow Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts