Question: Chapter 04, Supplemental Question 07 (GO Tutorial) On-site Testing Service has received four investment proposals for consideration. Two of the proposals, X1 and X2 are

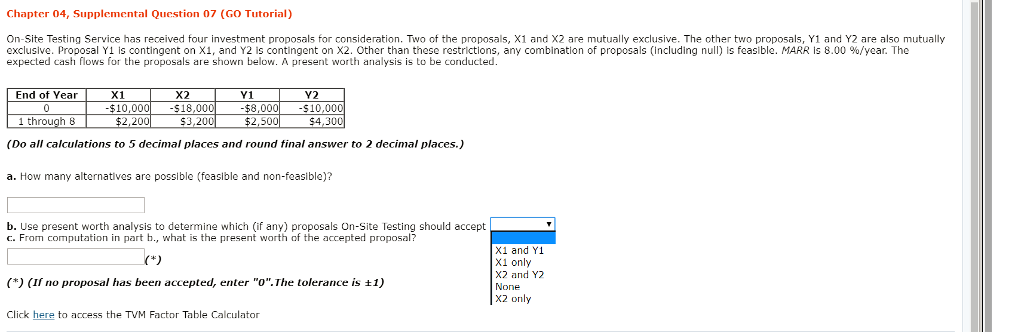

Chapter 04, Supplemental Question 07 (GO Tutorial) On-site Testing Service has received four investment proposals for consideration. Two of the proposals, X1 and X2 are mutually exclusive. The other two proposals, Y1 and Y2 are also mutually exclusive. Proposal Y1 is contingent on X1, and Y2 is contingent on X2. Other than these restrictions, any combination of proposals (including null) is feasible. MARR is 8.00 %/year. The expected cash flows for the proposals are shown below. A present worth analysis is to be conducted X1 Y1 X2 $18,00 Y2 10,00 End of Year 8,000 2,500 1 through 8 2,200 3,20 (Do all calculations to 5 decimal places and round tinal answer to 2 decimal places.) a. How many alternatives are possible (feasible and non-feasible)? b. Use present worth analysis to determine which (if any) proposals On-Site Testing should accept c. From computation in part h., what is the present worth of the accepted proposal? X1 and Y1 X1 only X2 and Y2 None X2 only (*) (If no proposal hds been accepted, enter "0". The tolerance is 1) Click here to access the TVM Factor Table Calculator

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts