Question: Chapter 06 Practice Test Question 05 Calculating Ex-Post Covariance An analyst obtains 24 annual return observations for Stock 1 and Stock 2. The analyst finds

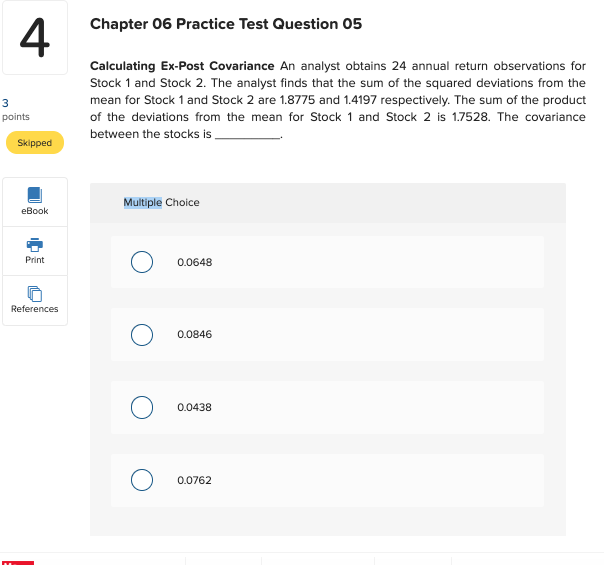

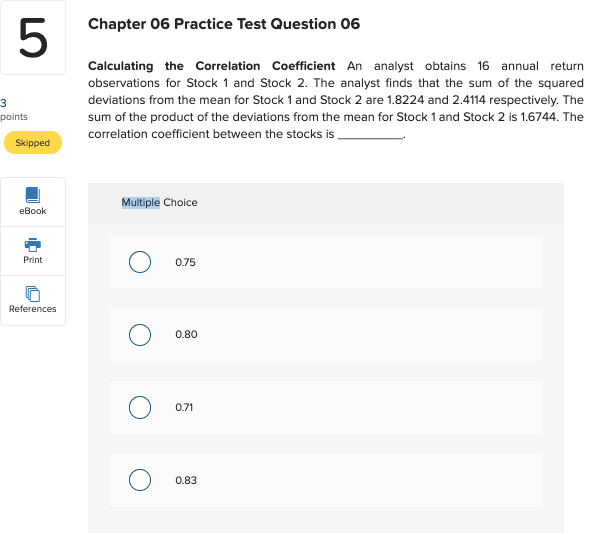

Chapter 06 Practice Test Question 05 Calculating Ex-Post Covariance An analyst obtains 24 annual return observations for Stock 1 and Stock 2. The analyst finds that the sum of the squared deviations from the mean for Stock 1 and Stock 2 are 1.8775 and 1.4197 respectively. The sum of the product of the deviations from the mean for Stock 1 and Stock 2 is 1.7528. The covariance between the stocks is points Skipped eBook 1 Print 0 0.0648 References 0 0.0846 0 0.0438 0 0.0762 Chapter 06 Practice Test Question 06 Calculating the correlation Coefficient An analyst obtains 16 annual return observations for Stock 1 and Stock 2. The analyst finds that the sum of the squared deviations from the mean for Stock 1 and Stock 2 are 1.8224 and 2.4114 respectively. The sum of the product of the deviations from the mean for Stock 1 and Stock 2 is 1.6744. The correlation coefficient between the stocks is points Skipped eBook 1 0 Print References 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts