Question: Chapter 07 Group work - STU.xlsx Problem 3a Page 6 On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $200,000. Among the accounts receivable was

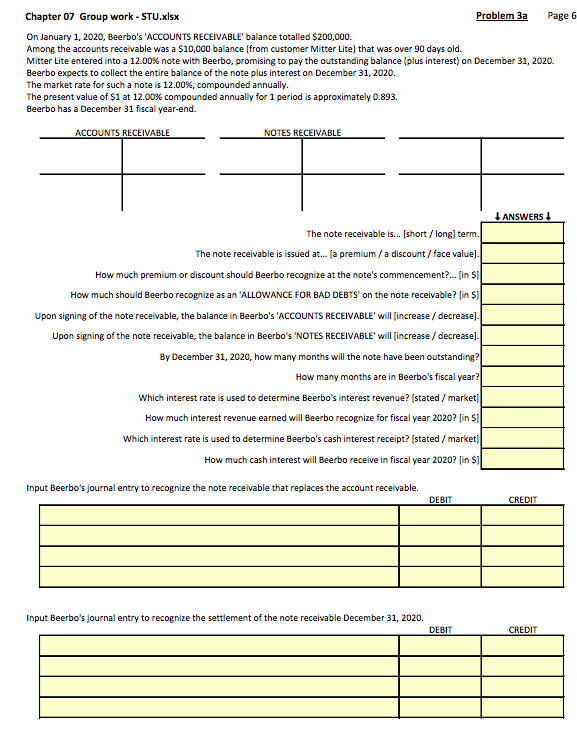

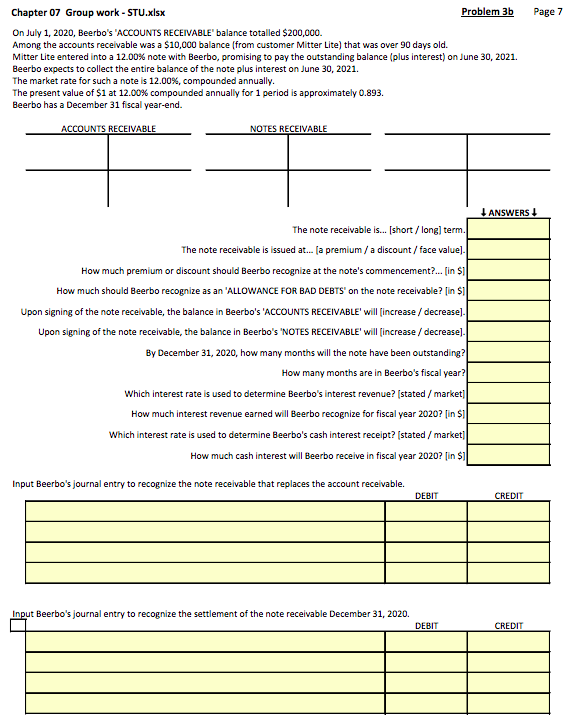

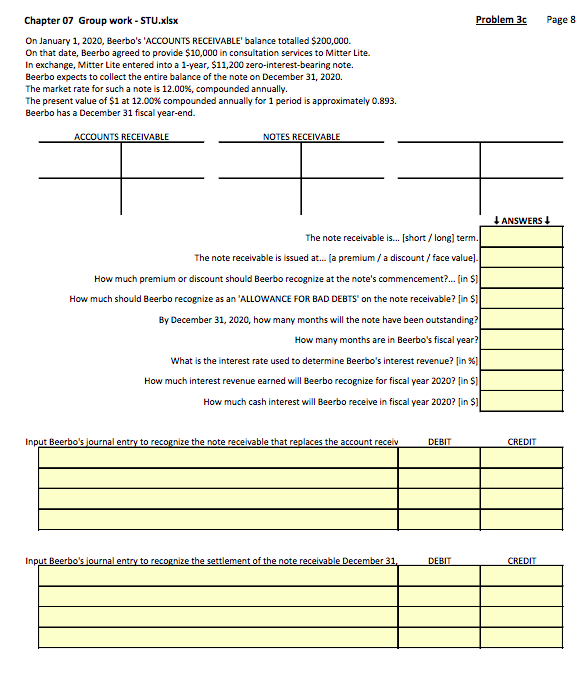

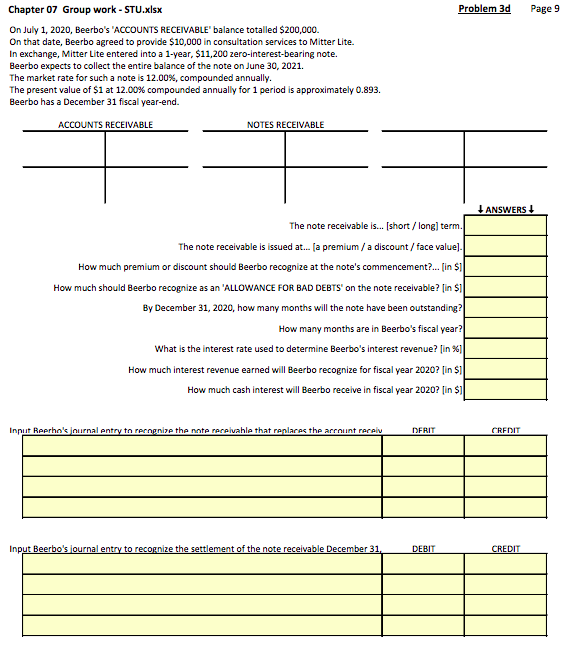

Chapter 07 Group work - STU.xlsx Problem 3a Page 6 On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $200,000. Among the accounts receivable was a $10,000 balance (from customer Mitter Lite) that was over 90 days old. Mitter Lite entered into a 12.00% note with Beerbo, promising to pay the outstanding balance (plus interest) on December 31, 2020. Beerbo expects to collect the entire balance of the note plus interest on December 31, 2020. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE NOTES RECEIVABLE 1 ANSWERS The note receivable is... (short / long term. The note receivable is issued at... (a premium / a discount/face value). How much premium or discount should Beerbo recognize at the note's commencement?... [in $1 How much should Beerbo recognize as an 'ALLOWANCE FOR BAD DEBTS' on the note receivable? (in $1 Upon signing of the note receivable, the balance in Beerbo's 'ACCOUNTS RECEIVABLE' will increase / decrease] Upon signing of the note receivable, the balance in Beerbo's 'NOTES RECEIVABLE' will increase / decrease) By December 31, 2020, how many months will the note have been outstanding? How many months are in Beerbo's fiscal year? Which interest rate is used to determine Beerbo's interest revenue? (stated/market||| How much interest revenue earned will Beerbo recognize for fiscal year 2020? [in $|| Which interest rate is used to determine Beerbo's cash interest receipt> [stated / market) How much cash interest will Beerbo receive in fiscal year 2020? fin $il Input Beerbo's journal entry to recognize the note receivable that replaces the account receivable. DEBIT CREDIT Input Beerbo's journal entry to recognize the settlement of the note receivable December 31, 2020. DEBIT CREDIT Chapter 07 Group work - STU.xlsx Problem 3b Page 7 On July 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE" balance totalled $200,000. Among the accounts receivable was a $10,000 balance (from customer Mitter Lite) that was over 90 days old. Mitter Lite entered into a 12.00% note with Beerbo, promising to pay the outstanding balance (plus interest) on June 30, 2021. Beerbo expects to collect the entire balance of the note plus interest on June 30, 2021. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE NOTES RECEIVABLE 1 ANSWERS! The note receivable is... (short / long term. The note receivable is issued at... (a premium / a discount/face value] How much premium or discount should Beerbo recognize at the note's commencement?... [in $1 How much should Beerbo recognize as an 'ALLOWANCE FOR BAD DEBTS' on the note receivable? (in $1 Upon signing of the note receivable, the balance in Beerbo's 'ACCOUNTS RECEIVABLE' will increase / decrease). Upon signing of the note receivable, the balance in Beerbo's 'NOTES RECEIVABLE' will increase / decrease] By December 31, 2020, how many months will the note have been outstanding? How many months are in Beerbo's fiscal year? Which interest rate is used to determine Beerbo's interest revenue? (stated / market) How much interest revenue earned will Beerbo recognize for fiscal year 2020? (in $1 Which interest rate is used to determine Beerbo's cash interest receipt? stated / market How much cash interest will Beerbo receive in fiscal year 2020? [in $] Input Beerbo's journal entry to recognize the note receivable that replaces the account receivable. DEBIT CREDIT Input Beerbo's journal entry to recognize the settlement of the note receivable December 31, 2020. DEBIT CREDIT Problem 3C Page 8 Chapter 07 Group work - STU.xlsx On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $200,000. On that date, Beerbo agreed to provide $10,000 in consultation services to Mitter Lite. In exchange, Mitter Lite entered into a 1-year, $11,200 zero-interest-bearing note. Beerbo expects to collect the entire balance of the note on December 31, 2020. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE NOTES RECEIVABLE ANSWERS The note receivable is... (short / long term. The note receivable is issued at... la premium / a discount/face value). How much premium or discount should Beerbo recognize at the note's commencement?... in $1 How much should Beerbo recognize as an 'ALLOWANCE FOR BAD DEBTS' on the note receivable? [in $] By December 31, 2020, how many months will the note have been outstanding? How many months are in Beerbo's fiscal year? What is the interest rate used to determine Beerbo's interest revenue? (in %) How much interest revenue earned will Beerbo recognize for fiscal year 2020? [in $1 How much cash interest will Beerbo receive in fiscal year 2020? in $] Input Beerbo's journal entry to recognize the note receivable that replaces the account recel DEBIT CREDIT Input Beerbo's journal entry to recognize the settlement of the note receivable December 31. DEBIT CREDIT Chapter 07 Group work - STU.xlsx Problem 3d Page 9 On July 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE" balance totalled $200,000. On that date, Beerbo agreed to provide $10,000 in consultation services to Mitter Lite. In exchange, Mitter Lite entered into a 1-year, $11,200 zero-interest-bearing note. Beerbo expects to collect the entire balance of the note on June 30, 2021. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE NOTES RECEIVABLE LANSWERS The note receivable is... [short / long term. The note receivable is issued at... (a premium / a discount/face value). How much premium or discount should Beerbo recognize at the note's commencement?... in $1 How much should Beerbo recognize as an 'ALLOWANCE FOR BAD DEBTS' on the note receivable? (in $1 By December 31, 2020, how many months will the note have been outstanding? How many months are in Beerbo's fiscal year? What is the interest rate used to determine Beerbo's interest revenue? (in %] How much interest revenue earned will Beerbo recognize for fiscal year 2020? [in $il How much cash interest will Beerbo receive in fiscal year 2020? [in $1 Input Reerho's nurnal entry to recognize the note receivable that replaces the arrunt recal DEBIT CREDIT Input Beerbo's journal entry to recognize the settlement of the note receivable December 31. DEBIT CREDIT Chapter 07 Group work - STU.xlsx Problem 3a Page 6 On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $200,000. Among the accounts receivable was a $10,000 balance (from customer Mitter Lite) that was over 90 days old. Mitter Lite entered into a 12.00% note with Beerbo, promising to pay the outstanding balance (plus interest) on December 31, 2020. Beerbo expects to collect the entire balance of the note plus interest on December 31, 2020. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE NOTES RECEIVABLE 1 ANSWERS The note receivable is... (short / long term. The note receivable is issued at... (a premium / a discount/face value). How much premium or discount should Beerbo recognize at the note's commencement?... [in $1 How much should Beerbo recognize as an 'ALLOWANCE FOR BAD DEBTS' on the note receivable? (in $1 Upon signing of the note receivable, the balance in Beerbo's 'ACCOUNTS RECEIVABLE' will increase / decrease] Upon signing of the note receivable, the balance in Beerbo's 'NOTES RECEIVABLE' will increase / decrease) By December 31, 2020, how many months will the note have been outstanding? How many months are in Beerbo's fiscal year? Which interest rate is used to determine Beerbo's interest revenue? (stated/market||| How much interest revenue earned will Beerbo recognize for fiscal year 2020? [in $|| Which interest rate is used to determine Beerbo's cash interest receipt> [stated / market) How much cash interest will Beerbo receive in fiscal year 2020? fin $il Input Beerbo's journal entry to recognize the note receivable that replaces the account receivable. DEBIT CREDIT Input Beerbo's journal entry to recognize the settlement of the note receivable December 31, 2020. DEBIT CREDIT Chapter 07 Group work - STU.xlsx Problem 3b Page 7 On July 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE" balance totalled $200,000. Among the accounts receivable was a $10,000 balance (from customer Mitter Lite) that was over 90 days old. Mitter Lite entered into a 12.00% note with Beerbo, promising to pay the outstanding balance (plus interest) on June 30, 2021. Beerbo expects to collect the entire balance of the note plus interest on June 30, 2021. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE NOTES RECEIVABLE 1 ANSWERS! The note receivable is... (short / long term. The note receivable is issued at... (a premium / a discount/face value] How much premium or discount should Beerbo recognize at the note's commencement?... [in $1 How much should Beerbo recognize as an 'ALLOWANCE FOR BAD DEBTS' on the note receivable? (in $1 Upon signing of the note receivable, the balance in Beerbo's 'ACCOUNTS RECEIVABLE' will increase / decrease). Upon signing of the note receivable, the balance in Beerbo's 'NOTES RECEIVABLE' will increase / decrease] By December 31, 2020, how many months will the note have been outstanding? How many months are in Beerbo's fiscal year? Which interest rate is used to determine Beerbo's interest revenue? (stated / market) How much interest revenue earned will Beerbo recognize for fiscal year 2020? (in $1 Which interest rate is used to determine Beerbo's cash interest receipt? stated / market How much cash interest will Beerbo receive in fiscal year 2020? [in $] Input Beerbo's journal entry to recognize the note receivable that replaces the account receivable. DEBIT CREDIT Input Beerbo's journal entry to recognize the settlement of the note receivable December 31, 2020. DEBIT CREDIT Problem 3C Page 8 Chapter 07 Group work - STU.xlsx On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $200,000. On that date, Beerbo agreed to provide $10,000 in consultation services to Mitter Lite. In exchange, Mitter Lite entered into a 1-year, $11,200 zero-interest-bearing note. Beerbo expects to collect the entire balance of the note on December 31, 2020. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE NOTES RECEIVABLE ANSWERS The note receivable is... (short / long term. The note receivable is issued at... la premium / a discount/face value). How much premium or discount should Beerbo recognize at the note's commencement?... in $1 How much should Beerbo recognize as an 'ALLOWANCE FOR BAD DEBTS' on the note receivable? [in $] By December 31, 2020, how many months will the note have been outstanding? How many months are in Beerbo's fiscal year? What is the interest rate used to determine Beerbo's interest revenue? (in %) How much interest revenue earned will Beerbo recognize for fiscal year 2020? [in $1 How much cash interest will Beerbo receive in fiscal year 2020? in $] Input Beerbo's journal entry to recognize the note receivable that replaces the account recel DEBIT CREDIT Input Beerbo's journal entry to recognize the settlement of the note receivable December 31. DEBIT CREDIT Chapter 07 Group work - STU.xlsx Problem 3d Page 9 On July 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE" balance totalled $200,000. On that date, Beerbo agreed to provide $10,000 in consultation services to Mitter Lite. In exchange, Mitter Lite entered into a 1-year, $11,200 zero-interest-bearing note. Beerbo expects to collect the entire balance of the note on June 30, 2021. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE NOTES RECEIVABLE LANSWERS The note receivable is... [short / long term. The note receivable is issued at... (a premium / a discount/face value). How much premium or discount should Beerbo recognize at the note's commencement?... in $1 How much should Beerbo recognize as an 'ALLOWANCE FOR BAD DEBTS' on the note receivable? (in $1 By December 31, 2020, how many months will the note have been outstanding? How many months are in Beerbo's fiscal year? What is the interest rate used to determine Beerbo's interest revenue? (in %] How much interest revenue earned will Beerbo recognize for fiscal year 2020? [in $il How much cash interest will Beerbo receive in fiscal year 2020? [in $1 Input Reerho's nurnal entry to recognize the note receivable that replaces the arrunt recal DEBIT CREDIT Input Beerbo's journal entry to recognize the settlement of the note receivable December 31. DEBIT CREDIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts